Younger consumers create long-term trends. The brands they love are a key focus for our team.

Key Points

- Morgan Stanley’s 5th annual AlphaWise survey of 575 summer interns is out.

- Youth culture creates tomorrow’s spending and investing trends.

- We highlight some of the rich insights & preferred brands and trends.

Morgan Stanley Equity Research is Best in Class. AlphaWise is a Key Report for Trends.

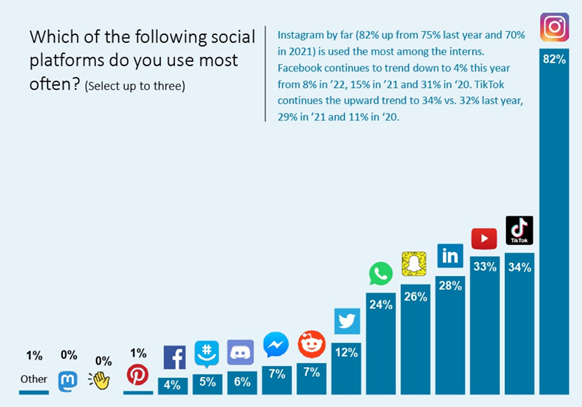

Key long-term trends are created by younger consumers. Tracking how they think, act, and spend, offers investors some wonderful insights & stock selection ideas. Trends created by younger consumers across the globe can offer significant investment tailwinds given they are often multi-decade in duration. AlphaWise surveys Morgan’s summer interns each year to see what trends they are paying attention to and which brands and spending categories matter most. We have talked about the powerful and global demographic trends driven by a staggering number of Millennials and GenZ consumers in our notes. This is a big focus inside the Brands Fund. The AlphaWise report confirms many of the conclusions our work has uncovered. I’ll highlight a few key categories and preferences from this terrific consumer trends report. The first chart highlights where our time is being spent on social media apps.

Meta (Facebook) & Google, recently reported a very strong quarter and forward guidance as advertising spend returns with a vengeance. Instagram, the primary growth property within Meta, maintains its dominance by a large margin. Another Meta property, WhatsApp also continues to be very popular with global youth. YouTube, TikTok, LinkedIn, and Snap also were cited as attractive properties. When the eyeballs are present and persistent, strong monetization can occur.

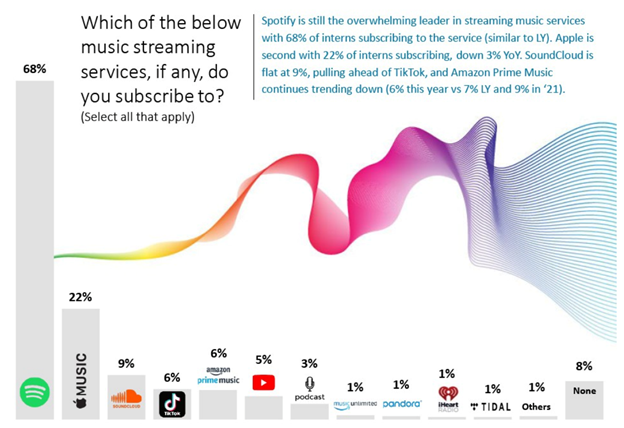

Music is a very important category for younger consumers. Portfolio holding, Live Nation, and their recent quarterly report would agree. Streaming music and live entertainment are how consumers love to engage with their favorite artists and Spotify continues to have a sizable lead over peers. Unfortunately, the stock has not reflected the dominance and has been quite volatile since the public offering but so long as these trends persist, I suspect they will finally figure out how to make solid profits on a sustainable basis.

