Our blog topics are often informed by the subjects that come up in conversations with clients. October was a wrenching month, with the Alerian MLP index slumping to -6% versus +2% for the S&P500. MLPs have lagged equities by an astonishing 22% YTD. Over the last couple of weeks we have been busier than usual fielding calls from investors. By far the most common question in various forms is, when will MLPs recover?

So, for the benefit of those with whom we haven’t recently chatted but are wondering the same thing, below we summarize our thoughts:

- Energy sector sentiment. This remains terrible. Investors would still prefer more disciplined capital allocation. Management teams too often seek dilutive growth, often because their compensation isn’t aligned with per-share metrics.

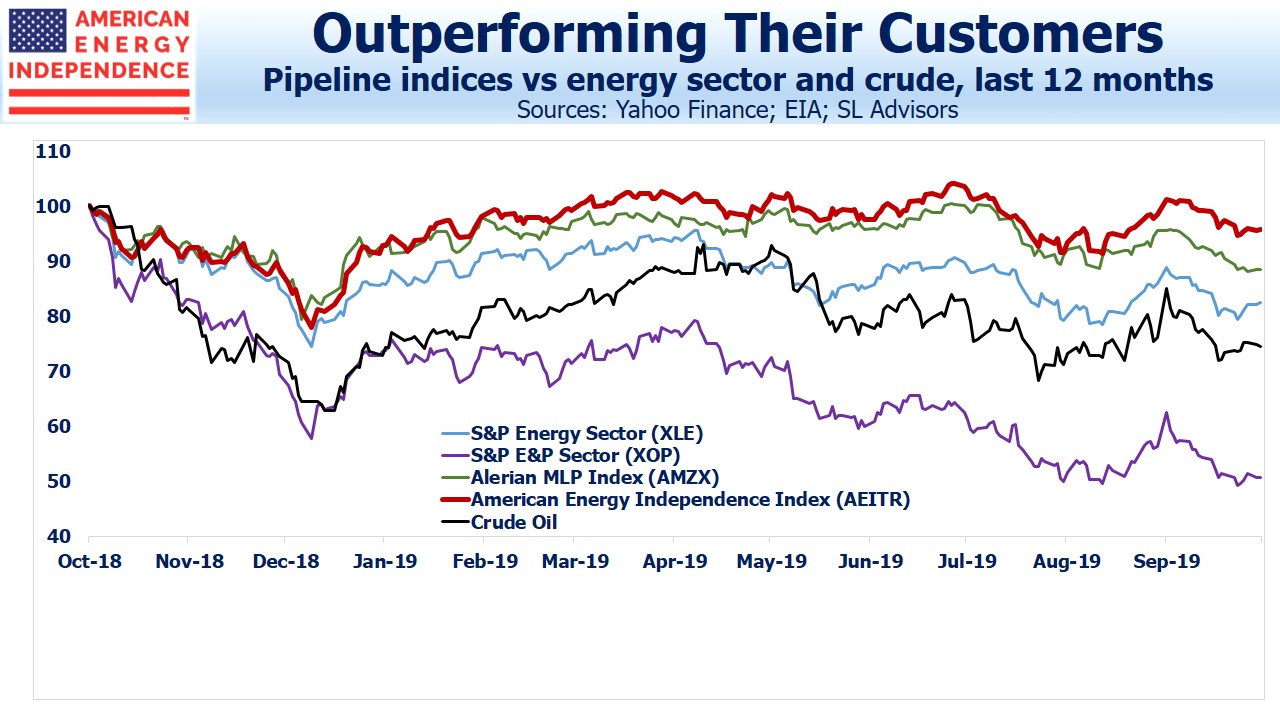

Midstream energy infrastructure has handily outperformed the E&P sector this year, and capital discipline is improving. But many of the people we talk to are weary, looking for reasons to remain invested and searching for confirmation in their original investment thesis that increasing production should benefit pipelines with their toll-like model. However, there are positive signs here, in that Free Cash Flow for midstream energy infrastructure is set to soar over the next couple of years (see The Coming Pipeline Cash Gusher). Growth capex peaked last year, and existing assets are generating more cash. These are both driving FCF to almost $10BN this year, $27BN next year and $43BN or so in 2021. Recent quarterly earnings generally provided confirmation of this positive trend. For example, Targa Resources (TRGP), one of the worst offenders, has 2020 investment spending plans of $1.2BN, half of this year’s. Former CEO Joe Bob Perkins flippantly talked about new projects as “capital blessings”. Investors won’t miss his self-serving arrogance.

