5 Minutes, 3 Brand Updates, Consumer Focused.

Core allocations should be highly correlated to core themes around the globe.

Global consumer spending is 60% of the world’s $100 trillion GDP or $60 trillion per year.

Key Summary:

- Brand update #1: Amazon – Our favorite stock for the next 3 years.

- Brand update #2: Nike – Expectations this quarter are exceptionally low.

- Brand update #3: META – strong advertising trends & accelerating engagement continue

Important thesis: Buying leading companies operating in vital consumer spending industries is a timeless investment approach. Being opportunistic and buying these great assets when the market puts them on sale (like today) allows your recovery time to shorten. These are not opinions; they are commonsense.

Consider this: the S&P 500 Index has generated an annualized return of roughly 8-10% over the long-term, leading companies serving important industries should, in theory, generate 300bps+ more over long periods of time. That’s what history has shown where leading brands are concerned. Understanding this and investing for it offers investors a long-term edge. Brands matter because consumer behavior is largely driven by brand loyalty. The higher the loyalty, the better the business. The better the business, generally the better the stock.

Blue Chip Brands Update:

- Amazon (AMZN): the most attractive of the Magnificent Seven in our eyes.

- Since the 1997 IPO, the stock has annualized at 4x the S&P 500.

- AMZN has ~$540B in revenue, with FCF returning & margins expanding again.

- The stock tends to lag in spending cycles and play major catch-up afterward.

- Amazon has lagged badly over 3 years; a mean reversion opportunity has begun.

- AMZN logistics/shipping capex was historic, and they built a UPS in two years.

- Strong consumer demand will drive higher profitability as capex falls.

- AWS & public cloud adoption is still early days. We expect AI to aid adoption.

- AWS & core retail accelerating together equals a potent/profitable combination.

- The stock is cheap to itself at 2x sales and 25x 2025 expectations.

- Strong forward returns tend to happen when easier comps meet accelerating business trends, improving operating metrics, particularly margins & FCF.

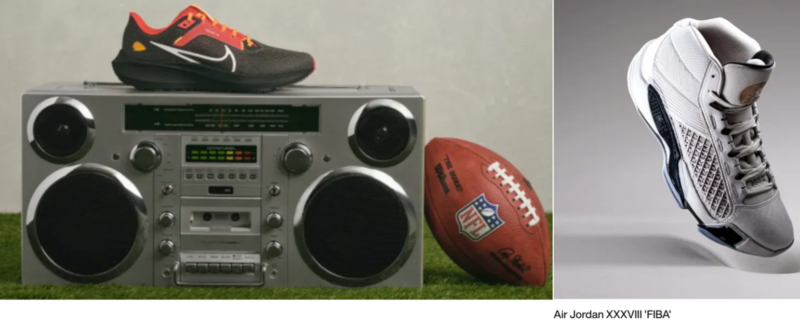

- Nike (NKE): The world’s largest & most recognizable apparel & footwear brand.

- Nike dominates the sports apparel & footwear industry, globally.

- Owner of iconic and still highly relevant brands: Converse, Air Jordan, Nike.

- Supply chain closures and high inventory levels have weighed on the stock.

- One of the lowest bars for earnings & expectations offers unique setup today.

- We see a re-acceleration in business momentum, particularly in Asia.

- A margin acceleration story after multiple years of business-mix shifts.

- Demand from China is returning, and so will the attractive margins from that region.

- Our work suggests Nike has 60%+ upside from current levels.

- Nike has >$52B in annual revenue, major margin upside, and $10.6B in cash

- Meta (META): The world’s largest & most recognizable social commerce brand.

- Highly recognizable brands that include Facebook, Instagram, WhatsApp, Reels.

- Combined, Meta properties have 3.88 billion monthly active people.

- Greater than $130B in annual revenue, $53B in cash, & $40B+ in annual FCF.

- Expect continued capex on important growth initiatives like AI, creator tools, etc

- Revenue growth remains on solid footing.

- Ad trends remain strong and, in some categories, are accelerating.

- Important: time spent on primary platforms continues to accelerate.

- More time spent equals higher monetization opportunities.

- Reels continues to capture more attention, currently ~30% of core but rising.

- Massive future monetization upside in WhatsApp and Reels.

- More AI tools for creators drives more engagement, which drives monetization.

- Buying META in Q4 2022 was one of the easiest buying decisions in years.

- We see 25-40% upside in the stock over the next few years.

Disclosure: The above report is a hypothetical illustration of the benefits of using a 3-pronged approach to portfolio management. The data is for illustrative purposes only and hindsight is a key driver of the analysis. The illustration is simply meant to highlight the potential value of building a consumption focused core portfolio using leading companies (brands) as the proxy investment for the consumption theme. This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.