What a difference a year makes! Despite the bear market forecast a year ago, 2019 turned out to be a stellar year for global equity markets paced by the S&P 500. The Dow Jones Industrial Average and NASDAQ Composite also posted record highs.

Ironically, just 12 months ago, investors were licking their wounds following one of the worst fourth quarters in recent history. This time last year, Wall Street economists were forecasting three or four rate hikes from the Federal Reserve (Fed) throughout 2019. Such forecasts stoked recessionary fears and weighed on stock prices.

As it turns out, the Fed cut rates three times, creating an excellent tailwind for stock prices. But perhaps what is most noteworthy about 2019’s stock market rally is the fact that earnings for companies in the S&P 500 declined in the March, June, and September quarters (and are forecasted to decline in December, as well) versus the comparable quarters of 2018. Therefore, the 29% return posted by the S&P 500 was entirely due to multiple expansion. We would be more accepting of this if we were exiting a bear market, where valuation levels are compressed. However, we are now 10-plus years into a bull market where price/earnings multiples for the S&P 500 are above 5- and 10-year averages.

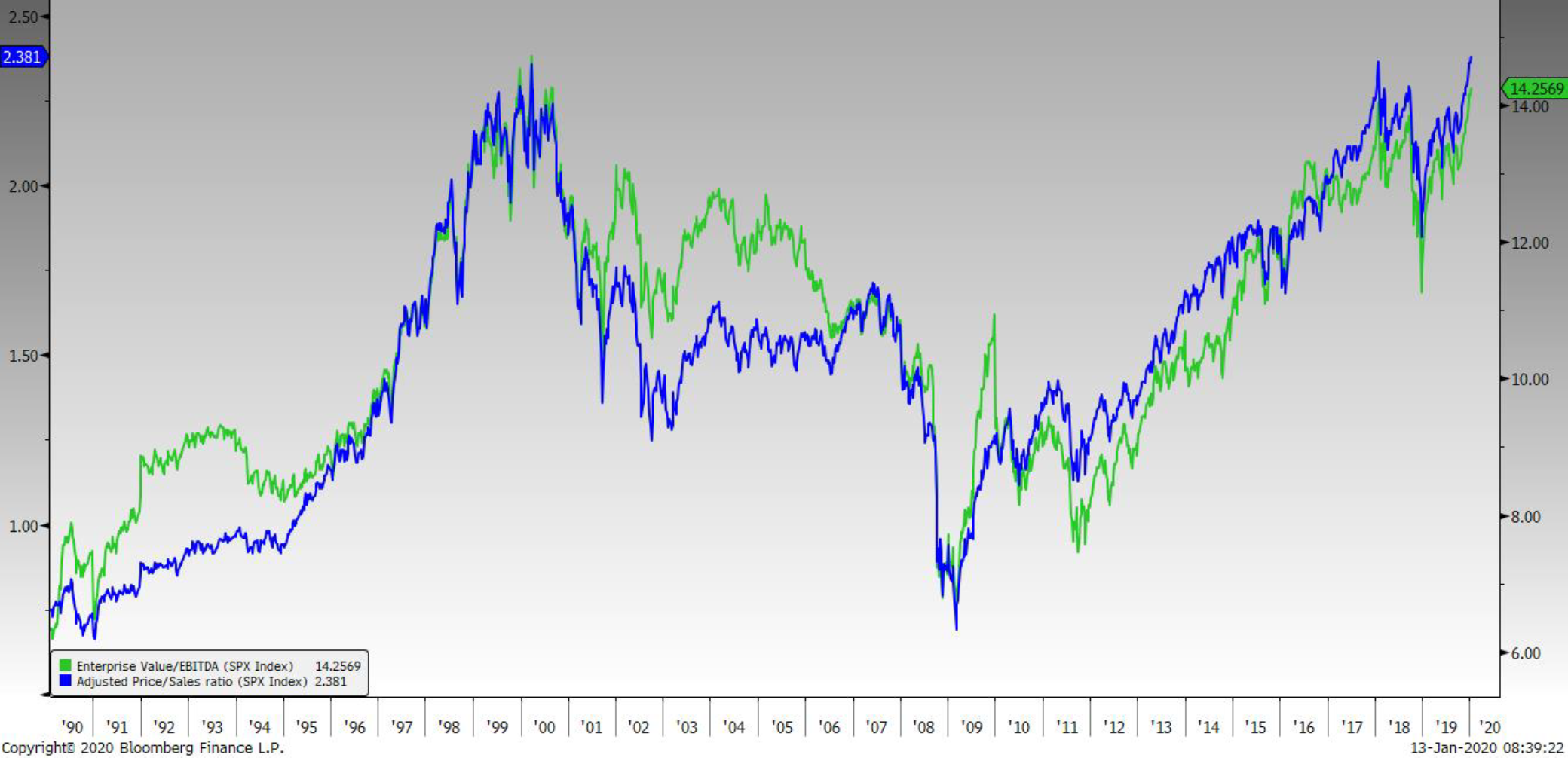

As the chart above illustrates, the S&P 500 is currently selling at 14.25x Enterprise Value/EBITDA, and 2.38x Adjusted Price to Sales. Ironically, this is about the same valuation level as the late 1990’s when the dot-com bubble inflated valuations to unsustainable levels. As such, we are currently finding more attractive valuations and dividend yields outside the U.S. Markets such as Mexico, Indonesia, and South Africa, appear to offer more attractive risk/reward characteristics than U.S. counterparts.

Last month, the Fed announced its intentions to hold interest rates steady for 2020. A day later, the European Central Bank (ECB) followed suit announcing their plans to keep rates steady to lower throughout 2020. Investors found these comments soothing and fueled the markets higher while laying the foundation for a constructive 2020. While we are cautiously optimistic regarding equities for 2020, we believe a rotation is long overdue. Last year, the S&P 500 was the leader of the pack, but, as mentioned previously, its steep advance in the face of declining corporate earnings has left its valuations lofty.

The trade spat between the United States and China grabbed a lot of headlines and flooded Twitter feeds last year. Eventually, both countries were able to come to terms with a “Phase 1” treaty agreement. This was enough to calm the markets; however, we believe a more substantive pact (one with Intellectual Property Protection) will be needed in Phase 2 to bring the conflict to a halt and have a more profound impact on the economy, as well as the global markets.

We would be remiss if we did not touch on the upcoming U.S. national election. Certainly, the election will garner a lot of attention between now and November. Historically, odds favor incumbents, especially when the economy isn’t in decline. For more of our thoughts on the election, along with a historical perspective, please see our publication about the election on our website at www.managedassetportfolios.com.

As we close in on the 11th anniversary of this bull market, we will continue to strive to seek out the best opportunities for our clients on a risk-adjusted basis. We remain steadfast in our search for investment ideas that meet our valuation parameters; however, they are not as plentiful as they once were. In our opinion, many stocks and indices appear to discount many of the potential positive catalysts, while ignoring many of the risks that appear on the horizon. We believe selectivity will be the key to investment successes, as the herd mentality has bid up valuations of many technology names, with 7 of the top 11 performers in the S&P 500 residing in that sector.

Certain statements made by us may be forward-looking statements and projections which describe our strategies, goals, outlook, expectations, or projections. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements.