Key Points:

- Despite an ongoing bull market run, investors are pulling a record amount of cash from U.S. stock-focused mutual funds and ETFs.

- History has proven that timing the market doesn’t bode well for investors’ portfolios.

- As investors sit on the sidelines waiting for the “right time” to get back in could be missing out on market upswings and dividend paydays.

- Hybrid investment strategies, especially those that combine equities and managed futures, offer many potential advantages in today’s market environment.

It’s no secret that the S&P 500 index has been on a bull market run since the global financial crisis. In fact, the index is currently having its best streak in six years. Against the backdrop of geopolitical concerns, trade wars between China and the U.S., and recession worries, however, investors have pulled a record $135.5 billion from U.S. stock-focused mutual funds and exchange traded funds so far in 2019, according to the Wall Street Journal. But let’s face it, history has proven that trying to time the market hasn’t worked well for investors. On one hand investors wind up paying extra fees for entering and exiting the market. On the other hand, as investors sit on the sidelines waiting for the “right time” to get back in could be missing out on market upswings and dividend paydays.

Financial advisors can use the transition into a new decade to explain this possibility to their clients, better position them to handle adverse market conditions, and demonstrate the value a financial advisor can add over the long-term. But in the age of high asset prices and low bond yield may require a revision of the traditional 60/40 equity/bond portfolio mix. As a result of integrating several non-correlated assets and trading strategies into one product, investing in hybrid investment strategies, especially those that combine equities and managed futures has historically provided: improved risk-adjusted returns, reduced correlation to traditional asset classes, a more favorable drawdown profile, and crisis alpha.

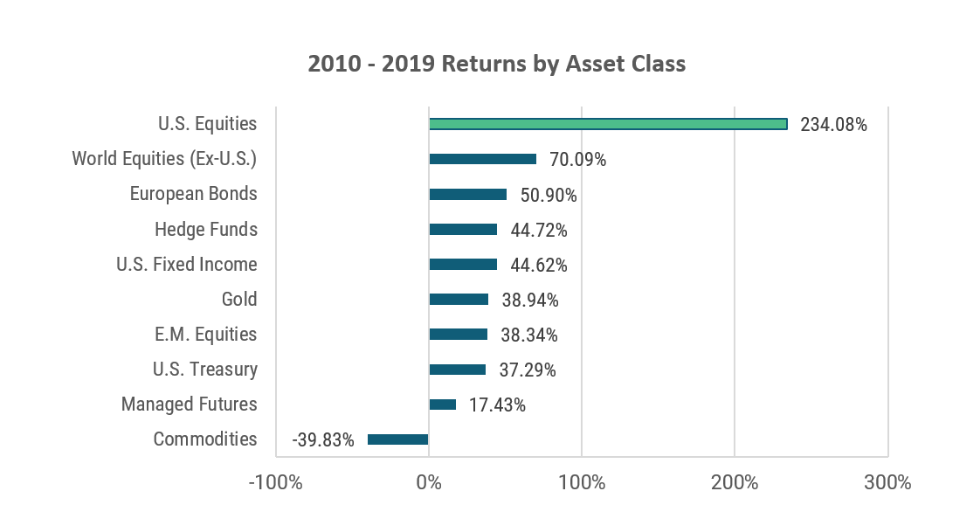

Compared to other asset classes, the returns of the S&P 500 have been remarkable

.

When looking at the performance of the S&P 500 since 2009, it should be no surprise that assets into passive low-fee and no-fee strategies have ballooned. In fact, no other major asset class has even come close to the returns of the S&P 500. One of the best trades has been to simply buy passive S&P 500 exposure as a “set it and forget it” investment strategy. While this has been a great opportunity for investors to grow the value of their portfolios, a side effect has been a shift in investor mindset to one moving away from the need for active management, including the need to manage a portfolio’s overall risk.

After a significant rally in the 1990’s, the S&P 500 TR Index ended the 2000’s down -9.1%. For those without a balanced portfolio, it was a painful decade that likely had a material impact on long-term financial objectives. On the other hand, an asset class like managed futures that can perform well during structural market changes put up significant returns for the decade at +90.0%. While diversification may take away from upside, it plays an important role on mitigating downside risk.

Just because the S&P 500 is following a similarly strong path as it did in the 1990’s does not necessarily mean we are in for a market downturn. In fact, there are several factors that suggest the S&P 500 may continue to perform well for several years. Corporate America is proving strong and still adjusting to the new, lower tax environment. Monetary policy is favorable, and it’s unlikely that there will be any interest rate hikes through 2020. U.S. consumers have benefited from wage and job growth, and lower financial obligations. Even trade policy seems more likely to be on a path of getting better rather than worse.

Nevertheless, there are several risks that could potentially derail the market at any point, including many of the factors mentioned above getting undone or reversed. In addition to these factors, a bull market long in the tooth, stretched valuations, and only moderate economic growth makes it hard to argue that the 2020’s will be as lucrative for equities.

Clients must understand this risk. Using the transition into a new decade offers a great opportunity to discuss the potential risks and rewards of changing allocations to passive equity strategies.

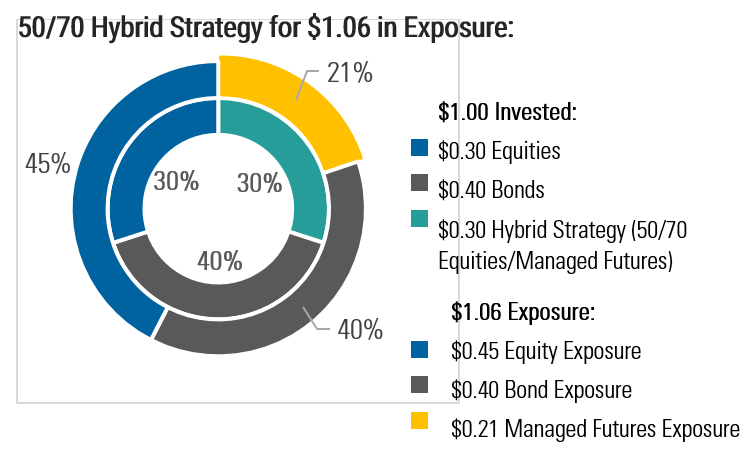

Diversifying streams of risk and return will be necessary to mitigate the impact of any future equity market collapse. One option that financial advisors could suggest to their clients is a hybrid strategy, which integrates equities and managed futures into one portfolio. These strategies allow clients to maintain equity exposure, while also having a managed futures allocation that can deliver positive returns for the strategy even during structural market changes.

Allocating to Hybrid Strategies

The key to success with hybrid strategies is a long-term investment approach based on an allocation methodology versus a short-term trading idea. In the current environment where geopolitical concerns, trade disputes, and short-term noise can lead to a quick drop in the market, inverse equity strategies may be the only investment strategies that reliably deliver positive returns on down-market days.

However, inverse equity strategies tend to converge to zero over time and are therefore not an allocation option. What most investors need is an allocation methodology that can deliver positive returns in various market environments, including the structural changes in the equity markets that can derail investors’ long-term financial objectives; this is the goal of hybrid equities/managed futures strategies.

Allocating $0.30 of Equity Exposure from $1.00 of a 60/40 Portfolio to…

Think Long-Term!

In the current market environment, we believe that many investors have put themselves at risk by inappropriately benchmarking performance to unsustainable equity market returns over the past five years. This risk has been compounded by an increasing tendency to analyze performance on a short-term basis. That said, we believe successfully implementing hybrid strategies into a portfolio requires a long-term allocation mindset and avoiding making sell decisions on short-term noise.

As we look ahead to the next decade, market history may not repeat, but there are economic and market patterns that are too similar to ignore. Even if your clients choose to not change their asset allocations, discussing the risks with them helps them better position for the potential downside. It also demonstrates the need for clients to have a financial advisor, even if it’s to remind them of the risk they’re taking and letting them know somebody is looking after their investments. At some point, hybrid strategies will likely experience a draw-down like many investment strategies and this may offer compelling entry points for increasing an allocation to the asset class.

Data Source: Bloomberg LP. 2010-2019 returns through 10/31/2019. U.S. Equities, World Equities, European Bonds, Hedge Funds, U.S. Fixed Income, Gold, E.M. Equities, U.S. Treasury, Managed Futures, and Commodities represented by the S&P 500 TR Index, MSCI World Excluding U.S. Index, Bloomberg Barclays EuroAgg TR Index, HFRI Fund Weighted Composite Index, Bloomberg Barclays U.S. Agg. TR Index, LBMA Gold Price PM USD, MSCI Emerging Markets Index, Bloomberg Barclays U.S. Treasury TR Index, SG CTA Index, and Bloomberg Commodity TR Index.