As a society we are tethered to our cell phones. The apps we download hold exceptionally valuable real estate if they make it on the first few screens of our phone. Familiarity breeds content so the more we stare at the apps on our phones, the more subliminal brand love we are building. When a brand has high brand love, high relevancy and brand recognition, it tends to have strong operating metrics and the company’s stock tends to perform well over time.

What brands occupy the first and second screens of your cell phone? If a brand makes it to these coveted positions, I’ll bet you spend a lot of time and money interacting with the brand. Do you own shares of the most coveted Brands on your phone?

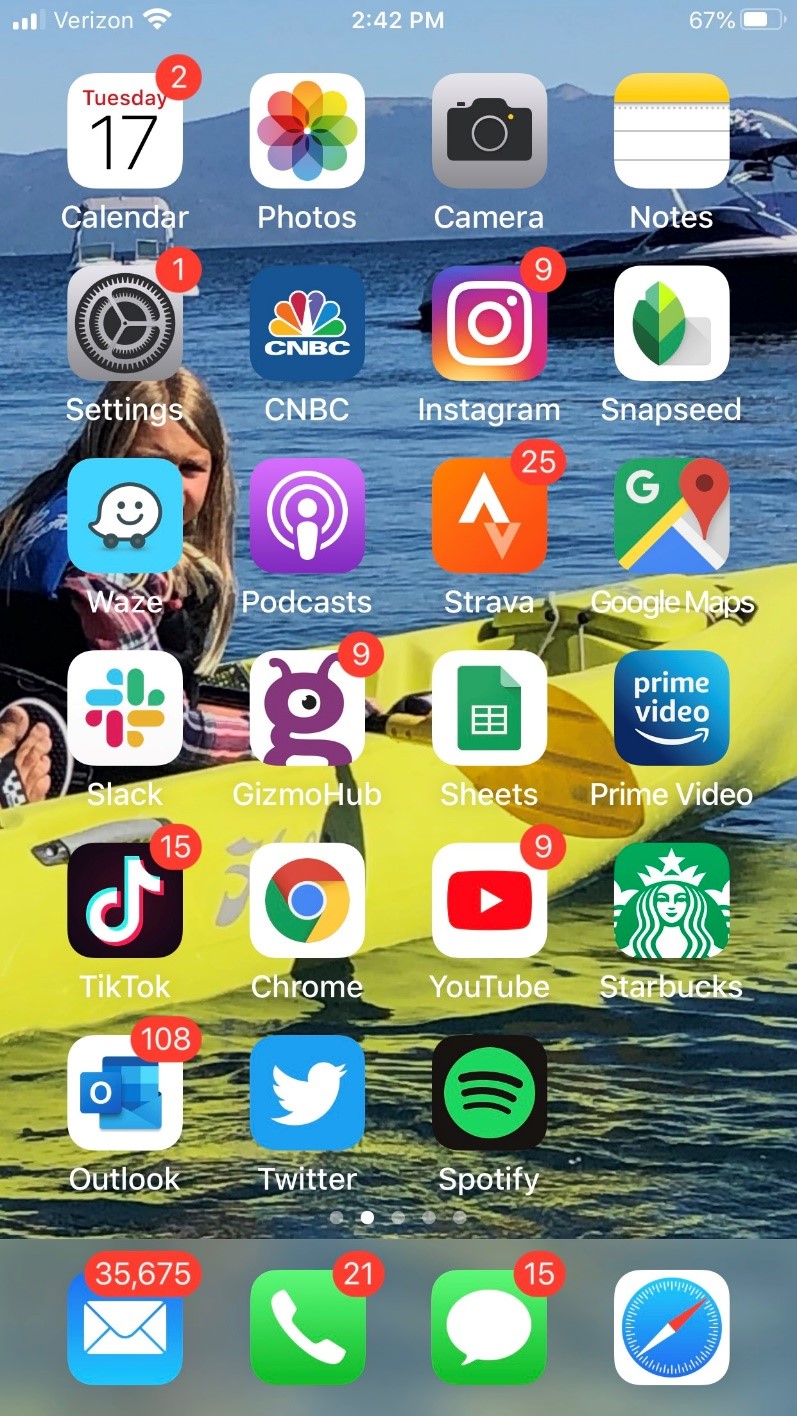

Let’s talk about the apps that made it on my iPhone:

The most coveted brands

- Music, Podcasts, Entertainment – Spotify, Apple, Amazon Prime Video

- Email, YouTube, Maps, Browser Search – Google

- Social – Twitter, TikTok, Instagram, Gizo Watch – Twitter, Facebook, Verizon

Music, Podcasts, Video Entertainment:

Spotify:

Per music ally, the average consumer around the globe spends roughly 18 hours a week listening to music. The listening comes from traditional radio, SiriusXM, and increasingly from streaming via Apple Music and Spotify. I tracked my streaming time on Spotify last week and it turns out I am the typical consumer. Spotify is firing on all cylinders and the stock is starting to play catch-up. If I had to pick my favorite stock for 2020 it would be Spotify. The direct initial public offering (ipo) was a bit of a flop and the stock has lagged badly with a return since the ipo of roughly -4% versus the S&P 500’s return of roughly 23%. When a company has high brand love, improving fundamentals, increasing revenues and market share and the stock lags, think like a contrarian and be opportunistic.

