Last week Williams Companies (WMB) held their first ever ESG Event. As might be expected, the most interesting parts were on the “E” (Environmental). It’s hard to find much original to say on Social issues, and Governance should simply mean following industry best practice.

WMB is in a position to be a big winner from policies to combat climate change. If pragmatists seize control from renewable evangelists, which they should now that Democrats own the issue, they’ll realize that measurable progress on reducing emissions will come from natural gas. Rising CO2 emissions over the next couple of years will be no surprise after almost a year of lockdowns. But the deteriorating mix of power generation (i.e. more coal and negligible increase in clean energy) mean that President Biden isn’t assured of overseeing lower emissions during his current term.

There may be valid reasons but failing to reduce emissions below their prevailing level at Trump’s exit will represent failure. Gains in natural gas over coal for power generation are set to reverse this year, because of higher prices for the former (see Emissions To Rise Under Democrats). Democrat policies to inhibit oil and gas production are already having an impact. Spending on new production continues to fall.

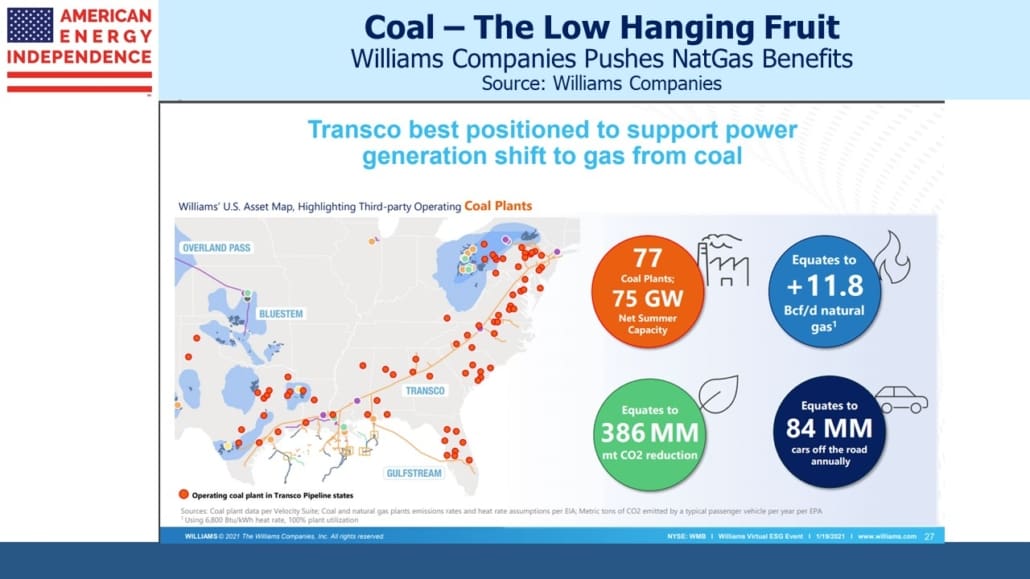

WMB moves 30% of America’s natural gas, much of it via their extensive Transco pipeline that runs from Texas to NY. Originally built to supply natural gas from the southeast to New York, in recent years it’s switched directions in places. Some natural gas now moves south, from the Marcellus Shale to Cheniere’s LNG export facilities in Texas and Louisiana.

WMB has identified 77 coal-burning power plants that are within Transco’s “footprint”. That is, they operate in a state through which Transco passes, and therefore can be supplied with natural gas should they be converted. Converting them all would lower US energy-related CO2 emissions by over 8%.

It must be the easiest 8% reduction available over the next few years, if the Administration can find a way to do it. WMB CEO Alan Armstrong clearly grasps the opportunity.

While America stands to benefit from shutting down coal plants, the world needs China to head in this direction. China burns half the world’s coal. They have four times the power output from such plants as the U.S. Much of the world’s planned investment in new coal burning power plants is in China. The Administration is already publicly calling for China to toughen its targets on greenhouse emissions, which are scheduled to keep rising for at least another decade.

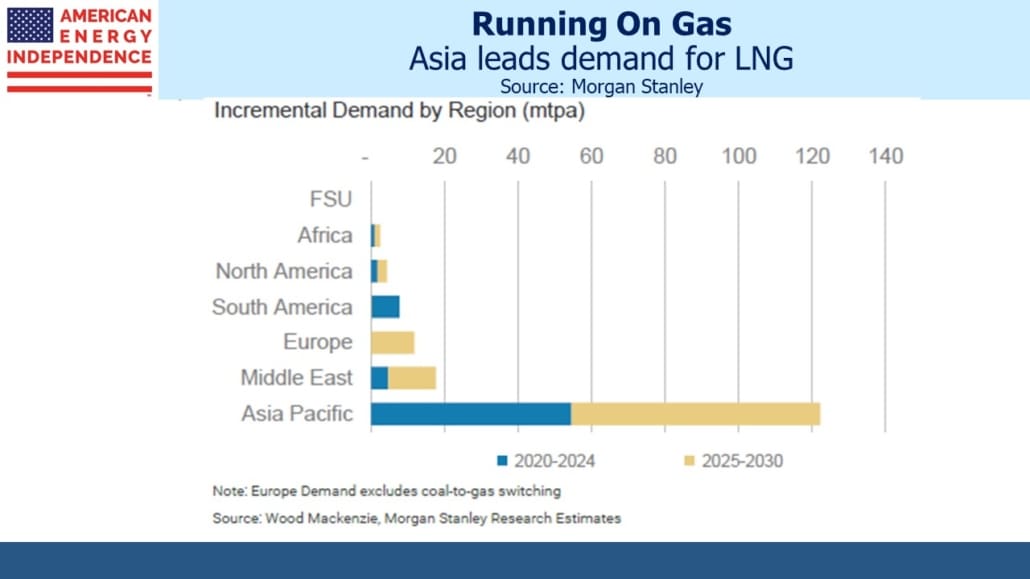

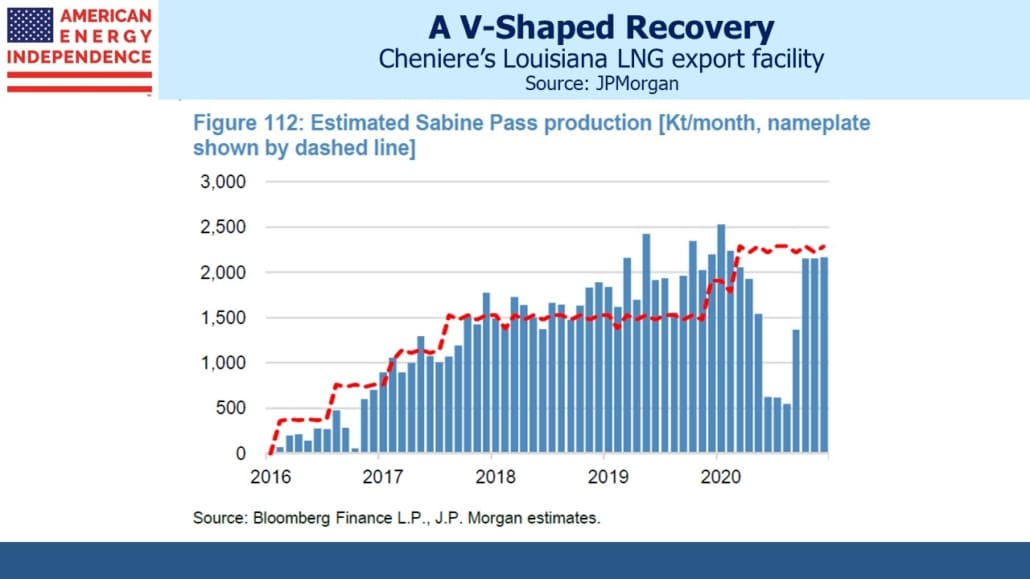

It’s no coincidence that 68% of global trade in Liquified Natural gas (LNG) is in Asia. Last year a sudden drop in demand caused shipments to plunge from Cheniere’s Sabine Pass LNG facility in Louisiana. But helped by a cold winter, European and Asian demand has driven shipments to a new record. U.S. LNG exports last year were up 10% on 2019, a result that seem improbably six months ago.

China sources almost half of its LNG imports from Australia, and the rest from other Asian countries and Qatar, because shipping costs are significant. American natural gas prices have been rising but remain among the lowest in the world. The EIA expects higher prices to drive increased production next year.

Even though U.S. LNG exports to China are incopnsequential, our LNG exports will still benefit. The recent price spike in Asian prices has slashed European LNG imports – because shipments have been diverted to Asia. Consequently, Morgan Stanley recently raised its 2021 price for European natural gas by 35% (from $4.30 per MCF to $5.80). They expect global trade in LNG to grow at a 4% compound annual rate through 2030, with Asia driving over 80% of this increased demand and rising to 73% of the global market.

The U.S. opportunity in natural gas is to substitute it for coal. The global opportunity is to take advantage of low U.S. prices to meet growing Asian demand. WMB is well positioned to be part of both solutions.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

The post Williams Companies Sees A Climate Change Winner In Natural Gas appeared first on SL-Advisors.