Key Points:

- Johnson & Johnson has spun out a portion of its consumer brands division

- Stable, predictable brands should thrive as the economy decelerates

- Johnson & Johnson is getting focused and spinning out its consumer health division

- Kenvue brands touch the lives of over a billion global consumers regularly

Defense has a Place in a Portfolio, Particularly Today

As the Fed’s historic interest rate hikes work their way through the system and the banking system tries to heal while lending gets more scarce, economic growth is expected to decelerate from here. As you know from reading our recent blogs, “Rotate in May and Go Play” and “How to Play Defense in a Portfolio”, generally, business models that are high quality, with stable, predictable EPS and serving customers in good times and bad, tend to get the benefit of capital flows during turbulent periods in markets. Cyclical industries and companies that will experience a slowdown in earnings and/or where the analyst community is too high relative to results, tend to struggle, while defensives tend to remain well-bid. As investors, we must learn to play offense and defense, sometimes together in a portfolio. When I look at our approach today, I see a prudent balance between offense and defense through highly relevant, global brands. That allows people to sleep at night. There’s a new consumer brand hitting the market and we are excited to be owners of shares.

JNJ is Getting More Focused. Investors Welcome a New Public Company to the Staples Sector.

Generally, investors like laser-focused exposures to the themes they have the highest degree of confidence in. Because of the desire for focused exposures, many companies and their share prices can often lag because of what’s known as a conglomerate discount. Companies that have too many businesses under one roof and that are in different sectors or industries simply do not have the shareholder interest like more focused businesses. JNJ is a leader across a variety of different and important verticals but some of these businesses are growers and some are more stable defensives. When the economy is roaring, the defensive divisions hold the stock back, and when the economy is struggling, the growth-oriented business segments suffer a setback while the defensive portions remain relatively constant. In order to streamline JNJ’s business, management decided to spin-off their slower growth, consumer health division to existing shareholders via a recent IPO. This division, now called Kenvue, owns a massive and highly recognized portfolio of household brands. JNJ will be slow and methodical about the spin-off of shares, but their intent is very clear. As the economy looks to be downshifting, Kenvue and its house of brands couldn’t be a timelier addition to a portfolio.

Kenvue: A Leading House of Consumer Brands with Strong Revenue and Free Cash Flow.

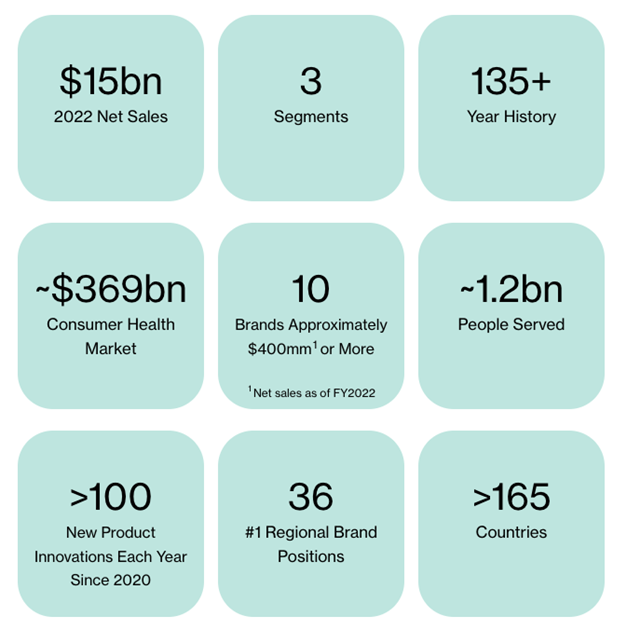

Here’s a summary of Kenvue taken from the new corporate website. Talk about a history of excellence. Kenvue is the world’s largest, pure-play consumer health company by revenue and holds a unique position at the intersection of healthcare and consumer goods. I love this stable of important and reputable brands and most of them are present in most households.

JNJ has been a bit slow to spell-out the spin-off terms and timing for the complete spin-off but for now, they still own roughly 90% of the company with the intent to spin out the remaining shares over the next year or so.

Because of this, there could be some selling pressure at certain times as more shares get spun-out, but I suspect there will be plenty of demand for these shares as they become available. The proposed dividend is about 3%-3.5% and I expect it will show good dividend growth over time as a dividend aristocrat. Additionally, as a new independent brand, they should be much more inclined to acquire other popular brands to build on the current house of top brands. I also suspect there will be more emphasis on international growth as management has likely been a bit starved for corporate resources under the JNJ umbrella. There are certainly a lot of moving parts to the business and management needs to execute on its business plan but over time, I expect great things for the company and the shares. The stock should become a favorite of buyers of stable, defensive staples, and healthcare brands. Here’s a look at the current stable of great brands. In our house we currently have exposure to about 80% of the brands listed below.

Bottom Line:

If you are a buyer of defensive consumer staples and healthcare stocks, Kenvue is now the largest brand in this category, and it owns an impressive roster of popular consumer health brands. In an uncertain economic and macro environment, a brand like this seems incredibly well placed for investors and offers a nice blend of stability and dividend growth.

Disclosure:

The above report is a hypothetical illustration of the benefits of using a 3-pronged approach to portfolio management. The data is for illustrative purposes only and hindsight is a key driver of the analysis. The illustration is simply meant to highlight the potential value of building a consumption focused core portfolio using leading companies (brands) as the proxy investment for the consumption theme. This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.