Looking back to the start of 2019, global financial markets had just experienced a sharp downturn in the prior quarter. Facing an increase in market volatility, many investors were hesitant to enter or even remain in the market given recent performance. In hindsight, this was a compelling time to initiate a buffered strategy.

Buffered notes seek to provide investors with enhanced returns and downside protection based on the price/performance of a particular asset. Moreover, buffered notes provide several compelling characteristics such as a defined return spectrum at maturity and a level of protection (the buffer) in return for a capped return. However, markets can move significantly between issuance and maturity resulting in very different characteristics in the interim. And given the structure and liquidity of notes generally, it is very hard therefore to adjust during a term of a note in order to optimize one’s exposure.

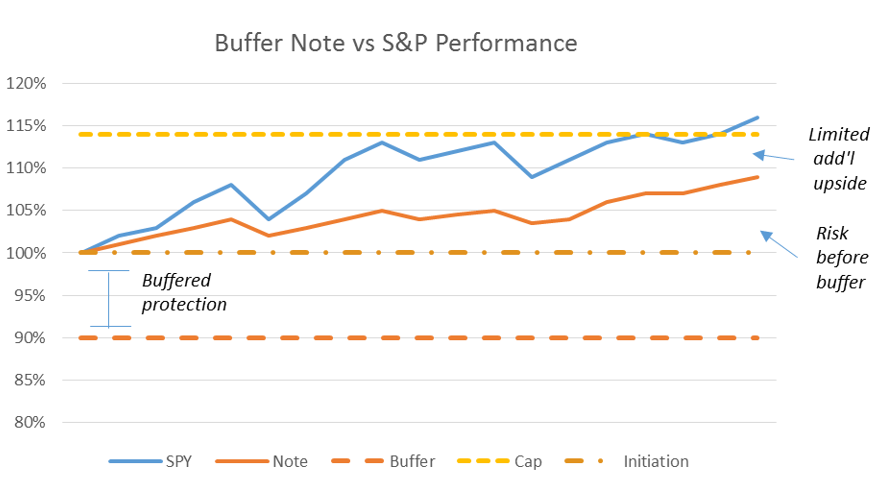

For example, if an investor purchased a one year 10% buffer on the S&P 500 with participation up to a 14% cap in January though, the market has now surpassed, in four quick months, the cap level placing the holder at a disadvantage.

A note consists of: (1) an option overlay expressing an exposure to the underlier (e.g., the S&P 500); (2) a fixed income component reflecting the issuers risk over the time period; and (3) an upfront fee component. Due to these underlying components, a note struck in January with a 14% cap would most likely be worth closer to 9% net even with the S&P 500 generating above a 14% return. In order to capture the remaining 5% the investor can remain in the note until maturity in 2020. However, the risk trade-off has now shifted.

The chart and table below reveal how an investor has 9% downside prior to capturing the 10% buffered protection. The initial first loss is now a second loss. Meanwhile, the original upside potential of 14% is now only 5%. The only positive the investor has going for them is that it is more likely they achieve the 5% gain as long as the market simply maintains its level. Yet, the risk/reward is a far cry from the one entered.

| January | May | |

| Downside Before Buffer | 0% | 9% |

| Buffer | 10% | 10% |

| Cap | 14% | 5% |

| Tenor (months) | 12 | 7 |

The current structure creates a sub-optimal solution as it is both expensive to exit as well as to wait. If exiting the note, the investor incurs a significant cost and then needs to re-analyze the market to decide on the best path forward regarding their risk exposure. If choosing to remain in the note they need to be content that the current characteristics may be sub-optimal as compared to when the note was initiated.

In summary, optimizing buffered note strategies can be an effective way to step-up one’s hedge to the downside. While it may be difficult and expensive to optimize within a traditional structured note, new entrants to the market as well as use of option strategies may be efficient ways to allow for this step-up hedging technique to be put in place.