As investors, we get bombarded with stock market news daily. The media is driven by advertising sales and fear, uncertainty, and doubt draw in more eyeballs and ad sales. The news-cycle, while important to understand, can sometimes tarnish our views and hurt our ability to get the returns we deserve and need given we are living longer than ever. As a Portfolio Manager, I assess mega trends and mega brands using a few different lenses that help give me perspective while in the trenches. You see, when you’re in the trench, you only see what’s right in front of your face and you often let your emotions dictate strategy. When that happens, the outcome is often less desirable. As we enter a new decade, I thought it was important to look at some unbiased data that might help connect the dots to where we are now, where we might be headed for 2020 and what the next decade might look like.

A History Lesson:

- The current decade.

- Equity & Bond flows.

- The last 20 years.

1 – The current decade 11/30/2009 to 11/30/2019:

The current decade turned in an above average annual return experience for equity investors. As you know, the long-term return of the S&P 500 is roughly 9% per annum. Rarely though does a decade show a return that’s “average.” Returns tend to be well below or well above average over time. Here’s what the important indices returned for this decade per Morningstar:

S&P 500: +13.34%

S&P 500 Long-Term Average: +9.0%

Russell 1000 Growth (large growth): +15.0%

Russell 1000 Value (large value): +11.59%

Russell Mid Cap Growth: +14.23%

Russell Mid Cap Value: +12.18%

Russell 2000 Growth (small growth): +12.86%

Russell 2000 Value (small value): +10.27%

The market bottomed on March 9, 2009 but as someone that was trading for a living at the time, I was not convinced the coast was all clear by year end 2009. The economy suffered one of the most savage recessions in 100 years and the consumer was licking his wounds from excessive speculation in real estate investments. Equity sentiment was absolutely dreadful back then, and most people would have predicted that investing in stocks was a bad idea. When the masses are convinced of something without a shadow if a doubt, it’s time to jump to the other side of the boat. As an investor and student of the markets I have seen the boom period in the late 1990’s, the tech bubble bursting, the 2000-2002 recession, the housing bubble, the 2008/2009 financial crisis, and now the rubber band recovery off the 2009 lows. I’ve learned to build up significant muscle memory to fade the crowded trades and instead, be a contrarian. While sometimes difficult, it has rewarded me much more than following the herd. Surely after such an above average decade for stocks, sentiment is now lopsided and uber bullish right? The data does not reflect optimism. That continues to make me optimistic about stocks.

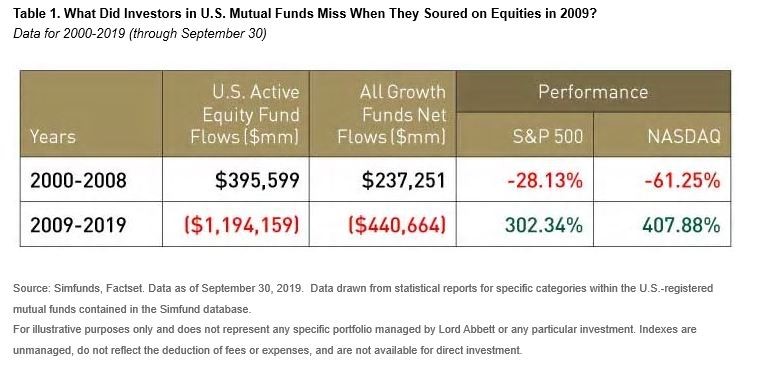

Money flows to equities and to growth stocks for the last decade have been horrendous even as the return profile has been 50%+ above the long-term average of roughly 9%. 2008/2009 had a meaningful impact on investor psychology. There will always be things to worry about but when the masses are running from something, it gets my attention. As you see from the image below, equity returns have been quite strong 2009-2019 while flows to equities and growth stocks have been poor. Flows to equities were strong from 2000-2008 yet returns were abysmal. As we end this decade, equities and growth stocks are not a crowded trade my friends.

2 – Equity & Bond Flows

Here’s a great additonal image from CNBC and Bianco Research showing the equity flows (ETF’s and Active Funds) in red and bond flows in blue since 11/2015. $1+ trillion into bonds and $100 billion out of equities overall. None of the data I can find screams equities, and particularly growth stocks are in high demand from investors. Yes, traders love growth stocks currently but they are momentum focused and are as fickle as the weather in San Francisco. I have written this many times before in these blogs, in my opinion, the real risk in markets and most peoples portfolio’s is not broadly in equities, it’s in assets deemed “safe” where no one expects anything bad to happen. Investor complacency is highest in bonds and bond proxies called “defensive” equities. Euphoria and complacency are neighbors.

3 – The last 20 years in markets:

Do you remember the great stock markets of the 90’s? The U.S. economy experienced above average GDP at full employment largely created by the Internet boom and computer revolution. The decade ending in November 30, 1999 was one of the most robust periods for equity returns as the S&P 500 average annual return eclipsed +17% and large growth stocks did even better at +19.34% as measured by the Russell 1000 Growth Index. (Source: Morningstar).

Then mean reversion & a recession kicked in as we entered the year 2000 resulting in a lost decade of equity returns between 11/30/1999 and 11/30/2009 with the S&P 500 average annual return being a dismal -0.57% or 800 bps below the typical annual return and large growth stocks delivering the worst average return of all the major asset classes at -3.32% annualized over this period. We should not be surprised the last decade has been a growth decade. As we move into 2020, I believe the large growth stocks are still the place to be for a bit longer. Investor psychology doesn’t seem to have swung back to euphoric for more than short periods of time since the peak in 2000.

Here’s the moral of the story. Yes, the last decade has been strong for stocks in general but when you widen the lens a bit further and look at the 20-year returns, equities are still under the long-term average by about 300 bps per year at +6.2% for the S&P 500 and +5.54% for the large growth style. Add to that sentiment towards equities being lackluster at best and it’s my belief the coming decade could surprise people to the upside. Buy fear, sell euphoria. Rinse, Repeat.

Have a wonderful holiday!

Disclosure:

This information was produced by and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.