Gains All Around

Investors seeking clarity on the future path of inflation and interest rates struggled to find it in March as key economic indictors sent mixed signals. The month kicked off with a strong February jobs report, with the Labor Department reporting that nonfarm payrolls increased by 275,000 for the month (against expectations of 198,000). While the February numbers suggested the economy continues to run hot, downward revisions to the December and January reports reduced the initial estimates for those months by 167,000 jobs and the unemployment rate rose from 3.7% to 3.9% in February.

While wage growth came in sluggish in February at 0.1%, the consumer price index (CPI) increased 0.4% for the month and 3.2% from a year prior, driven by higher energy prices as geopolitical uncertainty drove up the price of oil. While the monthly CPI print was in line with expectations, core CPI (which excludes food and energy prices) came in hotter than expected at 0.4% for the month and 3.8% for the year, leaving investors worried that the Federal Reserve Board would be forced to delay expected interest rate cuts.

Federal Reserve Chairman Jerome Powell assuaged these concerns somewhat following the March meeting of the Federal Reserve Board. While acknowledging that January and February inflation figures suggested that the fight against inflation had met headwinds, he noted that the Federal Reserve Board continued to forecast three rate cuts for calendar year 2024.

The release of the personal consumption expenditures price index (PCE) on Good Friday, the day after the last day of trading for the first quarter, largely validated the chairman’s comments as both PCE and Core PCE met expectations.

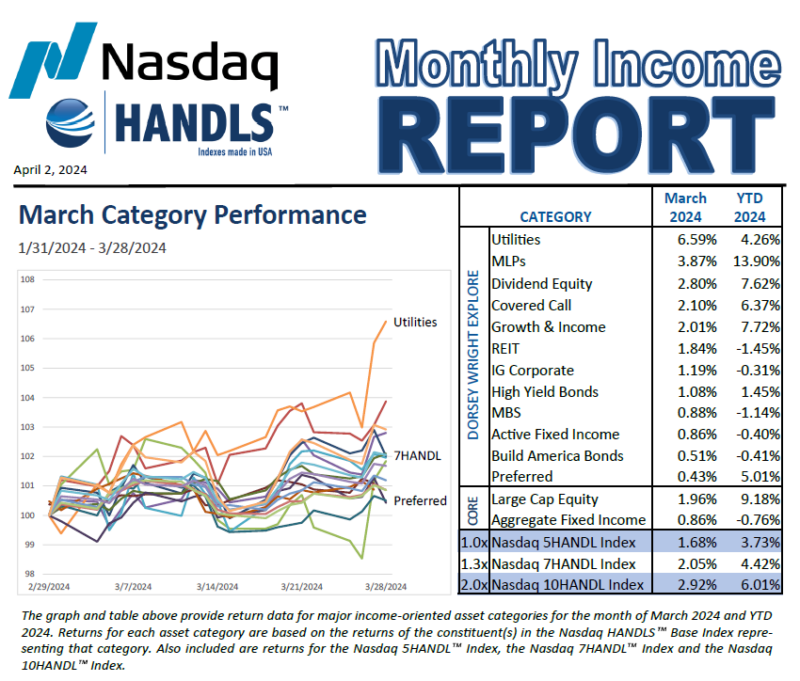

Despite or perhaps because of the mixed economic signals, financial markets generated positive returns across the board in March. While the technology stocks that had been leading the stock market in recent months faltered somewhat, the broader market rallied as the Core Large Cap Equity category generated a 2.0% return for the month. Meanwhile, modest declines in interest rates enabled the Core Fixed Income category to rebound from a challenging February with a 0.9% return in March (although the first two trading days of April erased these gains).

Every income-oriented category that makes up the Nasdaq Dorsey Wright Explore portion of HANDLS Indexes delivered positive returns in March. Leading the way were Utilities, which rallied 6.6% in March and pushed their year-to-date returns to 4.3% returns. MLPs continued their red-hot run, returning 3.9% in March and 13.9% for the year-to-date period. Also showing strength was the Dividend Equity category, which outperformed the Core Large Cap Equity category with a 2.8% gain for the month.

Fixed income returns were generally more modest, with the Preferred Securities category lagging the pack with a relatively paltry 0.4% return in March.

The Nasdaq 5HANDL Index returned 1.7% for the month. The Nasdaq 7 HANDL Index, the 1.3x leveraged version of the index, gained 2.1% in January while the Nasdaq 10 HANDL Index, the 2.0x leveraged version of the index, delivered a 2.9% return.

Disclosure: Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. © 2024. Nasdaq, Inc. All Rights Reserved

Important Disclosure. HANDLS Indexes receives compensation in connection with licensing its indices to third parties. Any returns or performance provided within are for illustrative purposes only and do not demonstrate actual performance. Past performance is not a guarantee of future investment results. It is not possible to invest directly in an index. Exposure to an asset class is available through investable instruments based on an index. HANDLS Indexes does not sponsor, endorse, sell, promote or manage any investment fund or other vehicle that is offered by third parties and that seeks to provide an investment return based on the returns of any index. There is no assurance that investment products based on an index will accurately track index performance or provide positive investment returns.

HANDLS Indexes is not an investment advisor, and HANDLS Indexes makes no representation regarding the advisability of investing in any such investment fund or other vehicle. A decision to invest in any such investment fund or other vehicle should not be made in reliance on any of the statements set forth in this document. Prospective investors are advised to make an investment in any such fund or other vehicle only after carefully considering the risks associated with investing in such funds, as detailed in an offering memorandum or similar document that is prepared by or on behalf of the issuer of the investment fund or other vehicle. Inclusion of a security within an index is not a recommendation by Indexes to buy, sell, or hold such security, nor is it considered to be investment advice. The information contained herein is intended for personal use only and should not be relied upon as the basis for the execution of a security trade. Investors are advised to consult with their broker or other financial representative to verify pricing information for any securities referenced herein. Neither Indexes nor any of its direct or indirect third-party data suppliers or their affiliates shall have any liability for the accuracy or completeness of the information contained herein, nor for any lost profits, indirect, special or consequential damages. Either Indexes or its direct or indirect third-party data suppliers or their affiliates have exclusive proprietary rights in any information contained herein. The information contained herein may not be used for any unauthorized purpose or redistributed without prior written approval from HANDLS Indexes. Copyright © 2024 by HANDLS Indexes. All rights reserved.