Key Takeaways:

- Market volatility and economic/policy uncertainty will likely continue.

- Investor’s predictability chase returns to improve alpha-generating returns, but it only causes benchmark underperformance amid increased risk.

- Equity/Futures hybrid strategies remain the “hidden gem” to combat market underperformance.

As the end of the third quarter quickly approaches, many market-moving events have started to challenge the frothy valuations not seen in over two decades. From China’s regulatory stampede leading to Evergrande’s liquidity squeeze to increased treasury yields, the overall market performance has seen some adverse catalysts. The Evergrande liquidity crisis (as the company is the most indebted real estate company in the world) coupled with the rapid-fire regulatory headwinds in China (that first affected Chinese education stocks and eventually Chinese technology stocks) impacted the domestic markets as China remains the region with the highest economic growth potential over the next decade (followed by India and the US). Therefore, these regulatory headwinds affected Chinese domiciled companies and domestic companies with exposure in the region on the fear of unforeseen regulatory pushback, eventually trickling into overall domestic market underperformance. Additionally, one specific regulatory clause caused the undoing of Evergrande, specifically the new limit on financial leverage. Since Evergrande has extensive debt, they were unable to tap into the credit markets, causing a liquidity crunch and a fear of a potential default as COVID-19 headwinds weighed on cash flows. Domestic markets reacted adversely due to fears of a credit event. In addition to the emerging market fiasco, domestic markets have dealt with a recently dormant market influencer: treasury yields. On the heels of Democratic leaders discussing approaches to raise the debt ceiling after Yellen warned that her department would eventually run out of cash in mid-October, treasury yields subsequently increased. The current bi-partisan impasse on this situation and the buildup of stagflation fears (as Brent Crude hovers near the psychological level of $80 a barrel), on September 28, 2021, has caused the stock market (particularly technology growth stocks) to sell off with the worst intraday performance since May as bond rates increased. Consumer confidence dropped in September for a third straight month as the delta variant and more permanent inflation fears continue to weigh on sentiment, adding fuel to the hypothetical flame.

On the other hand, home prices surged almost 20%, which was the biggest gain since the 1980s amid the renewed commodity supercycle (usually lasts about 30 to 40 years). Regardless, stock market fluctuations will likely continue as “dip buyers” come back into the market, driving up prices despite structural issues causing drawdowns. Therefore, market volatility will likely continue as the economic recalibration and policy/economic outlooks remain uncertain.

What remains important during times of economic uncertainty, policy stalemates, and recessionary fears is fundamentally understanding that beta becomes the center of investor attention as market volatility increases. Generally, when the market drops significantly intra-day (as we saw yesterday, September 28, 2021) or drops due to a recession (as in 2008 and March of 2020), the alpha available in all corners of the traditional market becomes increasingly thin. This may seem like common sense, but the behavior of traditional fund managers becomes almost “predictably irrational.” In attempts to beat the overall market during excessive drawdowns, investors subconsciously take on more risk to supplement their gains. This regular stock market dynamic, explained by the convexity of losses in prospect theory, is a regular decision by investors as they become risk-seeking to offset losses. Alternatively, timing the overall market can lead to missed opportunities as the top ten outperforming days of the S&P 500 Index makes up most of the index’s upside gains. Thus, remaining invested throughout various market cycles remains pivotal. Therefore, increased risk seeking, and inappropriate market timing can contribute to why fund managers underperform the indexes, especially the S&P 500 Index. But how can investors avoid this behavioral phenomenon while avoiding volatile markets caused by varying uncertainties?

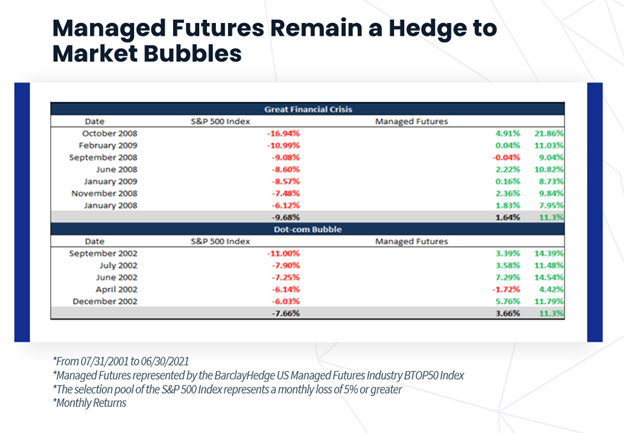

The answer to this question is simple. Look for alternative solutions. Many alternative funds have portfolio strategies that minimize human selection bias, reduce subconsciously increasing risk to offset investment losses, and provide exposure to low beta (to equity markets) investments. For instance, funds that invest in managed futures (including metals, agriculture, energy, other commodities, forex, currencies, etc.) combined with equity exposure can create an investing approach for all market environments as managed futures naturally have a negative correlation to overall equity market performance while collaboratively not missing out on an equity bull market. Thus, the hybrid strategy provides a hedge to market headwinds without a capped outperformance. As described in our chart of the week for July 19, 2021 (seen below), managed futures remain a solid hedge to market dislocations as collective returns remain positive. For instance, when the S&P 500 Index lost more than 5.00% during a market drawdown, the average return for managed futures was approximately 1.64% during the Great Financial Crisis and 3.66% during the Dot-com Bubble, showing the benefits to managed futures exposure.

Though market volatility will remain high in equity markets and the overall bond market continues to cool off and normalize, alternative investment strategies, especially those with low beta approaches, can remain the “hidden gems” for investors to weather the future market environment. Collectively, this strategy as a category can provide alpha opportunities, but specific and carefully considered equity/futures hybrid strategies can uncover an even better option. Specific hybrid funds have historically outperformed the S&P 500 Index since the mid-1990s, provided positive annual returns during recessionary years (2000, 2001, 2002, & 2008), and employed machine learning algorithmic approaches that help minimize unwarranted human behavioral risk-seeking investments. In essence, these specific equity/futures hybrid strategies are the most valuable gem among the hidden gem bunch. Therefore, investors should remain aware of potential market influencers and gain increased exposure to lower beta, hybrid strategies to supplement returns while keeping in mind that some strategies can optimize investing goals better than others.