Key Points

- U.S. Retail Sales has mean reverted to its long-term trend (as expected).

- Because of high inflation and macro uncertainty, consumers are forced to make choices again.

- Spending on “essentials” and “must-have” discretionary items is the focus for now.

Consumer Spending Has Been Robust and Has Mean Reverted Back to Trend

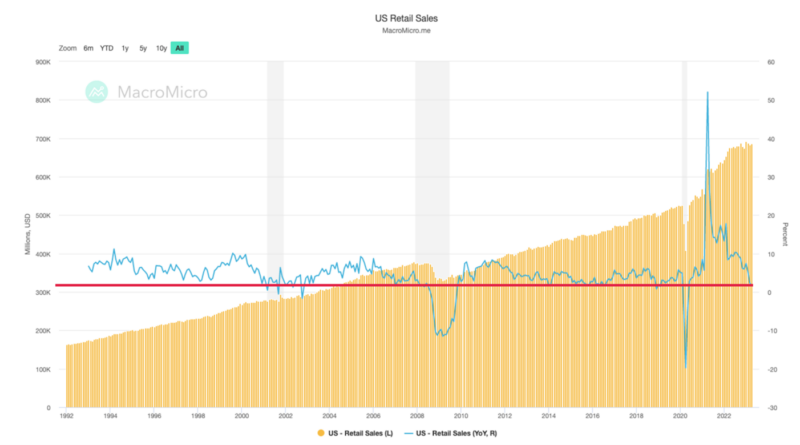

When consumers were locked in their homes and shopping online, savings rates and goods spending went parabolic. When things go parabolic, they should be expected to mean revert to the long-term trend over time. That’s exactly what has happened with Retail Sales and the components within this $7 trillion per year component of GDP. The entire COVID period is now normalizing from a spending perspective, but there will still be some ripples across different categories. Consumers over-spent on goods and durable items and under-spent on services and experiences. We see some fracturing of services spend around the edges currently, but this component of spending is still more stable and elevated relative to the goods spending that is soft as we enter summer vacation season.

As you can see from the chart below, retail sales went parabolic and have now steadily fallen back to an area where it tends to chop around. We are watching closely for continued weak spending, which could warrant more defensiveness in our positioning. With inflation across most services and food categories, we expect consumers to simply make choices about where to spend their money and time. Some items will be deferred while others get the benefit of our marginal discretionary dollar. Needs over wants is our focus, while also holding exposure to the most important wants, which include technology, travel, everyday fashion apparel & footwear, and entertainment.

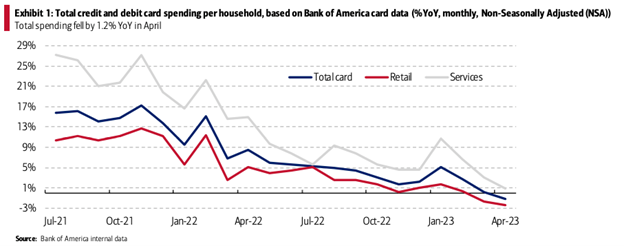

Consumers Do Not Have Unlimited Spending Capacity; Choices Must Be Made

The bears will highlight the extreme fall of total credit and debit card spend, but one must remember the spending was extreme and always expected to mean revert down. Whether consumers retrench even more aggressively, only time will tell, but thus far we are seeing exactly what we expected in spending trends. This BofA spending chart from their May 2023 report highlights what’s been happening since the peak in Q1 2021. Remember, our savings ballooned and have also mean reverted to slightly below long-term averages, now about 4.6%. Savings are now being built up again as we get more nervous about the economy. BofA states, savings overall are still about 40% higher on average than the 2019 levels, so there is still a savings cushion for most consumers. Lots of data here for a bear or a bull which simply makes for more volatility around these numbers.

