Key Takeaways:

- One year ago we forecasted stagflation. It remains spot on.

- Stagflation presents a tangible risk for investors amid Fed constraints.

- Gold-linked fund, actively managed commodity funds, short-term corporate bond funds, floating rate bond funds and legacy non-agency RMBS funds can weather stagflation risks.

Hindsight is 20/20 and the future is always to a degree uncertain. The same is true when looking at the macro environment whether you are an economist, investor, etc. The current macro environment continues to reside under the COVID-induced cloud of uncertainty, spawning overreactions, underreactions, and misdirection. However, one thing remains a common concern: inflation. More specifically, slightly more sophisticated, and financially savvy individuals’ share a common concern of pending stagflation. With that said, based on our in-house research we forecasted that stagflation could develop as we emerge out of the pandemic riddled economy. So far, our forecast (one-year ago) remains spot on.

Stagflation, or recession-inflation, is an economic situation with high inflation, slow economic growth, and steadily high unemployment. This dynamic is a policy nightmare as usually economic policy implementations have an inverse relationship between inflation and unemployment. For instance, actions to lower inflation such as raising interest rates to increase the cost of borrowing subsequentially reduce the rate of lending and consumer spending stimulating unemployment. Currently, stagflation fears started to metastasize as inflation becomes increasingly sticky as it spreads to more categories amid supply chain bottlenecks and as energy prices broke through resistance levels coupled with sluggish hiring data due to the delta variant (September net hiring of only 194,000 well below expectations for a 500,000 increase).

As the economy and society emerge out of the pandemic, opinions on the trajectory for the U.S. economy remain divergent. Some believe that inflation is a near-term risk while others believe it may have long-term implications. Some believe that supply bottlenecks will continue to improve, while others believe it has the potential to get worse before it gets better. Furthermore, some believe that loose monetary policy should continue to support the economy while others believe it will continue to create an imbalanced reliance on stimulus. Others believe that technology and innovation stocks will continue to appreciate outside of the recent pullback while others believe that value investing has reemerged from a decades-long slumber. Regardless of the varying opinions on the street, heightened by the looming cloud of directional uncertainty, certain directional forces continue to currently impact markets such as:

- Heightened inflation

- Increasing bond yields,

- Federal Reserve (Fed) scaling back pandemic-era stimulus programs,

- Supply chain bottlenecks,

- COVID-19 booster shots,

- Soaring energy prices,

- Surging commodity prices,

- Slowing consumer spending,

- Retreating real yields, and

- Uncertain economic growth prospects

Is stagflation a real risk?

In short, yes, but the degree of 1970s-like stagflation may be overdrawn. However, stagflation does remain a tangible risk as we highlighted back in October of 2020. Our main rationale back in Q4 2020 was the nightmarish policy cocktail of record-breaking capital injections, overextended stimulus programs, steep job market deterioration, and balance sheet liquidity crunches. Specifically, we believed that the path out of this type of environment created an opportunity for the Fed to make policy missteps (compounded small mistakes) as asymmetric interpretations of a path forward from a global pandemic were not on their resume. As time progressed new policy constraints have continued to develop that make Fed action increasingly more difficult. For instance, the potential for asset bubbles or overvaluation poised by the excessive stock market valuations, that have developed in the wake of the V-shaped recovery post-March 2020, pose a tangible investing risk. With few bouts of volatility and few market pullbacks, the overall stock market has become increasingly vulnerable to market inconsistencies or other potential risk-generating events (such as Evergrande, inflation, supply bottlenecks, monetary and fiscal policy implementations, etc.). This dynamic of potential stock market overvaluation and “other asset bubbles” (as described in The Physics of Markets: Synergy of Cavitation and Financial Bubbles) can constrain the Fed from preventing or limiting stagflation pressures. Additionally, supply-side inflation remains a new caveat that makes the Fed’s inflation responses less influential since their traditional quantitative tightening (QT) remains geared towards demand-side inflation. For instance, traditional QT involves interest rate hikes, adjustments to asset purchases, and strong policy guidance. Coincidentally, interest rate hikes and other contractionary monetary policy is geared to reduce the money supply (the same M1 and M2 money supply that increased 388.5% and 34.4% respectively since March 2020), reduce spending, and reduce business expansion (as research and development expenses decrease during inflationary times) potentially leading to lower or more stagnant hiring/jobs market. This comes as a counterintuitive issue the Fed must unravel. If supply-side inflation continues should the Fed continue to taper and start to quantitatively tighten despite the negative indirect impact on hiring? Even though an interest rate hike is not expected until the end of 2022 or 2023, could a tightening of spending hinder the slowly improving job market?

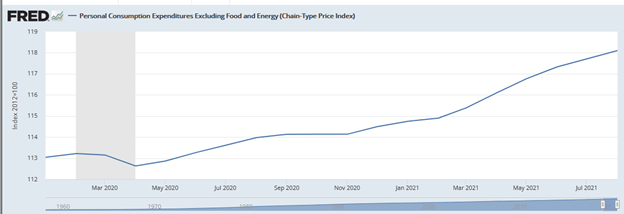

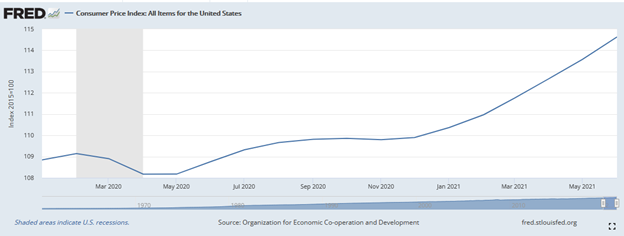

These questions remain pivotal to the stagflation argument. However, there remain some aspects of the economy that remain difficult to ignore. For instance, the money supply (as indicated above) increased due to a liquidity crunch and COVID-related stimulus plans. Additionally, interest rates remained at historically low levels (around 0%), spurring business spending (as we saw with a steep stock market recovery). The increased spending has driven up demand in various sectors. However, a supply bottleneck has ensued causing the prices of consumer goods (used cars, consumer durables, etc.) to higher levels, pushing inflation to overheating territory. Shipping rates continue to increase, delivery delays continue to compound, and inventories continue to fall potentially pushing the supply bottlenecks and inflation well into 2022. Unequivocally, supply not meeting demand and increasing pricing pressures have both been undervalued by markets as well as the Federal Reserve. For instance, since the onset of the supply bottleneck the Personal Consumption Expenditures (PCE) index and the Consumer Price Index (CPI) have both steeply increased (as seen below):

Source: FRED 10/14/2021

Source: FRED 10/14/2021

Furthermore, amid record-setting unemployment numbers due to COVID-19, the path to pre-Covid employment levels remains increasingly difficult to attain. For instance, at the peak of COVID-19, the unemployment rate skyrocketed from 3.5% to approximately 14.8%. Currently, we have significantly improved with a continued downtrend in unemployment (currently 4.8%), but as we have experienced in the past the toxic combination of inflation, quantitative tightening, and elevated unemployment could cause this downtrend to stall and potentially reverse as described above.

In essence, stagflation remains a tangible risk in markets that warrant investors to start to risk manage their portfolios in the likelihood of stagflation’s full development. Even though Wall Street opinions vary (as it does on every topic) investors, fund managers, and individuals should start to look for ways to hedge cash flows. As explained in depth in How to Weather the Risks of an Economic Recovery, Inflation, Increasing Rates, Tapering, gold, soft commodities, short-term corporate bonds, floating-rate securities, and legacy non-agency RMBS can be successful investments to mitigate stagflation risk.

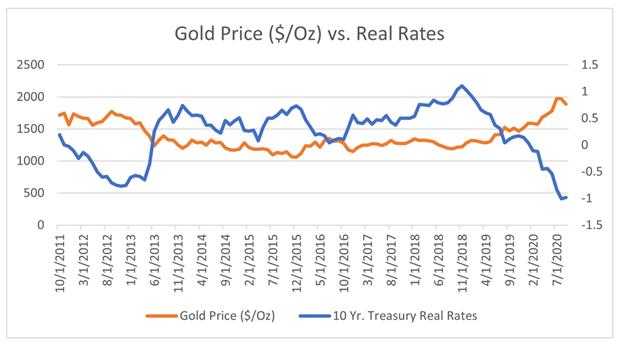

For instance, as described in “Gold Continues to Shine,” real rates (not nominal rates) drive gold prices. Real rates remove inflation from the calculation.

“As real rates turned negative, gold’s 0% interest rate becomes increasingly more attractive (as seen below). Therefore, gold’s divergence from real rates can be driven by a potential shift in U.S. Federal Reserve inflationary bias amid the current thematic backdrop. Gold’s inflationary hedging debates aside, this precious metal provides a good way to hedge stagflation or persistent high inflation, high unemployment, and sluggish economic growth. Based on the current economic backdrop, stagflation remains a viable possibility.” (We have been forecasting stagflation for a year since October of 2020).

Source: Bloomberg 10/20/2020

Other precious metals such as silver and soft commodities such as coffee, cocoa, sugar, corn, wheat, soybeans, fruit, and livestock typically do well as the demand for consumer staples will likely remain stable. However, hard commodities like steel, copper, aluminum, etc. tend to underperform during slowing economic activity as demand decreases. So, commodity exposure to funds that understand the macroeconomic effects on different commodities remain pivotal, or in essence, actively managed commodity funds.

Furthermore, long-term bonds typically do not perform well during a stagflation environment amid the Fed trying to combat inflation by raising rates. The action of raising rates negatively impacts the value of longer-dated fixed-rate bonds (price attrition). However, bonds with shorter maturities and subsequent less inflation and interest rate risk could be ideal for fixed income investors during this type of economic environment. Additionally, floating-rate bonds or leverage loans tend to perform well during rising rate environments as their interest payments float with interest rate movements. As interest rates increase these floating rate interest payments increase. On the other hand, “legacy non-agency RMBS indirectly hedges inflationary pressures and bond price drawdowns due to low correlations with the overall market. As mentioned in “Fixed Income’s Year Ahead 2021: Short-Term Corporate Bonds & Legacy Non-Agency RMBS‘.”

All in all, stagflation remains a viable possibility and risk amid the haphazard economic recovery, asymmetric monetary policy, and monetary policy constraints (supply-side inflation, asset overvaluation, etc.). Thus, investors should start to think of ways to hedge their cash flows and portfolio exposures. Gold-linked funds, actively managed commodity funds, short-term corporate bond funds, floating-rate bond funds, and non-agency legacy RMBS funds can provide that necessary risk management without trading off portfolio outperformance.