Interest rates have gone from 3% on the 10-year Treasury to roughly 1.5% at the lows last month. In addition, mortgage rates have gone from 5.2% last November to as low as 3.4% in late September. The big question is what happens when rates go lower, particularly in an economy out of recession more often than not?

Recent GDP statistics confirm that the consumer is getting a benefit from the “falling interest rates and wealth effect.” GDP rose a better-than-expected 1.9% in the third quarter as the consumer continued to spend. Personal-consumption expenditures, a gauge of spending by American households, rose at a 2.9% annualized rate. U.S.

Consumption capacity increases.

We already know the consumer accounts for 72% of U.S. GDP and over the last few months, the reduction in interest rates has allowed millions of consumers to re-finance their home or buy that home they have been saving for. The re-fi boom lately allows for a reduction in monthly mortgage payments and when people have more money at the end of the month, historically they save some and spend some. That’s an extra boost to domestic consumption that’s very helpful as the economy cools year-over-year. The wealth effect of rising home prices, stock markets at all-time highs and a refi-boom should make for a robust holiday shopping season in 2019.

That narrative sounds a lot different than this week’s Barron’s cover doesn’t it?

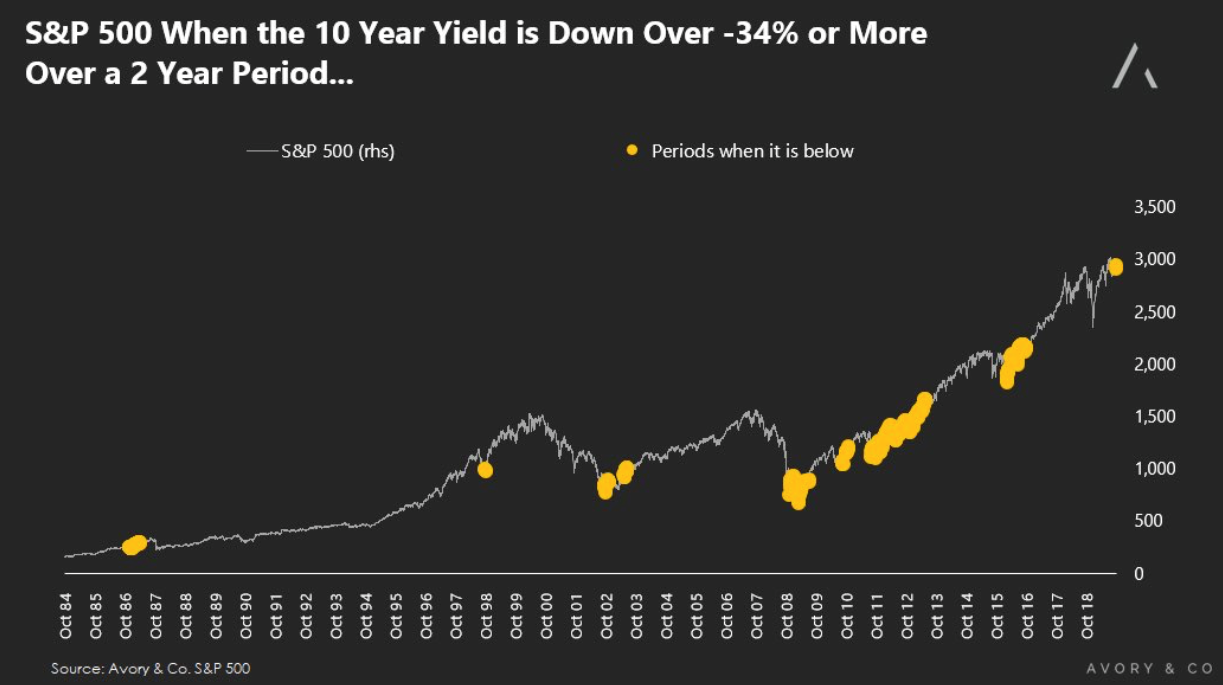

Rates Falling Outside of Recession is a Boon for Your Pocket-Book:

I presented this chart a few weeks ago but it bares reminding: When rates fall by this magnitude and the Federal Reserve (Fed) and other global central banks begin pumping the global economy with liquidity, there’s typically a very positive and stimulative outcome. Historically, stock investing has been rewarded and we spend when we feel like our net worth is rising.

That drives further consumption as consumer sentiment recovers and people feel better about their jobs, lives, and prosperity. That’s where we are today. The tariff discussions seem to be on hold to not upset the holiday shopping apple cart so unless the Fed does something silly later this week and the Tariffs go into the next phase of implementation, things look great for the spending economy.

Where might we spend some of the extra cash from rates falling?

#1 The experience economy – Live concerts & music (Live Nation, Spotify), eating out (Chipotle, Shake Shack, Starbucks, PayPal/Venmo for splitting the bill with friends), going to the movies and binging shows (Disney, Roku platform), Video gaming with friends (Nintendo, Sony, Microsoft, Google via Stadian streaming service) and going on that bucket list vacation you’ve always dreamed of (Booking.com).

#2 Shopping online and in stores – Athleisure lifestyles (Nike, Adidas, Lulu Lemon), Discount shopping for essential items (Costco, Five Below, Alibaba, Amazon), Vanity & self-promotion (Estee Lauder, Ulta Salon, LVMH (just made a bid to buy Tiffany), Home improvement (Home Depot & Sherwin Williams paint), E-Commerce brands enabling other brands to build e-commerce capabilities (Shopify).

#3 Luxury purchases – Cars (Ferrari & Tesla), Home furnishings (Restoration Hardware)

The Bottom Line: The Most Relevant Brands Matter

When we have more, we spend more. It’s really that simple. As investors, we have a wonderful opportunity to generate returns by investing in this important theme. With interest rates falling and the wealth effect in full force, we should expect a decent holiday spending season favoring the most relevant brands resonating with consumers. Here’s the best part, while the market is short-term overbought, there is so much skepticism built into the market now that the path of least resistance in my eyes remains higher through the holidays.

DISCLOSURE:

This information was produced by and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.