The current environment favors industry titans.

3 Important Mega Trends:

- E-commerce & logistics – Amazon (AMZN).

- The migration of assets to private markets – Apollo Global (APO).

- Life sciences innovation across diabetes and obesity globally – Eli Lilly (LLY).

Important thesis: if the S&P 500 Index has generated an annualized return of roughly 8-10% over the long-term, leading companies serving important industries should, in theory, generate 300bps+ more over long periods of time. This is a generalization, but the moral of the story is: great businesses in important industries with global opportunities should outperform the broad market indices over time. Over the next few weeks, I’ll highlight some strong earnings trends through the leading brands.

#1 – E-Commerce: a Global Opportunity.

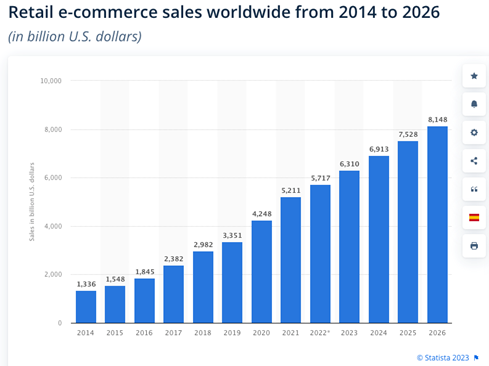

E-commerce has been growing faster than brick-n-mortar for many years. Through Covid, e-commerce adoption went vertical bringing tens of millions more consumers into the e-commerce flywheel. Once you’re in the house, you tend to stay and use its benefits more and more each year. Important though, the accelerated adoption curve was never expected to stay above the long-term trend and e-com use has been mean reverting back to the long-term trend line as expected. But make no mistake, with the ease of searching online and getting things delivered anywhere from same day to two days later, e-commerce will remain a key focus for consumers. Here’s a great chart from Statista showing the current $6 trillion global e-commerce growth trajectory.

Now, let’s talk earnings reports with our e-commerce favorite brand, Amazon. AMZN is one of the most impressive brands ever created. The stock has been a monster long term performer annualizing at ~31% per year since the IPO in 1997. Yet over the last 3 years, it’s been a major laggard. Over this period, AMZN’s annualized return is about -3.4%, a long way from the S&P 500’s 12.4% annual return. Amazon trailing 1 year revenue ending just before the pandemic was about $280B and the trailing 1-year look-back today is about $538B yet the stock annualized negative for these 3 years. That’s the opportunity in our eyes. These are customers that are loyal, using the services more each month, and committed to using them forever more. The quarter AMZN just reported should serve as the inflection point for future outperformance in our opinion. Why the underperformance? AMZN went into a historic spending cycle when Covid happened. Historically, the stock lags in investment cycles because the spending depresses free cash flow and other metrics. By all accounts, AMZN pulled forward years’ worth of investment spending in their logistics business to serve veracious demand. Imagine building a business the size of UPS in 3 years, that’s the scale of the investment cycle AMZN just experienced. In the recent quarter, spending trended down, cost controls took effect, and free cash flow mean reverted higher. This is not a one quarter phenomenon in our opinion. Yes, they will continue to spend, this time on their high margin AWS unit and for artificial intelligence capabilities to differentiate AWS from peers, but nothing to the degree of their logistics and hiring splurge which is mostly behind us. Over time, AMZN stock should return to its former glory as an outperformer and based on the -3.4% 3-year annualized number, there’s a lot of alpha still left to capture here.

#2 – Assets migrating away from public markets and into private market opportunities.

If you have been reading my notes, you know how favorably disposed we are to the alternative asset managers like Blackstone, KKR, and Apollo Global.

While it will take some more time for capital markets to fully open, the potential upside in all these names is meaningful. Let’s look at a standout from recent earnings reports. Remember, most HNW investors have little or no exposure to private markets, yet the return & volatility profiles have generally been superior to public markets because these portfolios are not marked to market daily like public securities nor are prices set by the madness of crowds and algos. This feature alone should drive a tremendous amount of interest in alts, in our opinion. All things being equal, if you could get the same return with full VOL (public markets) or 2/3 less VOL(private markets), which would your clients choose? That’s why the flows into these firms will continue to be tremendous.

Apollo (APO): Fundraising continues to be robust, which drives better fee-related earnings and EPS beats. APO is a leader in the category of alts with the highest demand today: Private Credit. APO is executing well in the HNW channel as well as with large institutions. They now manage $617 billion and saw $35 billion in inflows this quarter. They are aggressive buyers of their own stock when it’s struggling and because it’s absurdly cheap, and they are superior capital allocators that have stellar track records for customers. Here’s the kicker: Like Blackstone, APO has now generated positive net income for four straight quarters which is the final requirement needed to meet S&P 500 index inclusion rules. We suspect Blackstone gets added to the S&P 500 sooner than APO but if they were to get included, it would likely bring about $4.7B of buyers that track passive indexes (~14% of the free float) and another roughly $1.8B in demand from active strategies that are “benchmark aware”. Per Goldman Sachs Research, “this could drive ~$6.5B in incremental demand, or ~20% of the firm’s free float.” How’s that for a free call option to demand?

#3 – Life Sciences innovation via obesity & cardiovascular disease control.

Portfolio holding, Eli Lilly (LLY) reported quarterly earnings this morning. Sales of Mounjaro were $980 million, well above expectations. Serving the obesity epidemic could be one of the most profitable focuses for any company. The global statistics on obesity are dire so any potential treatment that aids weight loss and helps avoid all the ancillary ailments that occur due to obesity has significant and positive ramifications for the brands that develop these treatments. LLY peer, Novo Nordisk, released data showing their treatment, Wegovy, demonstrated a 20% risk reduction in other cardiovascular disease outcomes from using Wegovy making both treatments wider in scope than previously thought. Both stocks are +15-20% at the time of this writing.

LLY has been a monster long-term performer, so Mounjaro is not a 1-hit wonder for Lilly. The company raised guidance by about $2 billion while also raising the R&D guidance significantly. That’s what you want in a bio-pharma brand: strong innovation, continued R&D, visionary management that’s superior capital allocators, and strong growth metrics.

Bottom Line:

Leading companies serving large end-markets will tend to outperform over time. On the rare occasions when they struggle, that’s usually a time to be adding to those companies. Our team has added to the above brands when the market acted irrationally. Our clients are getting the benefit of that approach YTD.

Disclosure:

The above report is a hypothetical illustration of the benefits of using a 3-pronged approach to portfolio management. The data is for illustrative purposes only and hindsight is a key driver of the analysis. The illustration is simply meant to highlight the potential value of building a consumption focused core portfolio using leading companies (brands) as the proxy investment for the consumption theme. This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.