These thematic drives ~60% of world GDP.

Does a $57 trillion theme warrant dedication in an investment portfolio? Absolutely.

Key Points

- Investors are chronically underweight non-U.S. stocks and countries.

- The leading emerging market economies offer one of the best opportunities today.

- Asia, including India, offers the greatest long-term potential for U.S. investors.

Investors Have Always Been Overweight U.S. Stocks & Bonds.

Our bias to invest most of our portfolio in the stocks and bonds based in our home country has generally served us well. This “home bias” can sometimes lead to an underperforming portfolio. Why? Markets trade in cycles and there have been periods, typically multi-year in duration, where non-U.S. stocks and bonds significantly outperform the U.S. Our industry preaches proper diversification to help assure our portfolio’s do not suffer from missing opportunities, wherever they are. The reality, though, most investors need the U.S. to perform well for the entire portfolio to grow as required. Having very little or no exposure to non-U.S. assets makes a portfolio vulnerable. The good news: most companies in the U.S. have a global footprint so people are getting access to a key style factor: “high international sales.” Sometimes that’s sufficient, sometimes more direct exposure is required. Every country has a handful of dominant brands serving its own consumers. Holding a basket of these leading brands is ideal.

Internal Consumption Drives Most Economies.

Here’s a great visual showing where this important cohort resides around the world. Generally, emerging economies grow much faster than developed economies like the U.S. and Europe. A key thing happens as consumers begin to make more money and join the middle class: they spend more, and they also spend differently than they used to. Our team has witnessed this over and over making the outcomes very predictable. Using China offers a great example. China’s median disposable income per capita has more than doubled since 2013. In fact, the average annual disposable income of households in China has grown from about $904 yuan to about $36,883 yuan since 1990 (Source: Statista). Many decades ago, China became the world’s preferred manufacturing partner. Massive amounts of foreign direct investment came to China to help build the infrastructure needed to be a manufacturing powerhouse. Fast forward to today, China has rapidly become an internal household consumption story as Chinese citizens were pulled out of poverty and joined the middle class. The same story is playing out across India, Mexico, Indonesia, Brazil, and the many frontier markets with great demographic trends.

We know how this movie ends; it’s the brands that citizens favor most, that are the direct beneficiaries of extra earning, saving, and spending over time. This thesis of joining the middle class and accelerating spending is a key reason the emerging markets offer investors such a wonderful opportunity today.

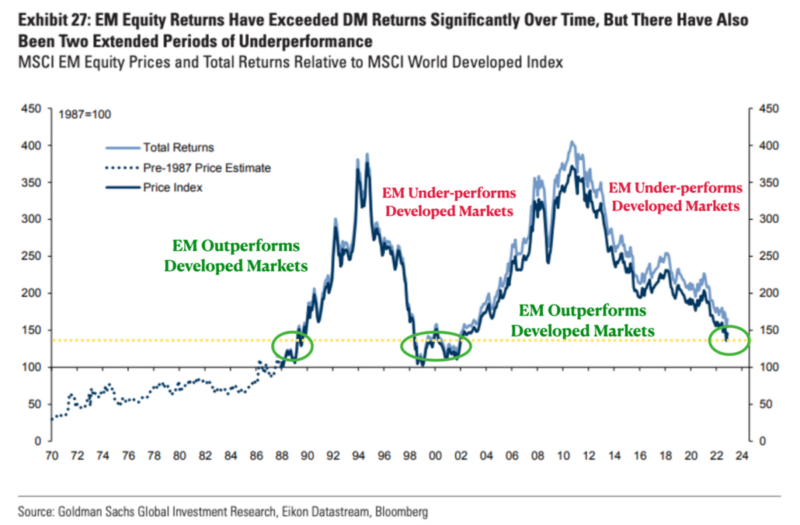

The best part, EM equities have significantly underperformed the developed economies, including the U.S., for the better part of the last decade. Many of these countries are trading at trough valuations as the economies begin to recover over time. The price you pay matters.

The chart below, highlights the under and outperformance cycles of EM equities vs developed markets going back to 1987. What you will see from this chart: when EM outperforms developed markets (the line goes up), it happens for many years and the outperformance can be significant. At the very least and after a 12-year period of EM underperformance, adding some exposure to the leading EM countries & brands is prudent. You can do that through ETF’s or active mutual funds, and you can certainly do it through investing in leading brands with significant non-U.S. sales exposure. The classic definition of being a highly relevant brand, means you have global exposure to consumers around the world.

Emerging markets outperformed developed markets from 1987 to about 1995 when the U.S. Internet boom began. EM again outperformed from the peak of the Internet boom in 2000 through about 2011. Since then, developed markets have handily outperformed emerging markets. As you can see from the chart, the underperformance ratio is about down to the extremes seen around 2000 when EM began its streak of outperformance. Again, the best part, most emerging market economies are some of the cheapest across the world today. See the patterns here?

Sizing-Up the Opportunity in Asia, including India & Latin America.

Last I checked, there are 48 countries in Asia. India and China, each have about 1.4 billion consumers. Ignore these two countries in your portfolio at your peril. If you read my last blog note, you know there’s billions of younger consumers across Asia and particularly in India, and they will be spending their money on their favorite brands for many decades to come. These consumers love luxury brands, are digital native, use e-commerce frequently, and are generally wellness and vanity focused. These insights alone, offer some wonderful opportunities with the brands serving these consumers. From a consumption perspective, Nike, Lululemon, LVMH, Hermes, L’Oréal, Estee Lauder, Tesla, Apple, Meta, Visa, Mastercard, American Express, McDonald’s, MGM, Wynn, Las Vegas Sands, Airbnb, Booking Holdings, and Uber come to mind as key beneficiaries.

Because Asia holds about 60% of the world’s population, you really shouldn’t ignore the region from an investment perspective. Yet, many ignore it completely and just hope some of their investments benefit from Asia’s growth. My friends, “hope” is not a strategy. It’s time to get some dedication to this important region and the brands strategy certainly can be a part of the discussion given our focus on the global consumer. In one fund, investors get access to leading brands serving U.S. and international consumers.

Bottom line:

Investors are chronically underweight non-U.S. stocks in general and woefully exposed to emerging market opportunities specifically. To rectify this, one can do some research and find attractive ETF’s and active mutual funds that are dedicated to this endeavor. Another way to gain exposure, is to identify ETF’s and funds that have a “global sales” mandate even if they do it through U.S. companies. In the brands fund, we have significant exposure to global sales trends and in U.S. and non-U.S. companies.

The definition of a Mega Brand should offer some perspective on what we look for: a leading company, selling products and/or services that appeal to multiple age groups, both men and women, and all over the world. Mega Brands earn the right to charge a premium, have high brand loyalty which feeds into repeat purchases, and continuously release new products or services that consumers can’t live without. When you become a Mega Brand, you also tend to join the $trillion-dollar market cap club. There are only a few members of the $trillion-dollar club today, which means there’s likely some wonderful gains ahead for the next batch of brands who meet the criteria to reach that milestone. Our team spends an enormous amount of time trying to identify the future $trillion club entrants.

Disclosure:

The above report is a hypothetical illustration of the benefits of using a 3-pronged approach to portfolio management. The data is for illustrative purposes only and hindsight is a key driver of the analysis. The illustration is simply meant to highlight the potential value of building a consumption focused core portfolio using leading companies (brands) as the proxy investment for the consumption theme. This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.