Key Summary:

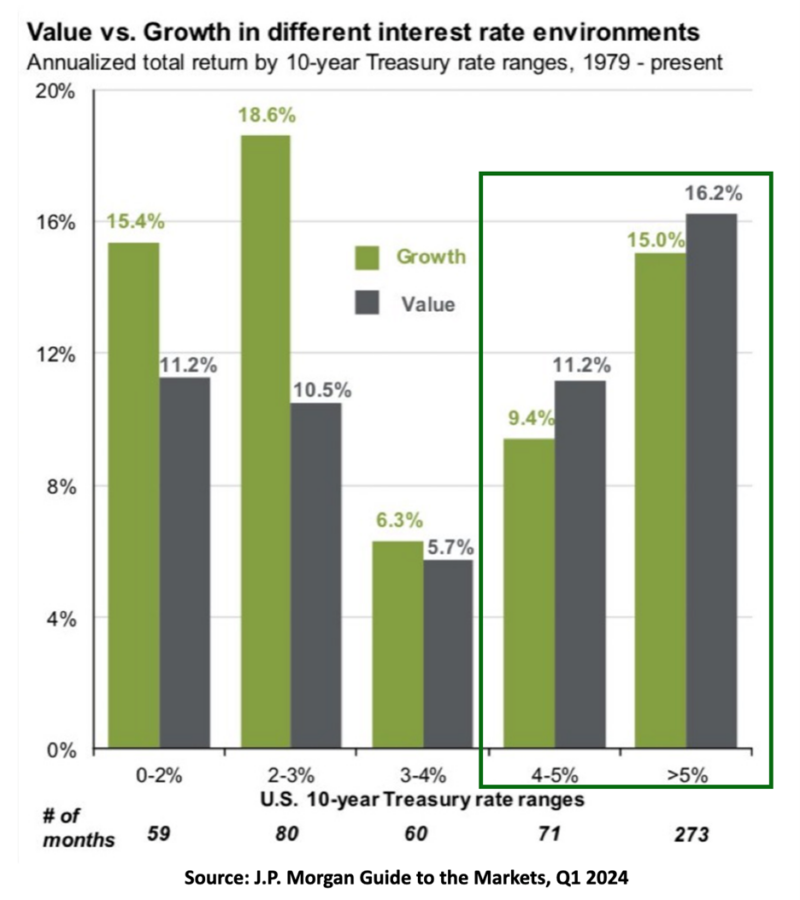

- Conventional wisdom states that stocks generally struggle in periods of higher rates.

- Fact: stocks generally perform above long-term averages in higher for longer regimes.

- Historically speaking, value has a slight edge versus growth in these periods but be careful of where you seek “value.”

Very Important thesis: If equities generate roughly 8-10% a year over time, leading brands serving the dominant driver of the economy, in theory, should compound at 13%+ over time. We have significant proof on this topic. In a world where rates and inflation are higher than we might like, business models with pricing power, exposure to quality factors, and that generate strong profits and free cash are set up to win versus the typical peer. Brands Matter.

Stocks – value and growth – have performed well in higher rate regimes.

Generally, it’s the trajectory of rates that matters, not the level of rates. With a hotter than expected recent CPI report, rates have moved swiftly higher, and stocks are pulling back for better entries today. In early 2022, the Fed finally began de-anchoring from the dreadful regime of zero rates. ZIRP created plenty of distortions and those are being unwound as we speak. That’s a very good thing but there will be volatility along the way. Use this volatility to your advantage and buy more quality companies, funds, and ETF’s on sale.

I have written about how stocks have historically performed in higher inflation and rate regimes before, and given the recent move up in rates, I thought it was timely to address the topic again. The chart above shows the annualized returns for value and growth stocks by different 10-year Treasury rate ranges. I think we can all agree, we should be locked in the 4%-5.5% range for the foreseeable future, for a variety of reasons. Contrary to conventional wisdom, stocks have performed just fine in the two periods as shown above.

In fact, going back to 1979, stocks have performed 50% better than the long-term average of stocks which is ~+9-10% per year. As I showed in a former note, one could call these higher rate regimes as “goldilocks” periods for stocks. And yes, there have been plenty of scary geopolitical events along the way, similar to today.

Value & Growth Have Performed Well in Higher Rate Regimes.

The investment world has changed over the decades and ETF adoption has been broad based. The bulk of the ETF capital still goes into market cap weighted, passive strategies so some historical norms have been altered a bit. It’s anyone’s guess how the ETF-effect will distort past data but historically, the value style factor has slightly outperformed the growth factor in the higher rate regimes we are likely stuck in for a while. Historically speaking, if our inflation issue stays “contained” and in the 2-4% range, we expect it will, stocks generally perform well. Since the first rate increase on March 17, 2022, large growth has been the outperforming style box so thus far, growth returns have diverged from the typical value outperformance stated above. Why might that be? In an economy with constrained growth due to demographics and high debt levels broadly, it’s quite logical to expect the highest caliber companies or brands to perform the best. Not every company is thriving in a high cost of capital, higher inflation and interest rates regime. It’s the QUALITY style factor that seems to make the most sense, (versus value or growth) because these businesses have solid competitive advantages, do not generally require debt to fuel their growth, and they generate solid profits and free cash flow. These businesses also tend to take market share in times where the average company is not thriving. All these circumstances are present today which is why our team advocates to stay UP in QUALITY, Up in SIZE, and UP in BALANCE SHEET STRENGTH. For the first time in a long-time, there seems to be a case for owning value AND growth equally so long as you stay up in quality and competitive advantage characteristics.

Value Comes in Many Packages.

In a market where the average stock has an elevated valuation, the term “value” can be misleading, particularly in ETF-land. Except for the deep value cohort, we are clearly in a “relative value” world. Most people’s exposure to the value style factor comes from their low vol, dividend paying strategies. Reminder: Value can be a difficult style factor to invest in when the indexes often hold many companies that most analysts would not consider cheap. And the deep value cohort has a history of very infrequent outperformance periods, often filled with “value traps.” All things being equal, I would much rather buy and hold high quality companies with stable and predictable growth opportunities that were trading at reasonable multiples relative to the opportunities. To find these companies, I would suggest using the PEG Ratio. Typically, having a PEG <1-1.25 offers as a solid GARP (growth at a reasonable price) opportunity. It’s here that our portfolio tends to spend the most amount of time, particularly in today’s “higher for longer” environment. With strong GARP characteristics, one gets access to the growth and value style factors all in one. That feels like the most prudent pond to fish in today.

Disclosure: The above data is for illustrative purposes only. This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.

[/vc_column_text][/vc_column][/vc_row]