- Retail investors are selling. Approximately $3.6BN, roughly 7% of the total, has left MLP mutual funds, ETFs and related products in the past twelve months, which creates constant downward pressure on prices. Although our own products have seen net inflows this year, this is not the norm.

- The MLP business model is probably dead. Pre-2012, pipeline companies organized as MLPs and paid out 90% or more of their cashflow. Back then, America obtained its oil and gas from roughly the same places in the same amounts year after year. Few new pipeline projects were needed, so with little need to retain cash MLPs offered high yields. These attracted income-seeking investors who, because of the K-1s that MLPs issue, tended to be wealthy. In other words, old, rich Americans. The Shale Revolution offered up oil and gas in places not traditionally served by infrastructure – for example, the Bakken in North Dakota and the Marcellus in Pennsylvania. The Permian in west Texas, although long a producing region, saw significant increases in volume. MLPs decided to invest in new pipelines, pressuring balance sheets and ultimately sacrificing distributions. Kinder Morgan was the first to slash its payout, before ultimately simplifying its structure as Kinder Morgan Inc (KMI) absorbed the assets of its MLP, Kinder Morgan Partners (KMP). The rationale for becoming a corporation was to access capital from the world’s institutional equity investors rather than just the old, rich Americans who buy MLPs (see Kinder Morgan: Still Paying for Broken Promises). Most institutions avoid publicly traded partnerships because of complex tax considerations. In the process, original KMP investors, who had invested for stable tax-deferred income, suffered two distribution cuts and a taxable transaction when their units were swapped for shares in KMI. Many thousands remain bitter to this day. Rich Kinder’s promise of ever rising distributions fueled higher payouts back to his general partner via Incentive Distribution Rights (IDRs).

- Prior to 2014, many investors viewed the distribution as sacred and assumed that Rich would honor his promise to continue paying them. After realizing they’d been duped into essentially transferring their money to Rich Kinder through this IDR mechanism based on broken promises, they’ve understandably become disillusioned. If you run into a former KMP investor, ask about their betrayal by Rich Kinder. It’ll be a colorful story. Other MLPs followed KMI’s lead. MLPs shed their income seeking investor base in their desire to fund growth projects. More distribution cuts and unwelcome tax bills followed. This transition to institutional, total return investors has been far harder than they assumed. The legacy of betrayal continues to hang over the sector. KMI had a slide titled “Promises Made, Promises Kept”, boasting about their 13 years of distribution growth.