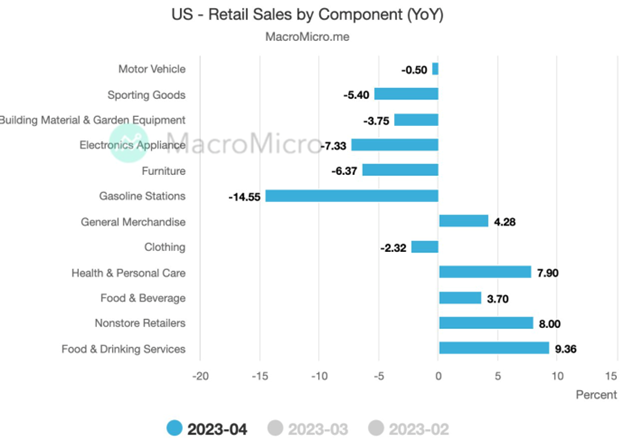

Digging deeper into consumer spending, the chart below highlights how consumers are making choices and where they are spending today. To reiterate, for now, it’s a “needs over wants” spending environment. The chart shows U.S. Retail Sales by component on a year-over-year basis. The focus continues to be experiences and “needs spending” across these areas: general merchandise (includes grocery), health & personal care, food & beverages, eating and drinking out, and nonstore retailers (e-commerce) over physical shopping. Traffic trends to physical stores has been slowing. With belts tighter from inflation, perhaps families are spending less in April, May, and maybe even half of June so they can have more fun and spend on vacation? Our family is certainly thinking that way.

As we look at stock performance, it’s clear for now, the defensive stocks are holding up well while many retailers and specialty retailers have pulled back. Based on our work, we could see one more quarter where retail sales trends get softer, which could offer much better entry points in some great retail stocks and even a few secondary brands that have gotten overly beaten up.

What Looks Attractive Now Across Positive Trending Categories?

General Merchandise:

Costco is still performing well, and the stock is off from the recent peak offering an opportunity. The management team at Costco are some of the best in the industry and as they see their costs fall from vendors, they pass along the savings to customers. That’s why the loyalty is so strong at Costco. They recently raised the dividend by 13%, which is better than most other consumer brands. Their business serves our general merchandise and grocery needs well so we expect stability in this great business model.

Health & Personal Care:

In last week’s blog, I highlighted a new edition to the portfolio in KenVue, the largest consumer healthcare brand by sales in the world. They own our medicine cabinet with brands like Band-Aid, Benadryl, Listerine, Pepcid, and Zyrtec for your seasonal allergies. If you haven’t read the report, click here to read it.

Food & Beverage:

Some of these brands have been monster performers for a long period of time and with consumers making choices and favoring needs, we still like these brands. Snacks are very important to consumers and Pepsi, through their house of brands that include Lay’s, Doritos, Ruffles, Tostitos, Sunchips, and Cheetos are doing quick well. In the most recent quarter, management cited strong volume trends with good pricing power and no pushbacks on price thus far. Hershey is performing well also and should benefit from falling input costs while prices remain higher. The stock is not cheap, but we see strong trends across this wonderful portfolio of brands. The traditional beverage business with Pepsi, Gatorade, Aquafina Water, 7Up, Starbucks Beverages, and its newest addition with the stake in emerging energy brand Celsius continue to do well. Similarly, Coke and its top beverage brands that include its partnership with Monster Beverage are performing well.

Food & Drinking Services:

Leading Brands like Starbucks, McDonald’s, Chipotle, Domino’s, and restaurants and bars are still performing well. So many of these brands, particularly local restaurants, have taken prices up significantly as workers were hard to find and expensive. I keep waiting for consumers to push back on price here but thus far, the top brands and our favorite restaurants are still performing well. Margin pressure could be a problem soon if consumers finally push back on their spending in this category.

E-Commerce:

Amazon is the 800 lb. gorilla in this category and we still think this stock has much further to run. It’s basically gone nowhere for a few years, yet revenues have ballooned. As their spending mean reverts closer to long-term averages, we expect the free cash flow line to vault higher once again. The stock is not currently priced for this eventuality in our opinion.

Next week, I’ll tackle the spending in services and which categories across travel and recreation still look attractive.

Disclosure:

The above report is a hypothetical illustration of the benefits of using a 3-pronged approach to portfolio management. The data is for illustrative purposes only and hindsight is a key driver of the analysis. The illustration is simply meant to highlight the potential value of building a consumption focused core portfolio using leading companies (brands) as the proxy investment for the consumption theme. This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.