5 Minutes, 3 Topics, Consumer Focused.

Core allocations should be highly correlated to core themes around the globe.

Global consumer spending is 60% of the world’s $100 trillion GDP or $60 trillion per year.

Key Summary:

- Contrarian view of the Week: Apple is attractive on this pullback.

- Brand update #1: Draftkings – Robust opportunities ahead.

- Brand update #2: Apollo Global – Continued demand for Private Credit & a stock that’s still too cheap.

Important thesis: if the S&P 500 Index has generated an annualized return of roughly 8-10% over the long-term, leading companies serving important industries should, in theory, generate 300bps+ more over long periods of time. That’s what history has shown. Understanding this and investing for it offers investors a long-term edge. Importantly, underperforming years tend to be great buying opportunities so being a contrarian also offers an edge. Brands matter because consumer behavior is largely driven by brand loyalty. The higher the loyalty, the better the business. The better the business, generally the better the stock.

Contrarian View of the Week: Apple product demand remains strong, particularly iPhone15.

- Apple stock has been a stellar performer since its 1980 IPO, annualizing at 19% per year.

- Apple stock has 15 calendar years of negative returns along the way.

- To receive great long-term returns, you must be willing to endure sell-offs & buy more.

- Apple has pulled back 12% since the recent highs 6 weeks ago, offering an opportunity.

- Reasons for the selloff: China volatility, high valuation concerns, slower demand.

- Reality: Apple is the greatest consumer staple and tech utility brand ever created.

- Apple trades at a premium because of the stability and recurring revenue in its business.

- There’s roughly 1.4 billion active iPhones globally. These need to be upgraded over time.

- Current data shows iPhone 15 Pro and Pro Max demand is stronger than expected.

- Strong carrier promotions should drive the next upgrade cycle.

- Stock performance may not be as correlated to iPhone sales as people think.

- iPhone sales declined between 2015 and 2019 yet the stock was +198% versus +70% for the S&P 500 Index.

- The next big upgrade cycle for Apple has likely just begun.

Some of Our Favorite Brands Now:

- Draftkings (DKNG): the leading digital sports entertainment & gaming brand.

- Continuing to take share from competitors to become the dominant brand.

- Street estimates appear too low, causing a positive estimate revision cycle.

- Revenue trajectory strong and should accelerate into 2024.

- Permanently focused on “efficiency” for revenues and cost containment.

- Customer acquisition costs continue to fall as brand dominance rises.

- Path to sustainable profitability continues to shorten.

- Expects to end 2023 with $1 billion+ in cash offering economic flexibility.

- Expect to generate meaningfully positive Adjusted EBITDA in F2024.

- AI and machine learning expected to expand revenue and efficiency benefits.

- New states “time to profitability” shrinks as efficiencies continue.

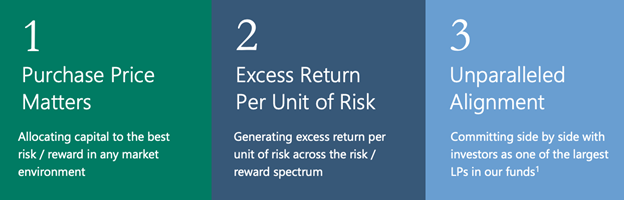

- Apollo Global (APO): Second largest Alternative Asset Manager with $617 billion AUM.

- Continuing to generate strong fee-related earnings and AUM growth.

- The largest Alternative Credit Manager in the world with >$450B in AUM.

- Have achieved some of their 5-year targets in 3 years given strong demand.

- Current demand for private credit is enormous and APO is the leader in category.

- Estimate: $40 trillion in investment grade fixed income is seeking better options.

- Private credit has historically generated much better returns with much less VOL.

- Apollo could be the next Alt Manager to join the S&P 500 after Blackstone.

- Apollo Aligned Alternatives (AAA) strategy should be their largest fund over time.

Disclosure: The above report is a hypothetical illustration of the benefits of using a 3-pronged approach to portfolio management. The data is for illustrative purposes only and hindsight is a key driver of the analysis. The illustration is simply meant to highlight the potential value of building a consumption focused core portfolio using leading companies (brands) as the proxy investment for the consumption theme. This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.