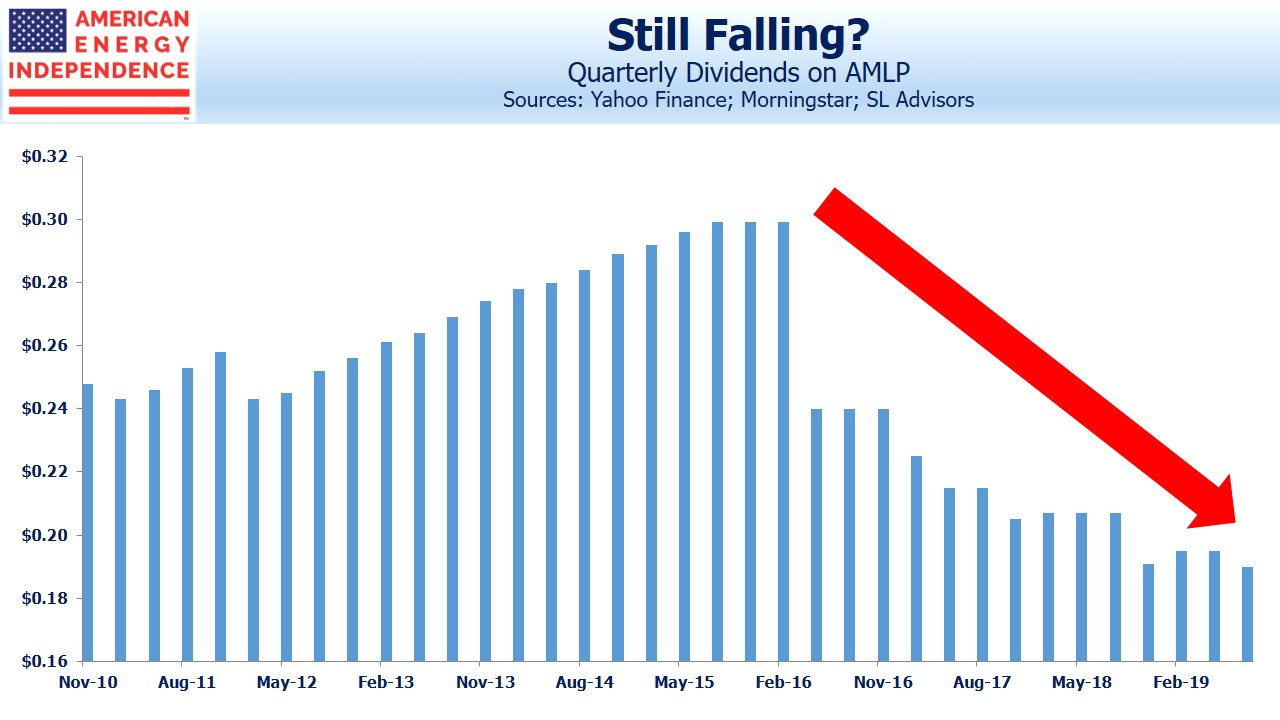

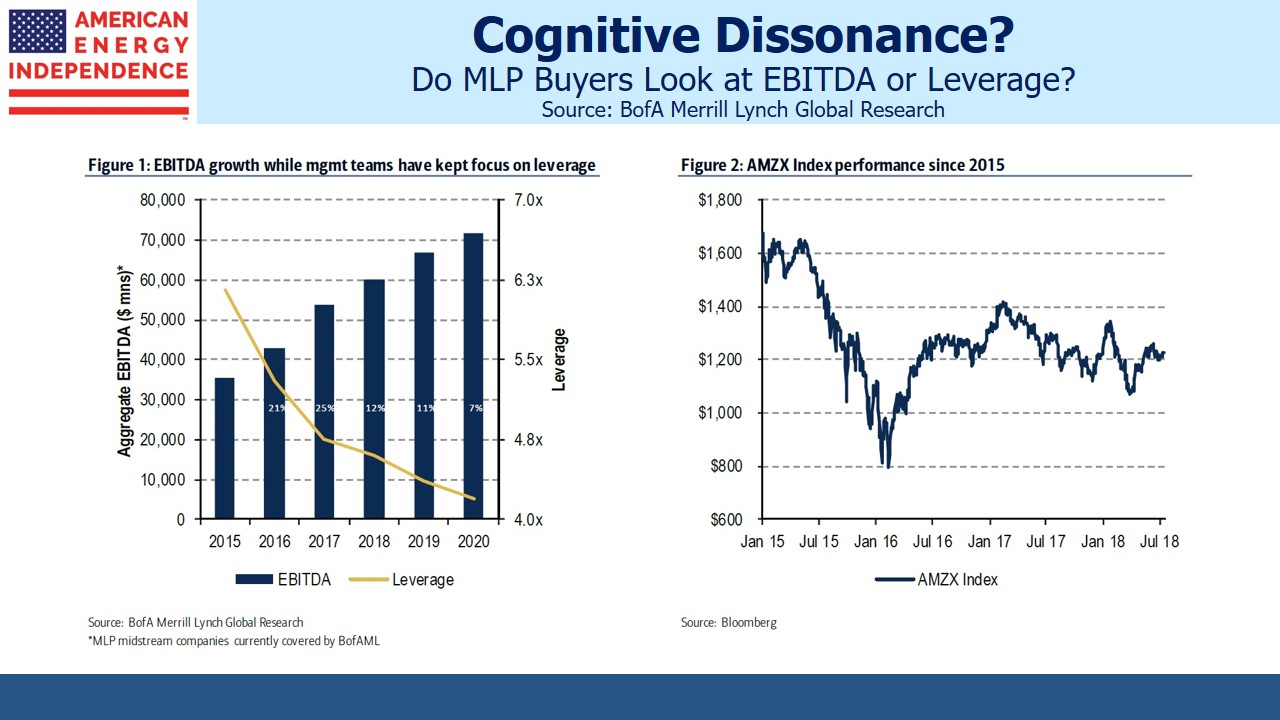

The Alerian MLP ETF has cut its distributions by a third, reflecting similar cuts by its underlying components. This is the only time we’re aware of in which companies slashed distributions even while operating performance was fine, as shown by the growing EBITDA on the slide below.

