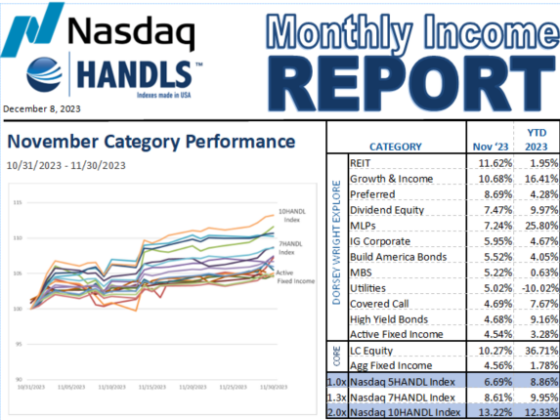

Ending the Fall Season Strong: November 2023 HANDLS Monthly Income Report

Securities markets shrugged off a challenging three months and delivered robust gains across the board in November as hopes for a soft economic landing gained ground among investors.