[vc_row][vc_column][td_block_text_with_title custom_title=”Company Description” tdc_css=””]

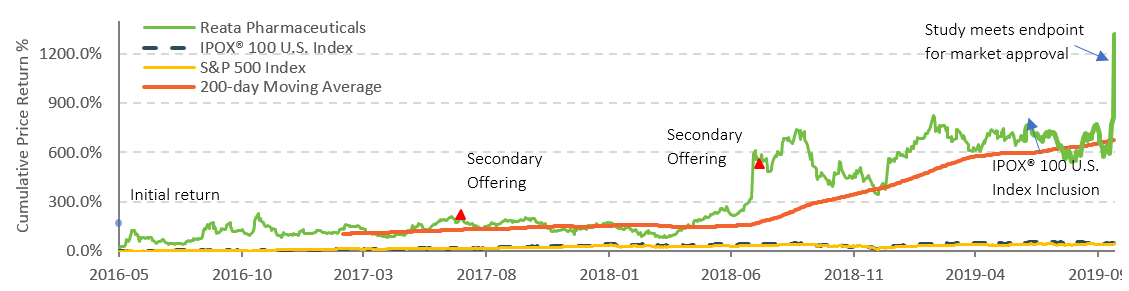

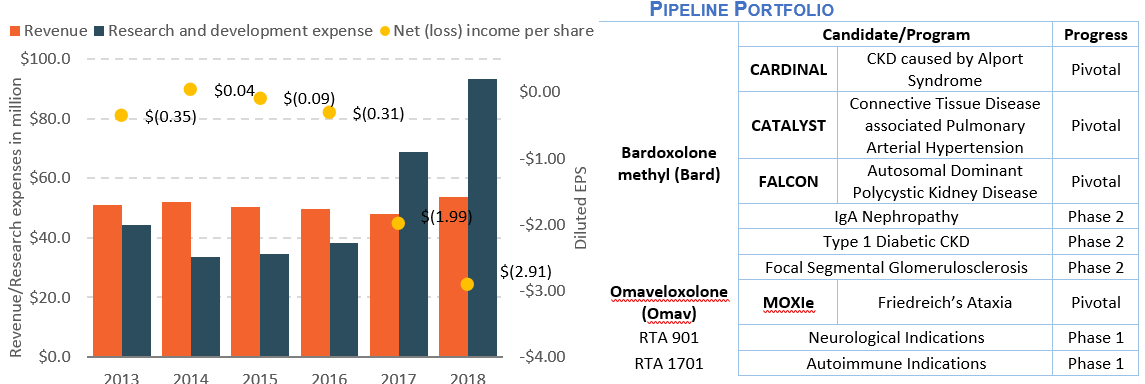

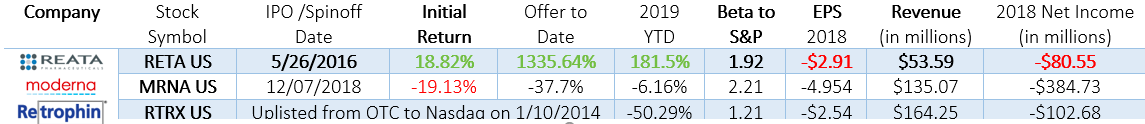

Founded in 2002, Reata Pharmaceuticals is an Irving, Texas-based biopharmaceutical company. The late clinical stage company focuses on small-molecule therapeutics by targeting molecular pathways that regulate cellular metabolism and inflammation. The three lead product candidates are for the treatment of a form of chronic kidney disease (CKD), a form of degenerative neuromuscular disease called Friedreich’s ataxia (FA), and a form of pulmonary arterial hypertension (CTD-PAH).[/td_block_text_with_title][td_block_text_with_title custom_title=”Business Model” tdc_css=””]Reata Pharmaceuticals generates revenues primarily from licensing fees (include upfront payments and milestone payments) received under collaborations with AbbVie and Kyowa Hakko Kirin (KHK). The company did not generate any revenue from sales of commercial products to date. Other revenues recognized include reimbursement for expenses incurred to obtain supplies.[/td_block_text_with_title][td_block_text_with_title custom_title=”IPO History” tdc_css=””]On 5/26/2016, Reata Pharmaceuticals launched on Nasdaq led by Citigroup, Cowen & Co and Piper Jaffray. The biopharmaceutical company sold 5.5 million shares with a 15% over-allotment option fully exercised, a 37.5% increase from the original plan. The IPO was priced at $11.00 per share, below its expected range of $14.00 – $16.00/share. The shares opened at $11.06/share and closed the first day higher at $13.07. Existing stockholders purchased $29.2 million of shares in the offering. Reata Pharmaceuticals was included in the IPOX® 100 U.S. Portfolio on 6/21/2019 and currently weighs approximately 0.2% of the portfolio. [/td_block_text_with_title][td_block_text_with_title custom_title=”Historical Performance” tdc_css=””] [/td_block_text_with_title][td_block_text_with_title custom_title=”Growth Outlook” tdc_css=””]

[/td_block_text_with_title][td_block_text_with_title custom_title=”Growth Outlook” tdc_css=””] [/td_block_text_with_title][td_block_text_with_title custom_title=”Industry Comparison”][/td_block_text_with_title][vc_row_inner][vc_column_inner el_class=”tablescroll”][vc_column_text el_id=”tablescroll”]

[/td_block_text_with_title][td_block_text_with_title custom_title=”Industry Comparison”][/td_block_text_with_title][vc_row_inner][vc_column_inner el_class=”tablescroll”][vc_column_text el_id=”tablescroll”] [/vc_column_text][/vc_column_inner][/vc_row_inner][vc_empty_space][/vc_column][/vc_row]

[/vc_column_text][/vc_column_inner][/vc_row_inner][vc_empty_space][/vc_column][/vc_row]