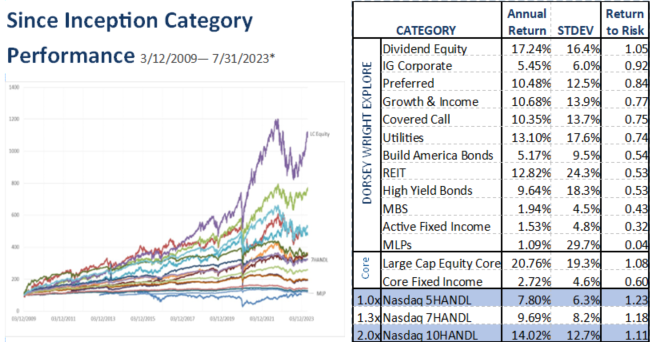

The graph and table above provide return data for major income-oriented asset categories for the month of July 2023 and YTD 2023. Returns for each asset category are based on the returns of the constituent(s) in the Nasdaq HANDLS™ Base Index representing that category. Also included are returns for the Nasdaq 5HANDL™ Index, the Nasdaq 7HANDL™ Index and the Nasdaq 10HANDL™ Index.

Equities Continue to Run

Despite concerns about inflation and the impact of higher interest rates on valuations, equities continued to perform well in July, with the Large Cap Equity Core category gaining 3.7% for the month. The broad fixed-income market traded sideways, with the Core Fixed Income category returning -0.1% in July.

Equity categories that make up the Nasdaq Dorsey Wright Explore portion of HANDLS Indexes generally outperformed the fixed-income categories, with MLPs leading the way with a 6.4% return for the month. Utilities, which tend to be more sensitive to interest rates, recovered from a difficult first half of the year to return 2.4% in July. Build America Bonds were the worst performing category in July, generating a -0.8% return for the month.

The Nasdaq 5HANDL Index returned 1.7% for the month. The Nasdaq 7 HANDL Index, the 1.3x leveraged version of the index, returned 2.1% in July while the Nasdaq 10 HANDL Index, the 2.0x leveraged version of the index, delivered a 3.0% return.

*The graph and table above provide return data for major income-oriented asset categories since inception of HANDLS Indexes (3/12/2009). Returns for each asset category are based on the returns of the constituent(s) in the Nasdaq HANDLS™ Base Index representing that category. Also included are returns for the Nasdaq 5HANDL™ Index, the Nasdaq 7HANDL™ Index and the Nasdaq 10HANDL™ Index. Inception dates for MLPs (1/2/2013), Build America Bonds (1/2/2010) and Active Fixed Income

For the year-to-date period through the end of July, the Core Large Cap Equity category continued to handily outperform all other categories, rebounding from a difficult 2022 to return 35.4% so far in 2023. The Core Fixed Income category was up 2.1% for the year-to-date period, as federal reserve tightening moderated increases in interest rates. For the income-oriented categories that make up the Nasdaq Dorsey Wright Explore portion of HANDLS Indexes, the Growth & Income category remained the leader for the year-to-date period, providing a 17.8% return. Utilities (-4.0%) were the only income-oriented category tracked by HANDLS Indexes to generate negative returns during the year-to-date period ended in July.

The Nasdaq 5HANDL Index was up 8.7% through the end of July, versus returns of 10.4% and 14.3% for the Nasdaq 7 HANDL Index and Nasdaq 10 HANDL Index, respectively.

Important Disclosure. HANDLS Indexes receives compensation in connection with licensing its indices to third parties. Any returns or performance provided within are for illustrative purposes only and do not demonstrate actual performance. Past performance is not a guarantee of future investment results. It is not possible to invest directly in an index. Exposure to an asset class is available through investable instruments based on an index. HANDLS Indexes does not sponsor, endorse, sell, promote or manage any investment fund or other vehicle that is offered by third parties and that seeks to provide an investment return based on the returns of any index. There is no assurance that investment products based on an index will accurately track index performance or provide positive investment returns. HANDLS Indexes is not an investment advisor, and HANDLS Indexes makes no representation regarding the advisability of investing in any such investment fund or other vehicle. A decision to invest in any such investment fund or other vehicle should not be made in reliance on any of the statements set forth in this document. Prospective investors are advised to make an investment in any such fund or other vehicle only after carefully considering the risks associated with investing in such funds, as detailed in an offering memorandum or similar document that is prepared by or on behalf of the issuer of the investment fund or other vehicle. Inclusion of a security within an index is not a recommendation by Indexes to buy, sell, or hold such security, nor is it considered to be investment advice. The information contained herein is intended for personal use only and should not be relied upon as the basis for the execution of a security trade. Investors are advised to consult with their broker or other financial representative to verify pricing information for any securities referenced herein. Neither Indexes nor any of its direct or indirect third-party data suppliers or their affiliates shall have any liability for the accuracy or completeness of the information contained herein, nor for any lost profits, indirect, special or consequential damages. Either Indexes or its direct or indirect third-party data suppliers or their affiliates have exclusive proprietary rights in any information contained herein. The information contained herein may not be used for any unauthorized purpose or redistributed without prior written approval from HANDLS Indexes. Copyright © 2023 by HANDLS Indexes. All rights reserved.

Disclosure: Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. © 2023. Nasdaq, Inc. All Rights Reserved