In this blog post, I’d like to dig into one of my favorite long-term themes and opportunities for investors: music and audio entertainment. I’ve written about this theme a few times before and made Spotify my favorite 2020 brand in the December 19, 2019 blog post, here: https://catalyst-insights.com/what-brands-occupy-your-phone-screen/

We know the average person spends about 18 hours a week listening to music (Musically.com) and that number continues to creep higher. More importantly, the number is sticky and predictable making the category very interesting from an investment perspective. In Spotify’s recent earnings report they had these important comments: “We continue to see exponential growth in podcast hours streamed (up approximately 200% year over year) and are now seeing clear indications that podcast usage is driving increased overall engagement and retention.” They also see strong evidence that their investments in podcasts are positively impacting the conversion rates from free to paid Spotify users. In English, they are saying there’s rabid appetite for podcast content and because they are the leading brand for the category, it’s driving strong new subscriber growth, and converting free listeners to paid, premium plans. That’s an enormous reason Spotify is my top under-appreciated pick for 2020.

Spotify Continues to Grow into New Verticals

Spotify has more than 700,000 podcast titles available on the platform. They added a new option called “Your Daily Podcasts” recently that helps personalize the listening experience. Their Artificial Intelligence engine continues to learn from how we navigate the platform, which keeps listeners engaged and loyal to the service as the tech pushes us to new and exciting music and podcast discoveries. I believe strongly the premium payers are fiercely loyal to the brand, offering them significant pricing power as they add new attractive services to the overall flywheel.

Case in point: on the earnings call yesterday they also announced the strategic acquisition of Bill Simmons’ pop culture show called “The Ringer” to grow the sports vertical. The Ringer is a website, podcast network and scripted and non-scripted video production house creating a diverse blend of sports, pop culture, politics, and tech content. The Ringer Network includes over 30 podcasts with shows like The Bill Simmons Podcast, The Rewatchables, and The Ryen Russilio Podcast. They also own hugely successful video network properties, including the Sports Emmy-winning show NBA Desktop, as well as Game of Thrones and Big Little Lies after-shows. Ringer Films offers Spotify the opportunity to build on the non-scripted programming. They have produced many popular documentaries for HBO, including Andre the Giant, the most watched documentary in HBO Sports history. Imagine what they can do with this production house when they connect it to the massive non-sports content, they have already acquired through their Gimlet Media acquisition. The press release won’t connect the dots for people, but they are quietly building the capabilities to produce audio and video content with the massive content library they have accumulated. When you own the content, the margins are very attractive.

Wall Street doesn’t seem to see the big picture here which offers people who are willing to connect the dots an opportunity before the stock really gets going. Since the initial public offering a few years ago, the stock has underperformed other tech and consumer brands but I’m patiently awaiting the realization phase when the stock gets re-rated for the opportunities it is building. The acquisition of The Ringer reminds me of Disney buying BamTech, which is the platform that now drives Disney+.

This is happening while they continue to delight traditional music streaming audiences all over the world. With this acquisition, Spotify gains the content, website and team to dive into the deep water of sports-talk content. It also offers future opportunities and funding for The Ringer to dive deeper into the sports vertical through audio and video content creation. Sports junkies are as loyal as music enthusiasts, so I love this acquisition. Imagine the opportunities to expand into global sports content when you plug into the Spotify network of 271 million users across 79 markets. I have confidence Spotify will eventually have more than 500 million users on the platform. That offers significant monetization opportunities.

Spotify Technical Look

When I assess a stock from the technical perspective, I like to see either momentum, which is still the best indicator of buying interest in any stock. I also like to look for brands that are mis-understood and stuck under a ceiling. If you have a dominant business, increasingly strong business momentum and it’s still stuck in the mud, that often offers investors an opportunity for a “catch-up” experience. Disney was a wonderful example of a catch-up opportunity last year. It was being held back by its lack of participation in the fast growing, streaming video category. Once their investor day highlighted their plans in granular detail, the stock re-rated quickly to where it should have been all along. With Spotify in the “ball under water pattern”, it looks attractive and still disconnected from the business opportunities I see long-term.

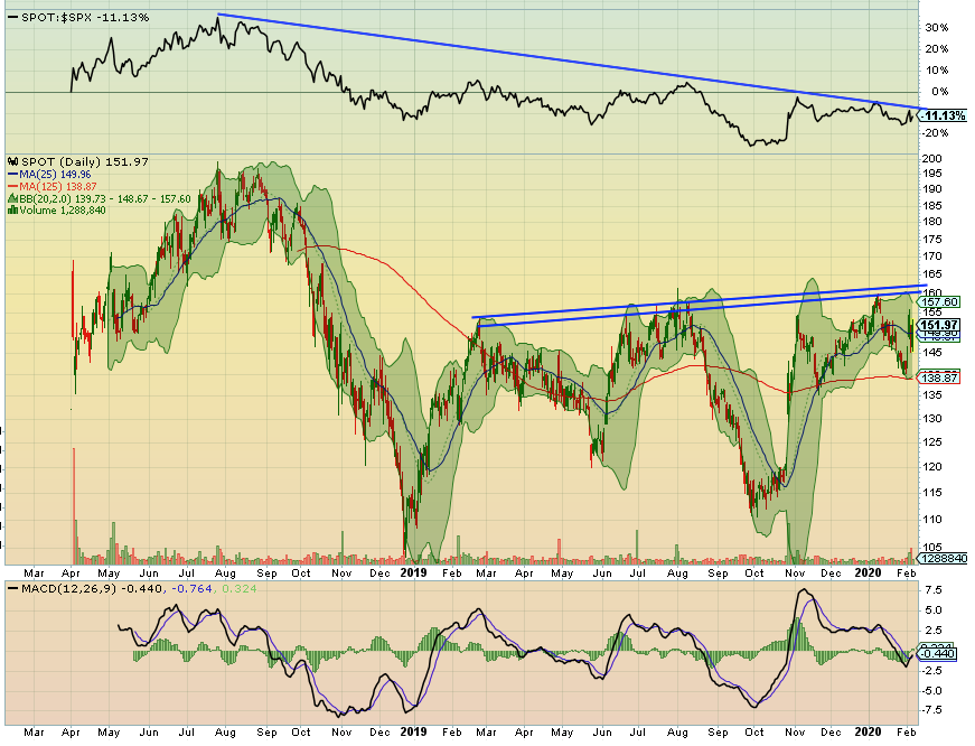

In the chart below, here’s what’s intriguing to me currently. The top pane shows Spotify performance relative to the S&P 500 and the stock has been lagging the index for the most part since August 2018. The down sloping blue line means for now, Spotify continues to underperform but the stock appears to be testing the downtrend and if it breaks over the blue line, it will usher in a new buy signal for investors and traders that buy leaders versus laggards. If stocks go higher because of more buyers than sellers then the first way to have more byers is a break of the downtrend.

Inside the chart the double blue lines are the ceiling that needs to be broken to offer a fresh buy signal for the same momentum traders. The stock has been stuck under this level, currently between $157-$160. A break over this level should be very bullish for the stock at a time when the business fundamentals are already gaining positive momentum.

BOTTOM LINE:

Here are some bottom-line takeaway points to consider:

- Human beings are addicted to their favorite music and it’s a key entertainment category.

- Streaming music is now the preferred approach to consuming our music habit.

- Audio content via podcasts are becoming an enormous follow-on opportunity for providers.

- Spotify is the leading streaming music, audio-cast leader and they are not stopping there.

- Imagine a world where Spotify offers a full menu of superior options to the current 200 million plus subscribers that includes music, podcasts, sports, and scripted and unscripted content. The current stock price is not priced for that potential outcome, which makes this amazing brand my 2020 spotlight pick.

Disclosure:

This information was produced by and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.