My Top Stock for 2020: SPOTIFY

Apple:

On my home screen I have the Apple Podcast app and the iTunes store on the second screen. I’ve been a loyal iPhone owner since the beginning so they have gotten a lot of my wallet share over the years. I recently flew across the country and did some fun channel checks on the flight but walking up and down the aisle seeing what brand of phone most of the passengers had. The overwhelming winner was iPhones. Look around your house, on your phone home screen and in your community, Apple products are everywhere. My local Apple store has been packed with holiday shoppers since Thanksgiving. Based on that broad analysis, I would guess Apple stock has performed well over the last year. In fact, Apple stock is +88% over one year versus the S&P 500 +32%. Coincidence? I doubt it. Buy An iPhone Here Buy an Ipad Here Buy a new Mac here Buy the Apple Watch here Buy AirPods Here

Amazon:

Amazon has been resting over the last 18 months, that doesn’t happen that often. The stock is +4% over the last 18 months versus the S&P 500 of +15%. I like that set-up. As the holidays near, the scramble to get our holiday shopping completed will increase. I don’t enter Amazon through an app for some reason but I do spend a ton of time researching products and buying my favorites. I find myself watching much more Amazon Prime Video versus Netflix which is an important development. The flywheel of benefits Amazon has provided to Prime Members is truly impressive. This is a spending year for Amazon as they build the next revenue acceleration so I’m actively watching to see some signs of Amazon getting its mojo back. From a consumer brand love perspective, they had me at hello. Buy an Alexa Here

Email, YouTube, Maps, Browser Search:

Google:

When I analyzed my home-screen, I was shocked at how prevalent Google properties were in my life. I spend tons of time looking at Google Maps and Waze to avoid Southern California traffic and both provide quick contact info for the companies I’m interested in. They even integrate with my Spotify, go figure. Between Gmail, Maps, YouTube, Sheets, the Google Home Mini, and the Chrome Browser, Google seems to have me on speed dial, no wonder they have $40 billion in quarterly revenues and over $100 billion in cash. I’ll bet I’m not that unique as a Google user and the stock has not added any value over the S&P 500 over the last 18 months with both returning roughly 16%. I have a feeling Google will get back to its winning ways soon enough.

Social:

Twitter, TikTok (private company), Instagram, Gizo Watch – Twitter, Facebook, Verizon

Twitter:

Whether we like it or not, Social Media is here to stay. Let’s face it, there is some entertainment value to social, and there’s definitely real value in Twitter for me and our industry. As a Financial Advisor, I urge you to start a Twitter account and start following some of your favorite news providers and investment managers. I have personally connected with some amazing people in and out of our industry and I know Advisors who are using Twitter to send their message to clients and prospects. News happens first on Twitter and the medium is a wonderful way to tell your story and gain instant scale. The stock is down 35% from the highs and scores very high on our brand relevance scoring system. Sign up for Twitter here

Instagram:

Facebook owns Instagram, paid $1 billion dollars for the company in 2012 and its estimated to be worth $100 billion, how’s that for an investment! I’m not a fan of Facebook the service but I understand its appeal. Instagram is much more intriguing to consumers and is just beginning to show the monetization opportunities. Instagram is a great way to follow friends, family and the experts in areas you are focused on. It’s ease of use via scrolling through images and clicking on links offers a frictionless way to engage with whatever and whomever you want. If you have a product or service to offer consumers or are a merchant that wants to reach a global audience, Instagram offers an easy opportunity given 500 million people around the world access the app daily. I have already used Instagram three times to buy Christmas gifts and the entire process was unbelievably easy. That’s the real power and opportunity for Instagram and Facebook the stock. Merchants all over the world can put up a store front in minutes and start generating revenue with little friction or initial cost. Amazon beware. Create an Instagram Account

Verizon & Gizmo Watch:

Another great gift for the holiday. As a parent, having my daughter wear the Gizmo watch from Verizon allows me to quickly communicate in short form formats and is linked to GPS so I know where she is at all times. The watch is inexpensive and offers significant peace of mind. My daughter loves it too and it’s become a hot item at schools and on holiday gift lists.

For Verizon customers: Verizon – Gizmo Watch Cheaper on Best Buy Best Buy Gizmo Watch

Charitable Giving Opportunity: I am a mentor for a wonderful organization that mentors and coaches at risk boys and those who grew up without a father. I grew up without a father figure and mentor and know what affect it can have on a young kid. I’ve seen Boys2Men change kids’ lives for the better and I wanted to allow anyone who has also not had a father figure as a young boy or anyone who understands the power of having mentors to help shape kids’ lives a chance to give whatever they can to help a great cause. We work with over 1,000 kids and have new mentor groups working in local schools all over the country. All donations help us open new schools and hire new mentors. Kids are our future and happy, well adjusted kids are the way to a better future. We are humbly grateful for any donations you are interested in pledging. Learn More about giving back and helping our kids thrive

Happy Holidays!