But if you’ve invested for the income and it’s cut, you’re let down and no mitigating circumstances will compensate. It’s why MLPs have shrunk to well under half the midstream energy infrastructure sector, with conventional corporations (“c-corps”) now dominant.

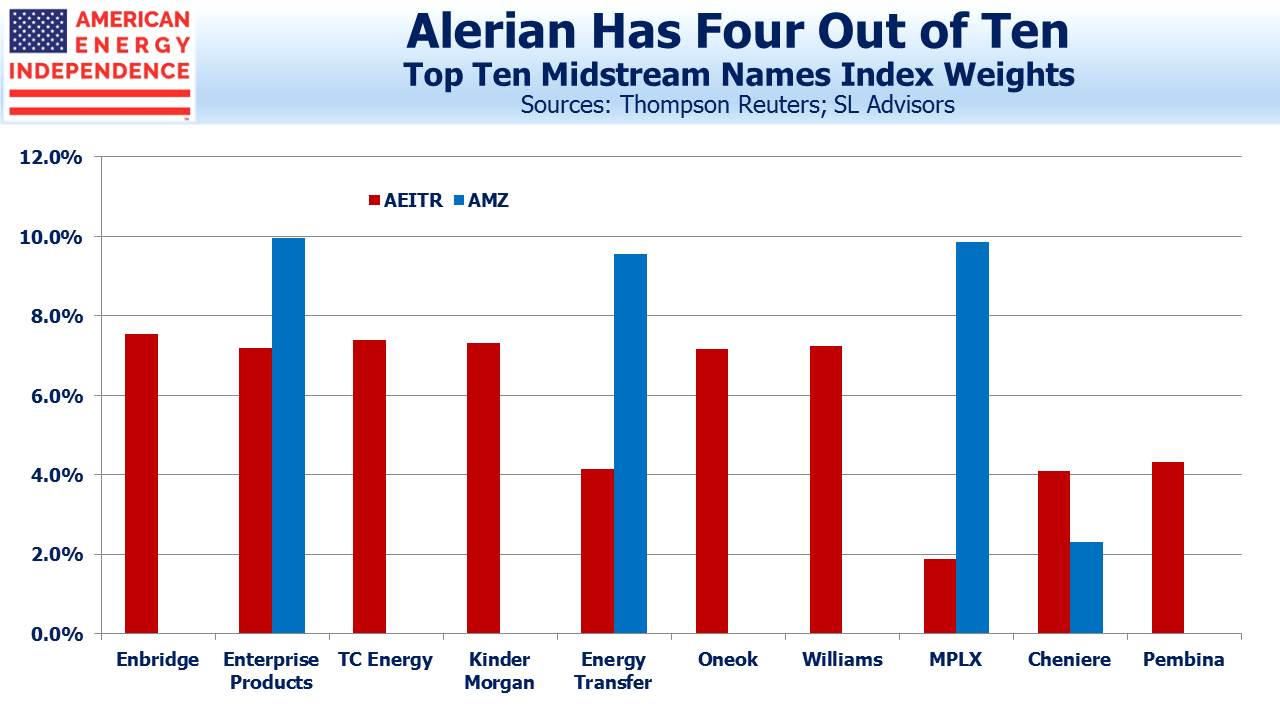

Investors in MLP funds or MLP-only portfolios can select from a couple of big MLPs and many very small ones while overlooking six of the ten biggest pipeline companies, since they’re corporations. AMLP, with its 100% MLP construction and disastrous tax structure, would never be created in today’s form. It is a slowly shrinking legacy to the past (see MLP Funds Made for Uncle Sam).

- Election year concerns. A Warren victory is perceived as the most negative, due to her proposed ban on fracking. If applied to federal lands this would have some very modest impact on production. Most drilling takes place on private lands and is regulated by the states. An outright ban on fracking would require an act of Congress which, barring a complete Democrat sweep to include control of the senate, we believe is highly unlikely.

- Tax loss selling. This seems to happen every year, but energy’s chronic underperformance has created opportunities for investors to pair gains elsewhere with losses in this sector.

