I don’t remember a time when the macro environment has received as much attention as it does today. Perhaps this is understandable given how weak global economic data has been and how much money has flowed into negatively yielding bonds. I’ve said before, global flows chase opportunities, wherever they may be. Lately, the equity markets have felt like one giant macro trade based on the direction of the U.S. dollar, U.S. and world interest rates, the yield curve inversions, and trade war anxiety. Allocators use historical analogues to try and predict what the future holds for stocks, bonds, interest rates, currencies, and volatility. To me, trying to figure out all these complex and interconnected moves and what they mean seems like an exercise in chasing one’s tail.

It’s important to remember that we should get used to short term volatility given what a news-driven “algo” world we live in now. It seems that one economic datapoint gets released and traders and investors extrapolate the ramifications into the future and act by allocating to whatever asset classes seem to make sense at the time. Then another datapoint gets released that’s contrary to the first datapoint so the trade gets reversed and a new trade gets put on. This seems like an impossible way to manage a pool of assets given how many crosscurrents we currently have.

I like simplicity. Here are some of the factors that seem very important for managing someone’s assets in a consumer-focused, iconic brands strategy:

- Where are we in the business cycle on an absolute and rate of change basis?

- Based on the answer to the above, should portfolios be fully invested or holding some cash or defensive allocations?

- What do retail sales trends look like?

- How financially secure is the U.S. consumer?

- What is sentiment for equities currently and how confident are consumers?

- What sectors should benefit from the answers above?

- What style factors are driving current equity returns and is it sustainable?

For this week’s blog post I want to laser-in on the style factor theme because we have seen some massive moves in sectors, industries and stocks over the last week.

Style Factor: Growth versus Value

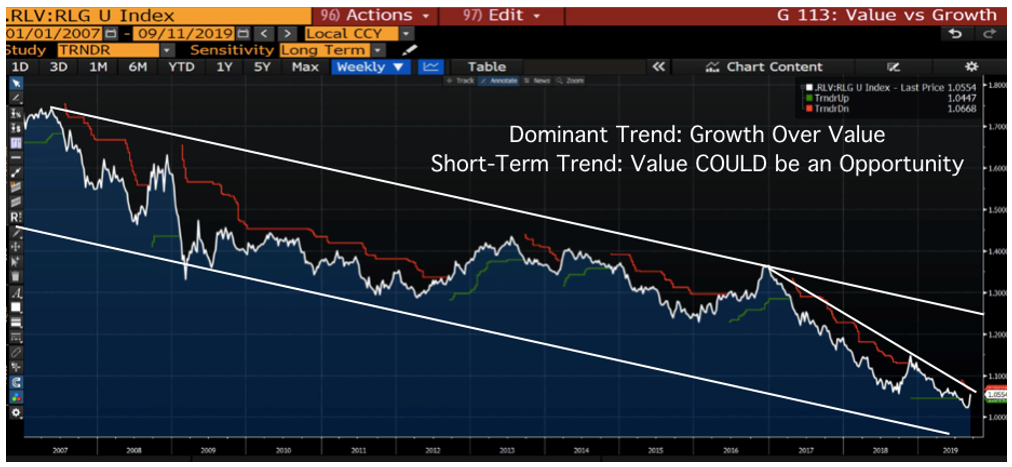

The chart below is a ratio of growth stocks via the Russell 1000 growth versus value stocks and the Russell 1000 value since 1/1/2007. When the white line is going down, growth stocks are outperforming value stocks and vice versa. As you can see, since the beginning of 2007 growth has largely been outperforming value, sometimes by a significant amount. Why is that important? Well, if your goal is to generate strong returns and outperform the S&P 500, knowing what style is performing best offers you an edge in your stock picking. My investment team and I pay a lot of attention to the style factors that are leading and lagging, and our goal is to have meaningful exposure to the factors that are winning. To use a metaphor, we want to fish where the fish are. For over a decade, the fish have been gathering in the growth pond so portfolio’s overweight growth versus value have likely performed well since 2007.

The trend is your friend until the downtrend is broken.

Source: Accuvest & Bloomberg

As you can see from the above value/growth ratio chart, the relative performance of value to growth has favored growth stocks. That makes sense given the recovery since 2009 is the weakest on record. Generally, when growth is scarce, the companies that have above average growth tend to be in high demand and performance of growth stocks tends to be strong. With the constant media attention on falling rates and what that means for economic growth plus the inverted yield curve and slowing earnings off very high and unsustainable levels, the nervousness surrounding a near term recession has been high. When investors expect a slowdown, they tend to buy a barbell of assets: 1) defensive companies, bonds, and higher cash holdings and 2) growth stocks, the higher the growth, the more demand there is. Up until the last week, these were the most crowded trades in the market. The fear trade was crowded and seemed extreme. In my last post, I showed a chart of U.S. interest rates today and in 1981 towards the peak of rates. The price action in interest rates today looked a lot like the upside capitulation in rates in the early 1980’s to me. If I was correct, the sharp move down in rates was more of an “end of trend” move than something that signaled severely bearish times ahead. If rates were historically oversold, then the falling rates, fear trade was also likely to reverse. The when is always the hard part.

Over the last week, we have seen some violent moves in assets as rates bottomed, at least short-term. As rates bottomed short-term, the defensive, “prepare for a slowdown” assets (top performing growth stocks, consumer staples, utilities, REIT’s, Treasurys) got sold heavily and a short-term rotation into cyclical value stocks occurred. One group went straight down, the other straight up. In my opinion, investors should not read too much into these extreme moves given how crowded the trades were.

Here are some summary points to consider:

- Until the downtrend has been broken, growth should be expected to outperform value.

- Short-term, value has some room to play catch-up versus growth given how stretched the performance has been growth over value.

- If the Fed eases interest rates soon, it’s clear that investors are front running a further easing cycle and its effect on U.S. economic growth. This easing of recession concerns caused the rotation into cyclical value stocks that have been deeply out of favor.

- The assumption that rates could only go down and would easily go to 0% was also very crowded. Rates may go to zero, no one knows but when everyone expects one thing to happen, it rarely does in my experience.

- Overall, the economic data here and abroad has still been trending lower with a few large economies entering recessionary conditions. We still have tariff anxiety and one more earnings season with incredibly high comparisons for companies. Volatility could stay higher for a bit longer.

- I would consider the recent sell-off in growth stocks an opportunity until there’s clear evidence that the economy has troughed and the trade dispute has been put to bed. There will always be attractive value and growth brands, I will be looking for value stocks with an attractive growth profile.

- Because of the high debt levels around the world, an aging global society and technology-driven deflation, I do not expect economic growth to break-free from the range it’s been in for the last 12 years. I also do not expect the U.S. economy to enter a recession in the next 12 months so in a slow growth world, companies with above average growth, reasonable valuations, sustainability of growth, and high brand relevancy should continue to perform well and offer investors an attractive ride along the way. That’s largely the pool I’d suggest fishing in.

DISCLOSURE:

This information was produced by and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors, companies or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts.