Key Points

- COVID-19, a 100-year storm, altered consumer spending habits which are normalizing now.

- Household consumption capacity remains stronger than the markets predicted.

- Holiday shopping trends should be driven by needs, wants, and strong discounting.

“At the current rate of decline (last 3 months), even the lower income groups would have a significant period of time before their savings buffers returned to 2019 levels…at least for now, and for some time to come, consumers appear to have sufficient buffers to weather any storm”. BofA earnings call, November 2022

Broad Consumer Spending is Affected by Many Factors

In my 30 years of investing and tracking consumer trends, I have never witnessed a more complex set of variables to assess consumer health and future spending trends. Covid, and the responses to it, have created a 100-year storm across many facets of the global economy. For investors, making investment decisions based on 100-year storms is generally a very bad idea. Please do not extrapolate recent trends and assume they will continue indefinitely. Consequently, what’s an investor to do? Anchor to timeless concepts is one answer. Let’s analyze consumer spending given it’s a very large phenomenon. Because we are all consumers, we have oodles of data and personal experiences to anchor to. I have said it many times: nothing is more predictable than a consumer’s propensity to spend. As investors though, we must understand HOW consumers will spend during different parts of the cycle.

Example: when our politicians decided to shut down the bulk of a $21 trillion economy, there were bound to be consequences, known and unknown. Our behaviors had to change. We knew we needed to grocery shop and consolidate our shopping trips to fewer stores, and we embraced online shopping like never before. Needs became more important than wants. Our homes were our safe place. We realized we needed to do some work on our homes to make them 24/7 ready. Understanding this progression led to some wildly profitable investments in the primary beneficiaries of that pivot to spending. Let’s unpack what we see today for consumer spending.

At the peak of COVID, all locked in our homes and unable to spend & travel like we are accustomed to, our savings ballooned. We spent less, concentrated our spending more, and most consumers received additional payments from the government for staying at home. With a few clicks of a mouse, we ordered what we wanted and needed online, given we had a significant amount of excess savings. Some used the opportunity to retire early, some began working from home which required home improvement spending and tech hardware upgrades, and most businesses were forced to pull forward 3-5 years of digital infrastructure upgrades so they could service the 100-year storm of high demand. Fast forward to today and things look different.

New consumer spending habits have emerged, mostly driven by macro uncertainty and higher inflation and its effect on the prices of things we want and need.

We have spent less on goods, and more on services like travel. To be sure, an economy that experienced “over-spending” will eventually experience “spending normalization” which simply means the unsustainable spending will mean revert lower and the abnormal under-spending will mean revert higher. That’s been happening for over a year now and will likely continue for a while longer.

Consumption Capacity & Savings Buffers Still Remain

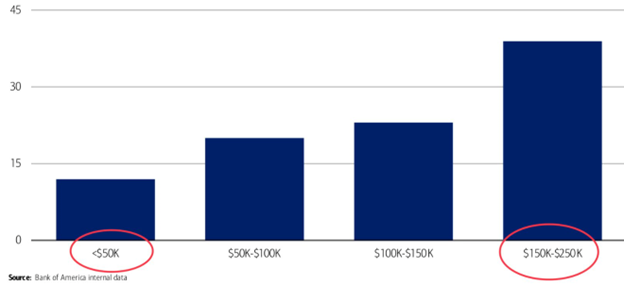

We know consumers do not have an infinite runway to continue paying-up for almost every product and service they need. Aside from our inability to pay, we just don’t like being taken advantage of. Who enjoys paying so much more for eating out, or grocery shopping, or staying at a hotel that costs 30%+ more than it used to? It’s maddening. The data shows, consumers are already making choices about what they are willing to be over-charged for and what they are willing to defer until prices drop. I expect that trend to continue, which makes the most relevant brands a very important focus for investors today. Recent earnings from luxury goods brands, LVMH and Ferrari, highlight the importance of brand love when prices are high and above normal. If you have the means or have high brand love, you continue spending on the brand. But, if a brand adds little value to you and you can defer the spending, you lower or cut the spending quickly. To be sure, the high inflation we see today has affected the lower income cohorts in a much deeper way than higher income cohorts. But there remain some savings buffers which could keep consumer spending from falling the way markets expect. This chart from Bank of America highlights how many months of savings are locked in their deposit base when using the last 3-month average of spending trends. The chart breaks this down by income cohorts and shows the more money you have in checking/savings, the longer you can dip into those savings if the cost of living remains higher than normal.

The <$50k income groups have an estimated 10-month savings buffer while the high earning cohort of $150-$250k have roughly 40 months of a savings buffer. Obviously, none of us want to pull from savings unless we have to but the doom & gloom surrounding an imminent collapse in consumer spending is clearly misguided. The market loves to over-react and most consumer stocks have significantly under-performed YTD, creating some great buying opportunities as actual business trends do not warrant the drawdowns we’ve seen. The key to unlocking the opportunities is to understand where spending will likely stay strong and to avoid areas where spending could slow further. Here’s the BofA chart, it’s very instructive.

Months for Median Deposit to Return to the Average 2019 Level Given Rate of Decline in the Last Three Months

BofA makes a great point in their recent report that bears repeating:

“Should a harder landing develop, then this run-way will clearly be shorter…at some point, consumers may need to make a bigger course correction in their spending…”

Holiday Shopping: Discounts Everywhere.

Some brands rarely discount because they have the luxury of high brand loyalty which drives pricing power and higher margins. Those brands tend to be great stocks. LVMH, Lululemon, Apple, Tiffany, and Hermes come to mind. Other brands thrive because they are the important low-price options for consumers. Great companies like Costco, TJX, Walmart, Target, Dollar General, and Five Below come to mind. These brands turn over their inventory a lot more than the luxury brands, operate on much lower margins, but do a significant amount of sales volume. These brands have also been solid long-term performers. There will be some massive holiday discounts in the apparel and general merchandise category this year because most companies have very high inventory levels driven by all the supply chain and freight delays. That could keep a lid on these stocks near-term, but it’s great for consumers.

Bottom line: consumers are feeling the pinch of high prices, but there’s more spending runway than people think via excess savings. The sheer amount of savings we started with is simply too large to be drawn down quickly. With a buffer to savings, inflation rolling over slowly, and discounts galore, your holiday shopping should offer you some wonderfully needed discounts!

Disclosure:

This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.

The Chipotle hypothetical cost averaging example highlights the potential power of holding core positions in industry leading brands and being committed to adding to these positions when the market acts irrationally. Cost averaging leading companies can add significant value to your long-term portfolio even if you do not catch the absolute bottom in the stock. Details on this hypothetical are below.