Key Summary:

- ETF’s have become the preferred investment wrapper of choice for investors.

- The vast majority of ETF assets are passive, rules-based, & market-cap weighted.

- Active strategies with high tracking error can add significant value to the portfolio mix.

Very Important thesis: If equities generate roughly ~10-11% a year over time, leading brands, dominant global franchises, particularly those serving the dominant driver of the economy, in theory, should compound at 13-15%+ over time. In a world where rates and inflation will likely trend higher for longer, business models with pricing power, exposure to quality factors, and that generate strong profits and free cash are set up to win versus broad markets. Brands Matter.

ETFs are the Preferred Investment Wrapper.

The data is very clear: actively managed mutual funds continue to lose assets to ETF’s. That’s the headline we all see every day. Remember, headlines are bold because they want your attention, the real story lives in the details. It makes sense that a portion of the active market is losing share to ETFs. Why pay a higher fee for a less tax efficient strategy, particularly if it’s a closet index strategy? In my opinion, true active strategies have a very important role in portfolios as complements to passive, cheap beta. Advisors need to understand what they own. Are the active funds’ benchmark huggers or do they do things very differently than the benchmark? Is there a similar strategy available in an ETF wrapper? Important: to have the chance to beat a benchmark, a strategy needs to look very different than the benchmark. The way to track this is by using Tracking Error. A high tracking error means the fund looks very different and can therefore be very valuable to a portfolio from a diversification and returns perspective. If you can get access to the themes you want and do it in a tax efficient wrapper while gaining high tracking error, congratulations, that’s valuable! Spoiler alert: that’s not easy to do, it requires a lot of research and sadly, the analytics providers do not make the research easy because they rarely look at the sector, sub-industry, and single-stock level.

In this week’s note, I’ll make the case that active deserves a place in portfolio’s along with passive ETF’s. Thank heavens there are more active ETF’s being launched because the market has been dominated by passive, rules-based, market cap weighted ETF’s (90% of ETF assets). What does that mean for a portfolio? It means more and more portfolio’s look the same and they are more tied to MOMENTUM as a style factor than ever before. That works until it doesn’t. This also means, benchmark hugging active managers are also too tethered to the momentum factor making “size and momentum” the biggest part of most portfolios.

Active, Contrarian Opportunities Are Everywhere.

Image: Created for Eric Clark by ChatGPT.

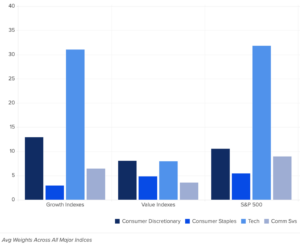

I am not saying run from passive, market-cap weighted ETF’s, I’m simply saying properly active strategies should be blended with passive, so portfolio’s get the benefit from many different style factors and exposures. As more and more “active funds” take on more passive characteristics, the value of true active strategies will grow by leaps and bounds. One area that’s likely the least crowded trade: the Consumer Discretionary, Consumer Staples, and Communication Services sectors. Our team traffics in highly relevant, high quality global brands. Many of which live in these three sectors and as you can see below, at the index level, these sectors are under-represented in a meaningful way, while a heavy tech weighting drives the returns. If the S&P 500 is the proxy investment for an allocation to the U.S. economy, and the economy is 70% household consumption, why on earth would the weighting to Consumer Discretionary & Staples be this low? We think that’s the opportunity today for investors.

I can almost guarantee your portfolio is chronically underweight the primary beneficiaries of a consumption-led economy. As you can see below, Tech holds the highest weighting across blend and growth indexes and Consumer Discretionary, Staples, and Communication Services is low. In the brands portfolio, we have 2-3x the discretionary and staples exposure, 40% more communication services and one-third the tech exposure. Our tracking error is almost 10, and this is not an accident.

What Does High Tracking Error Look Like?

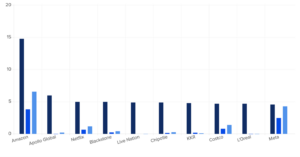

To highlight the high tracking error theme, below I show a chart of the top 10 brands and the weights in the Brands portfolio relative to the S&P 500 and the Russell 1000 Growth Index. Remember, these two broad style boxes are where the bulk of the typical portfolio is allocated. In the brands strategy, we focus on the dominant global theme of household consumption and business innovation spending through the leading brands. According to the economy and business cycle, we allocate to important sub-themes through market share leaders. Here’s why the tracking error is high. We own a lot of brands that are significantly under-represented or fully absent from indexes. That’s valuable!

The Top 10 Brands in the Brands Portfolio (57% of the total):

- Amazon: 15% versus 3.8% (S&P 500), 6.6% (R1Growth).

- Apollo Global: 6% versus ,0.55% in both indexes.

- Netflix: 5% versus <1.2%.

- Live Nation: 4.9% versus essentially 0%.

- Blackstone: 5% versus <.50%.

- Chipotle: 4.9% versus <.30%.

- KKR: 4.9% versus <0.20%.

- Costco: 4.7% versus <1.5%.

- L’Oreal: 4.7% versus 0%.

- Meta: 4.6% versus <4%.

Bottom Line:

- If you own any active funds or ETF’s, make sure they are truly active and have high tracking error to the benchmark.

- Blend active and passive in a portfolio to achieve maximum diversification and return benefits.

- Do not ignore the winners in a consumption led global economy, these brands are wonderful businesses, have significant economic moats, generate massive profits, and always have demand for their shares when the stocks go on sale. That makes them terrific adds to a portfolio and right now, buying consumer-focused brands is likely the least crowded trade in markets.

BE A CONTRARIAN

Disclosure: The above data is for illustrative purposes only. This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.