“Maintain a level of protection in down markets – while taking advantage of growth opportunities in up markets.” (The crux of marketing of Structured Annuities, according to Brighthouse.)

The objective of pretty much every investor is downside protection with upside participation, which is the goal of structured annuities, one of the fastest growing segments of annuities with over $9 billion of annual issuance.[i] Structured annuities are a bridge of sorts between fixed indexed annuities, which provide full downside protection though with anemic upside potential and variable annuities, which do not provide any defined level of protection but offer full potential upside.

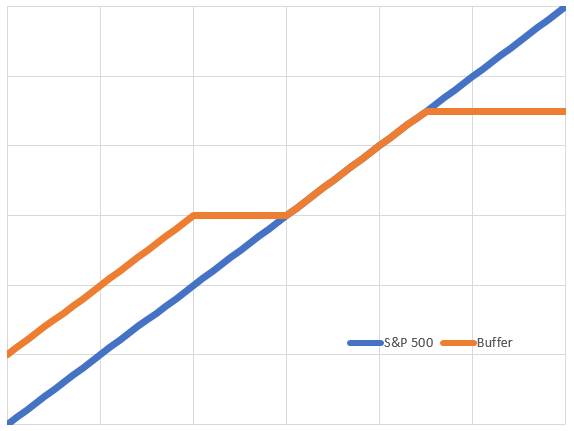

One of the most popular elements of the product is the ability to provide a defined outcome at maturity. For example, if a client purchases a three-year segment on the S&P 500 with a 10% buffer and a 33% cap, the exact payout they will receive in three years can easily be calculated. For instance, if the S&P 500 price return declines by less than 10% they will receive their full principal back. If the S&P 500 price return declines 25%, they will incur a loss of 15%, materially outperforming the market. Conversely, the client will participate 1 for 1 on the upside up to that 33% cap net of any segment fees though not inclusive of the underlying product dividend. The product is a nice approach in aligning one’s risk/reward profile with a market exposure fully defining potential loss and gain at a distinct future point in time.

The issuer can provide these exposures using equity options on the underlying securities (e.g., S&P 500 options). In the example below, the issuer is selling a three-year downside put 10% below the spot level of the S&P 500 at time of the segment issuance. A put provides the right to the holder to sell the S&P 500 at the strike level (10% below spot) at maturity. If the S&P 500 is above the put strike level at maturity the holder will allow the put to expire. If the S&P 500 is below that strike level, the holder of the put will exercise his option resulting in a loss for the put seller. Upside participation for the strategy is created by using a call spread, which includes going long a call at the current level of the S&P 500 and selling a call up above – the cap.

Buffered Structured Annuity (Buffer) Payout at Maturity Versus the S&P 500 Price Return

Hypothetical prices of the components that make up a segment of these sort of annuities.

| 1 Year | 3 Year | 5 Year | |

| Zero Coupon Bond | 97.8% | 92.9% | 87.3% |

| Less Fee @ 1.5% Annual | 1.5% | 4.5% | 7.5% |

| Total value | 99.3% | 97.4% | 94.8% |

| Plus credit from SELL of 10% OTM Put | 2.9% | 6.8% | 10.8% |

| Total value | 96.3% | 90.5% | 84.0% |

| Less Cost of BUY of ATM Call | 6.6% | 11.3% | 14.8% |

| Total value | 102.9% | 101.8% | 98.8% |

| CAP Level Needed to Equal 100% | 8.3% | 33.7% | NO CAP |

In the example above, the zero-coupon bond grows quicker than the fees allowing for more to spend as duration extends. Additionally, the option portfolios become relatively cheaper over time allowing for seemingly much better characteristics the longer the duration. One should note though that a five-year 10% buffer does not provide much protection given the owner of the segment does not receive dividends. The owner is simply trading in the dividend for a buffer – some food for thought.

Please watch our upcoming two-part video series Looking Under the Hood of Structured Note Annuities on www.Catalyst-Insights.com for a more in-depth explanation on how these products are constructed, the benefits and detriments, and a competitive analysis between two different terms to best understand risks and reward in context of time.

[1] Investment News, “Buffer annuities grow in popularity,” Greg Iacurci, Feb. 13, 2019.