History is filled with stories of investors chasing returns only to experience crushing losses. Bitcoin offers a recent example. After an incredible rally peaking at $18,674.48 in December 2017, Bitcoin was down over -83% to $3,156.89 one year later. This wasn’t even the worst drawdown in the history of Bitcoin!

Internet stocks, as measured by the Dow Jones Internet Composite Index, offer another example. After peaking in March 2000, internet stocks dropped over -95% through October 2002. During the second half of 2018, when the market got spooked by trade deterioration, internet stocks dropped more than -27%, while the S&P 500 TR Index dropped just under -17%.

Some prominent investors have suggested that a much larger bubble may be forming, a passive investing bubble. Billionaire investor Carl Icahn called passive investing a bubble that “will implode and could lead to a crisis bigger than 2009.” Icahn explained that investors are making a mistake using the market as a casino, with too much money flowing into index funds and investors not knowing what they own. It’s also worth noting that billionaire investor Ray Dalio recently put on a $1 billion bet on a big stock market selloff.

This begs the question: How much weight should financial advisors put on these types of statements? According to data from Morningstar, active strategies have experienced more than $1.25 trillion in outflows, with a similar amount going into passive equity strategies. Assets in passive equity strategies have surpassed more than $4.3 trillion. These are strategies that buy companies regardless of any fundamentals simply because they are in an index.

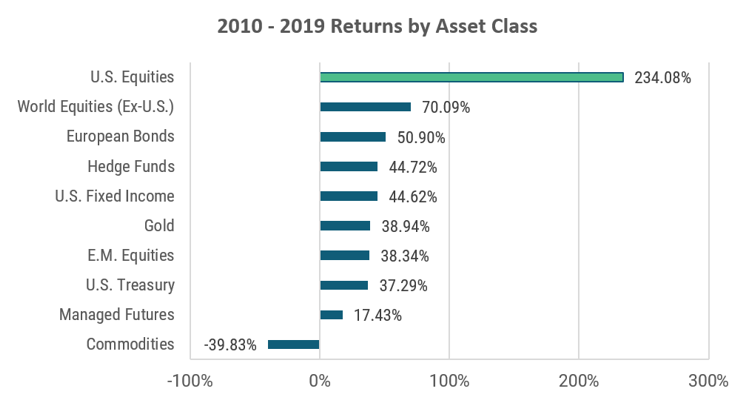

When looking at the performance of the S&P 500 since 2009, it should be no surprise that assets into passive low-fee and no-fee strategies have ballooned. In fact, no other major asset class has even come close to the returns of the S&P 500. One of the best trades has been to simply buy passive S&P 500 exposure as a “set it and forget it” investment strategy. When looking at the other major asset classes, however, the 2010’s have not been nearly as exciting. The equity market has overcome significant risk factors to continue its rally.

Compared to other asset classes, the returns of the S&P 500 have been remarkable

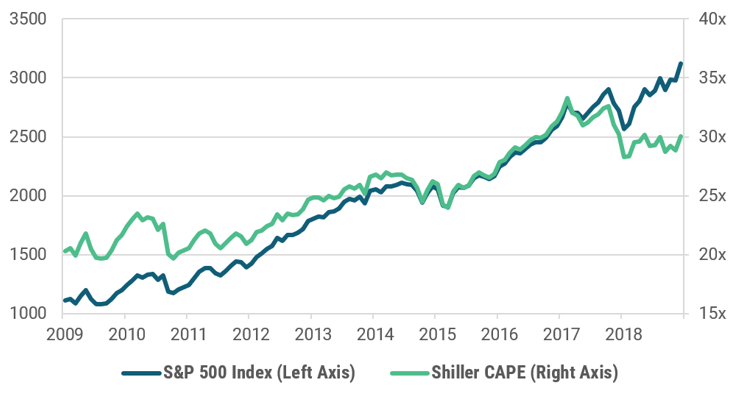

Valuations offer some additional insight, particularly when looking at the Shiller P/E, or cyclically adjusted price-to-earnings ratio (CAPE). The average CAPE ratio back to 1881 is 17.00x, and we are above 30x today. However, the environment today is defined by low-to-moderate growth and relatively flat corporate profits in combination with significant geopolitical risks and monetary policy that will eventually need to become less accommodative. Aside from the benefit that lower interest rates offer, these do not appear to be conditions that support historically high valuations.

The S&P 500 has spent the 2010’s with valuations significantly higher than the 17.00x long-run average

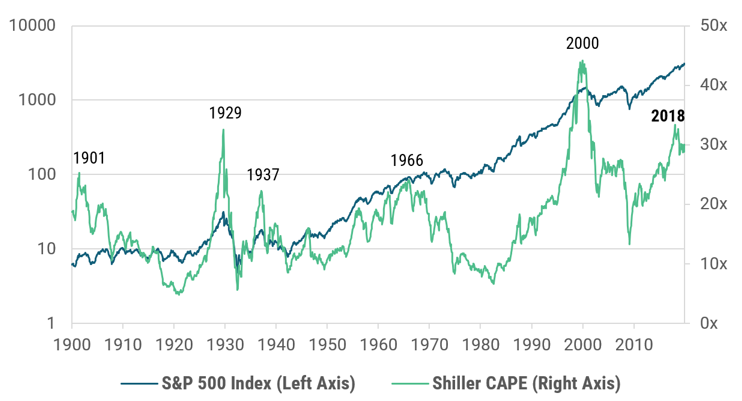

When looking at the CAPE ratio back to 1900, the current environment does not look too different from past situations where stretched valuations were followed by significant market declines.

Historical Shiller P/E (CAPE) versus S&P 500 Index

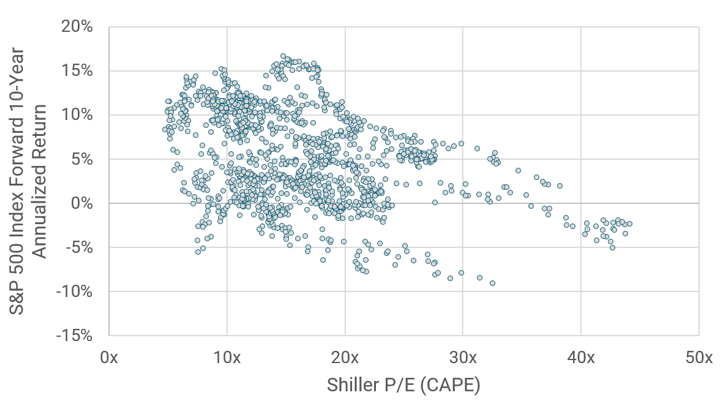

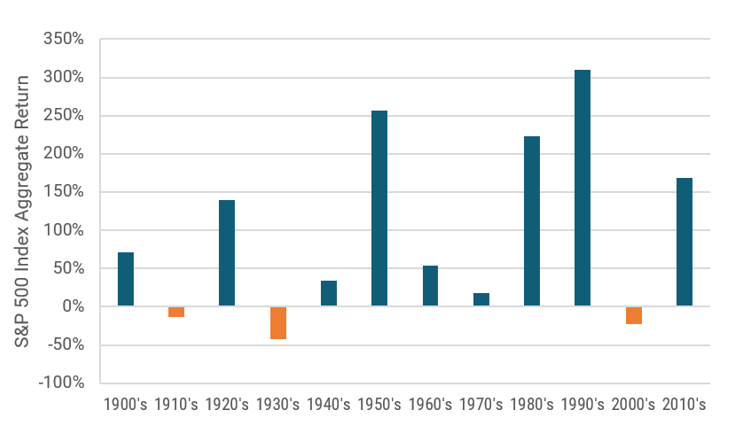

The 10-year annualized returns following these high valuations have been uneventful or negative for investors. After the rally of the 1990’s, the S&P 500 Index experienced a lost decade in the 2000’s. Lost decades are not uncommon, with the S&P 500 Index experiencing a lost decade 25% of the time going back to 1900.

The S&P 500 10-year annualized returns following elevated CAPE ratios have not been favorable to investors

Since 1900, the S&P 500 Index has experienced a lost decade 25% of the time

What can financial advisors take away from this? First, it’s highly unlikely that the S&P 500 will continue the level of outperformance that it has experienced in the 2010’s, especially when considering the environment and the valuation levels. At minimum, clients should be prepared for the fact that the passive S&P 500 trade has more of a chance of being an underperformer than an outperformer going forward. Second, the S&P 500 may experience another lost decade, meaning passive index strategies could deliver negative 10-year returns. Finally, and most concerning, is the unlikely but worst-case scenario of a major geopolitical event leading to equity investors rushing for the exits and $4 trillion in passive strategies all trying to sell in a similar fashion.

While it is easier to sleep at night not thinking about internet stocks or Bitcoin happening at such a massive scale, it is a realistic possibility. At minimum, clients should be aware of this type of risk and the types of strategies they can use to combat these risks. Diversifying streams of risk and return will be necessary to mitigate the impact of any future equity market collapse. One option that financial advisors could suggest to their clients is a hybrid strategy, which integrates equities and managed futures into one portfolio. These strategies allow clients to maintain equity exposure, while also having a managed futures allocation that can deliver positive returns for the strategy even during structural market changes.

As we look ahead to the next decade, market history may not repeat itself, but nonetheless there are economic and market patterns that are too similar to ignore. Even if your clients choose to not change their asset allocations, discussing the risks with them helps them better position for the potential downside. It also demonstrates the need for clients to have a financial advisor, even if it’s to remind them of the risk they’re taking and letting them know somebody is looking after their investments.

Data Source: Bloomberg LP, Morningstar, and Robert Shiller. U.S. Equities, World Equities, European Bonds, Hedge Funds, U.S. Fixed Income, Gold, E.M. Equities, U.S. Treasury, Managed Futures, and Commodities represented by the S&P 500 TR Index, MSCI World Excluding U.S. Index, Bloomberg Barclays EuroAgg TR Index, HFRI Fund Weighted Composite Index, Bloomberg Barclays U.S. Agg. TR Index, LBMA Gold Price PM USD, MSCI Emerging Markets Index, Bloomberg Barclays U.S. Treasury TR Index, SG CTA Index, and Bloomberg Commodity TR Index.