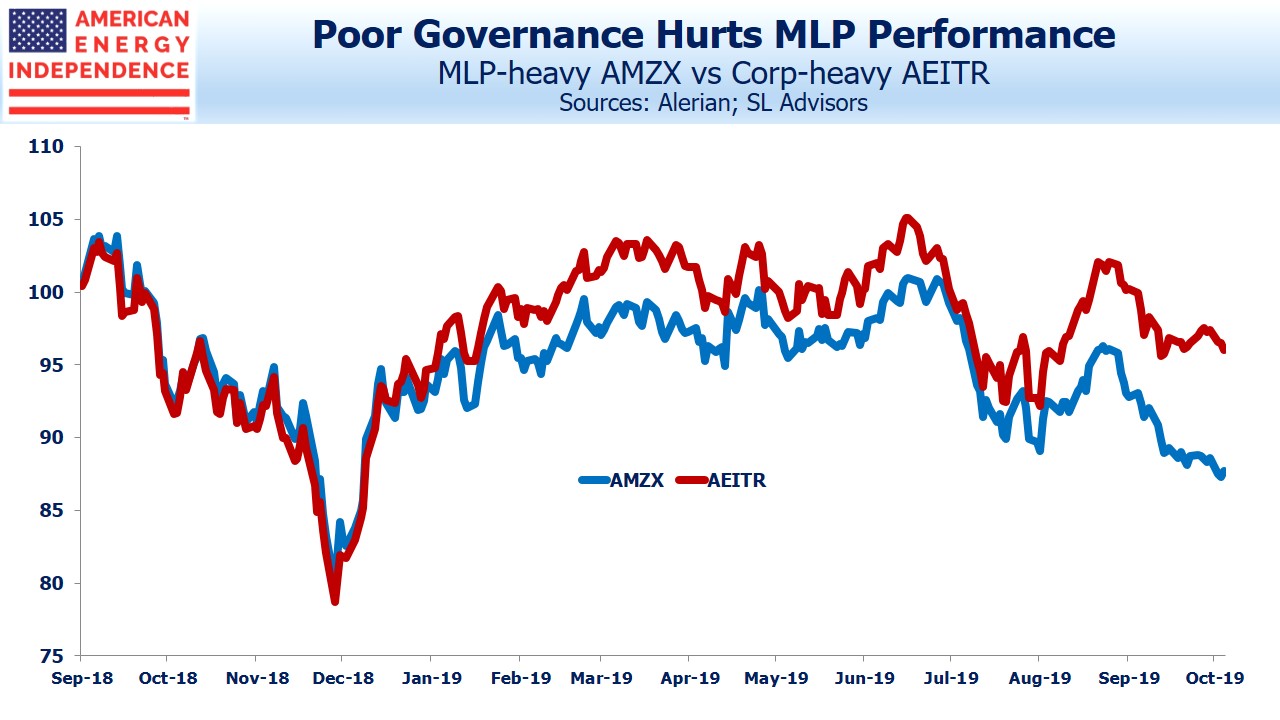

- Climate Change. It’s hard to assess the impact of investors who might otherwise invest in energy declining to do so, either for ESG reasons or because they fear public policy will impose harsh limits on use of fossil fuels. ESG funds are notable investors in some of the biggest pipeline corporations but not in MLPs because governance (the “G” in ESG) provides weaker investor protections. Tallgrass recently demonstrated this (see Blackstone and Tallgrass Further Discredit the MLP Model). The result has been that the MLP-dominated Alerian MLP index has increasingly lagged our own American Energy Independence Index, which is 80% corporations.

Our best bet is that tax loss selling will soon abate, and continuing evidence of capital discipline will draw generalist investors to invest. There’s certainly plenty of interest from other buyers (see Private Equity Sees Value in Unloved Pipelines). But the history of distribution cuts, some poor capital allocation decisions and episodes of investor abuse because of weak MLP governance have depressed sentiment for some time.

For many years November was the best time to buy, with the predominantly retail investor base making the January effect more pronounced than in the broader equity market. The effect has become more muted as companies have switched from MLP to corporation, but still remains a factor (see Give Your Loved One an MLP This Holiday Season)

We are invested in KMI and TGE

The post When Will MLPs Recover? appeared first on SL-Advisors.