Key Summary:

- >$80 trillion is set to trickle down to younger generations. GenX and Millennials win.

- The most relevant brands serving younger generations have enormous growth ahead.

- Periods of equity market weakness allow investors to build bigger positions in the brands serving mega trends.

Very Important thesis: If equities generate roughly 8-10% a year over time, leading brands serving the dominant driver of the economy, in theory, should compound at 13%+ over time. We have significant proof on this topic. In a world where rates and inflation are higher than we might like, business models with pricing power, exposure to quality factors, and that generate strong profits and free cash are set up to win versus the typical peer. Brands Matter.

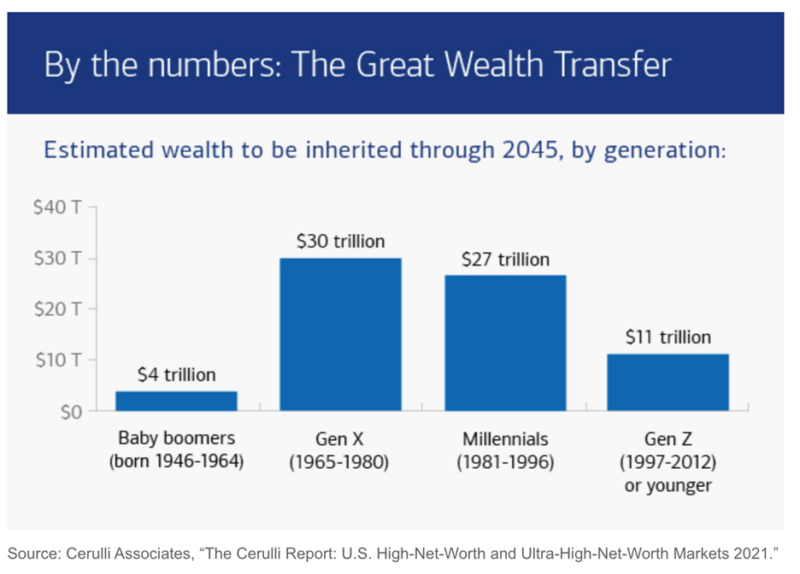

$80+ Trillion Will Be Transferred to Younger Generations Over the Next 20 Years (Cerulli).

I’ve written about the massive transfer of wealth happening in the U.S. many times. Most investors understand what’s happening and generally appreciate the long-term opportunities when trillions of dollars of wealth transfers to a new generation of consumers but I’m not sure they understand the investment implications or how large they are. The opportunity in front of investors is unlike anything we have ever seen because the size of the transfer is unprecedented in world history. The silent generation (born 1925-1945) and baby boomers (born 1946-1964) have amassed an enormous pool of wealth that’s now beginning to drip into the economy via inheritances and gifting. We know with certainty; each population cohort spends and saves differently and the brands they are loyal to stand to benefit greatly. Brand relevance is critical where consumer spending is concerned. As the GenX and Millennial generation continue to operate in their peak spending cycles plus inherit trillions of extra dollars, U.S. consumer spending will continue to be one of the most stable themes one can study. The data is very clear: consumers tend to reach their peak spending at about 55-60 years old. As these trillions trickle down to younger generations, more prone to spend, the extra capital infused into the economy and corporate America will be a consistent source of strength across profits, free cash flow, and earnings. All these factors tend to be the key drivers of stock outperformance over time.

The Brands Favored by Younger Generations Stand to Benefit Disproportionally.

Remember, this is a multi-decade theme and investment opportunity for investors. It’s not something we can see daily, it’s simply an X-factor to consumer spending over time. Why is this so important? Because this transfer of wealth will equate to more persistent and strong financial performance for the most important brands. It doesn’t mean great companies won’t miss earnings expectations occasionally, but it does mean any weakness is likely a gift for long-term accumulation of these stocks. As long as the brand relevance stays high and the spending category stays important, any weakness in stocks should be viewed as a gift, generally speaking. When you have the answers to the test, your stress levels in storms should be contained.

Think about this opportunity as an investor: we know brand love is a key driver of spending habits. We know which brands are loved the most by the cohorts receiving the trillions of wealth. Therefore, when we see short-term weakness in these shares, we are being given a gift by the markets. We urge you to take advantage of these gifts, and we also urge you to invest in the funds and ETF’s that own the key beneficiaries of the historic wealth transfer. Suffice to say, as a “top global brands” dedicated investor, we are excited to have such an epic, long-term tailwind for consumer spending and Mega Brands.

Which Brands are the Favorites of GenX and Millennials?

Where we are in the economic cycle and how consumers “feel” is a key driver of stock performance over shorter periods of time but there are a handful of brands that have built massive competitive advantages and high brand love across demographic groups. Through our extensive research and research from brand consulting groups like Interbrand, Morning Consult, and Kantar, here’s a list of some of the most beloved brands of younger generations. All of these are worthy of further research and potential ownership, particularly on market dips:

Apple, Google(YouTube), Microsoft, Amazon, Netflix, Disney, Spotify, Costco, Uber, Nike, lululemon, Chipotle, Airbnb, Target, Adidas, T-Mobile, Marriot, Home Depot, Tesla, Rivian, McDonalds, Walmart, Monster Beverage, Celsius Energy Drinks, LVMH, Hermes, TJ Maxx, Ralph Lauren, Ulta Salon, Sephora (LVMH), Meta (Instagram, WhatsApp, Facebook), Coke, Nintendo, Live Nation(Concerts), Draftkings(Sports betting)

Disclosure: The above data is for illustrative purposes only. This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.