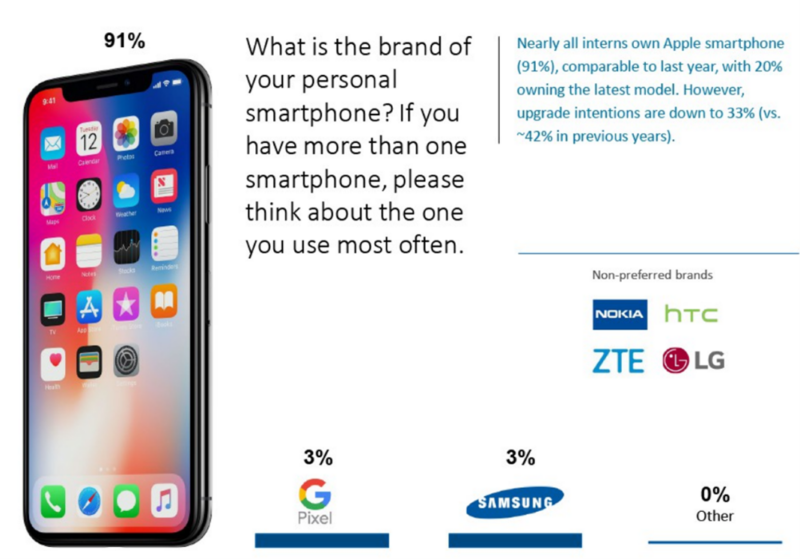

Phones: Apple Dominates Again.

Is there any wonder Apple is a $3 trillion company? It’s the greatest consumer staple ever created. Between the iPhone, the other products, and the service revenue from services like iCloud and AppleCare, this stock is a monster free-cash flow generator with exceptionally high brand love and loyalty all over the globe. Apple embodies what a Mega Brand truly means, and it’s been a stellar performer for shareholders.

The report showed 79% of the cohort own the Airpods, 68% own a Mac, 51% own an iPad, 41% own the Apple Watch. And all these products need to be replaced every 3 years or so, making Apple a recurring revenue machine.

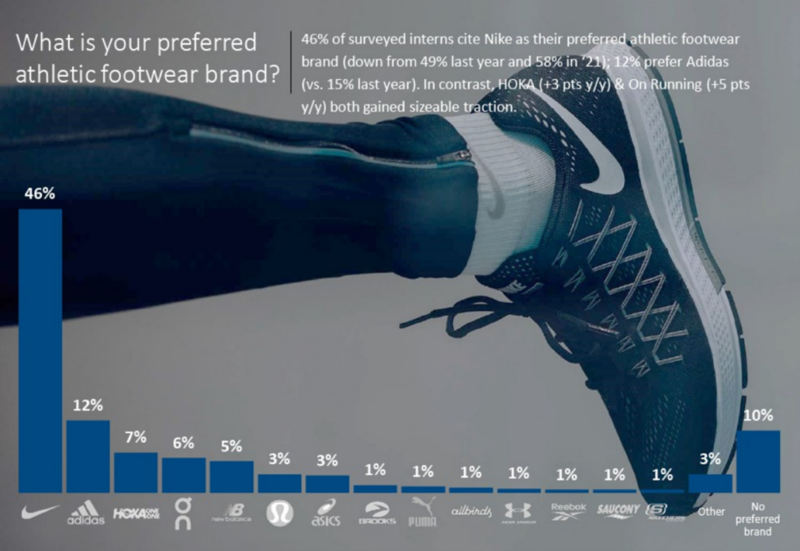

Athleisure is a key trend for consumers globally. In the athletic footwear category, some interesting trends are developing. Nike is still the king of the hill but smaller, boutique brands like Hoke (Deckers) and On Footwear have gained significant traction over peers. Deckers has been a tremendous stock over the years, and we think the management team are exceptional capital allocators.

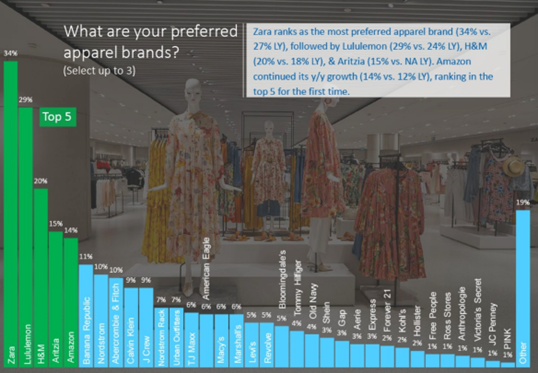

In the apparel category, a key athleisure brand for females in particular, is Lululemon. The growth across Asia offers significant forward growth for this great brand. Interestingly, Amazon pushed into the top 5 for the first time. Zara, (Inditex subsidiary) had a strong showing in the price-conscious upscale casual apparel category.

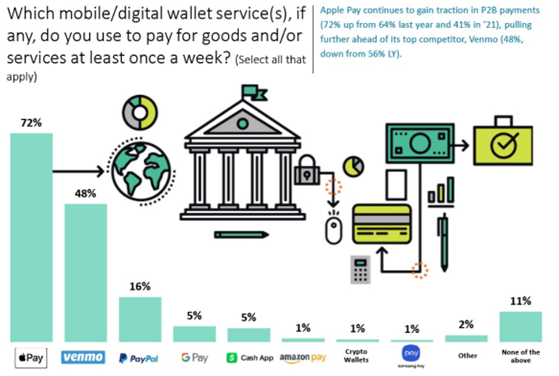

Payments: Apple Pay continues to gain traction as the preferred payments mechanism highlighting how powerful it can be when a company removes all the friction between a consumer and acting on their impulses. Waving your phone over a piece of hardware is simply a wonderful experience relative to carrying a wallet and using a card. Interestingly, PayPal and its subsidiary Venmo also score high for consumers. From a peer-to-peer payments perspective, Venmo still dominates as the preferred brand and at a time when the stock of PayPal is roughly 75% off the all-time highs and showing signs of getting its act together. PYPL is a recent add to the brands portfolio as a turnaround candidate that’s cheap and still generating strong free cash flow with attractive demographic growth trends that this report confirms.

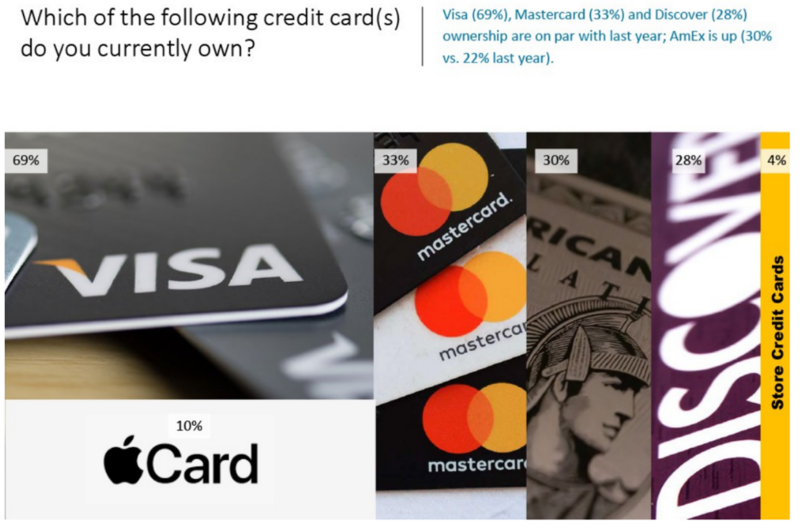

From a credit card payments perspective, Visa still dominates, and American Express has seen strong YOY growth in interest. Visa and Mastercard are some of the most profitable per unit of revenue brands I have ever seen. Roughly 70 cents of every revenue dollar for Visa drops to the free cash flow line and they consistently buy back stock each quarter and grow the dividend each year.

The next chart has important implications for forward looking consumer spending trends. Inflation, particularly when it is persistent, eventually drives change in our spending habits. We have said for a year now, brand relevancy is most important when the price of things stays elevated. Spending across important “needs” and “selective indulgences” are where our team is focused from an allocation perspective. The results show 68% of the cohort expects to change spending plans but interestingly, only 41% expect to slow their investing, which is a very smart move given they have time on their side. Roughly 20% do not expect to change anything due to higher inflation.

Bottom Line:

Demographics do not get near the attention as a key driver of stock selection and future alpha as they should. When brands appeal to men and women, young and old, domestic and foreign consumers and have high brand loyalty while selling products and services that consumers want and need, their business tends to be superior to market peers. Superior businesses tend to outperform over time and offer wonderful compounding vehicles for investors. Investing in the brands that matter most is where we focus every single day. Owning a portfolio of the most important and dominant brands remains one of the most under-appreciated yet valuable approaches available in the market today.

Disclosure: The above report is a hypothetical illustration of the benefits of using a 3-pronged approach to portfolio management. The data is for illustrative purposes only and hindsight is a key driver of the analysis. The illustration is simply meant to highlight the potential value of building a consumption focused core portfolio using leading companies (brands) as the proxy investment for the consumption theme. This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.