In the trade war, China targeted the U.S. farmers, who represent a sizeable voter base for President Trump, with its own tariffs on American farm products including soybeans, corn, cotton, and more. Now, the war is winding down, and U.S. ag exports are up. It’s time to start counting the winners and losers.

Not all impacted companies are traditional agribusiness or export companies. In this report, we’ll summarize how the trade war is impacting agricultural exports and then use the MacroRisk Analytics platform to find a list of stocks that you might not have anticipated would have positive (or negative) responses to the growth in U.S. agricultural exports.

According to MarketWatch, “President Donald Trump said Sunday [October 13, 2019] that China has begun purchasing U.S. agricultural products, just two days after the two countries reached a tentative pause in their trade war” on October 11, 2019. In its article, the American Farm Bureau Federation confirms this by stating that “from January through November 2019, U.S. ag exports to China totaled $12.3 billion, compared to $8.7 billion during the same period in 2018. The year-to-date export value in 2019 is significantly higher than the previous year because of increased purchases that began in June [of 2019]. Then, on January 15, 2020, the “Phase One” trade deal was signed between the U.S. and China with China committing “to buying an additional $200 billion worth of American goods, including agricultural products and cars, over two years” (source).

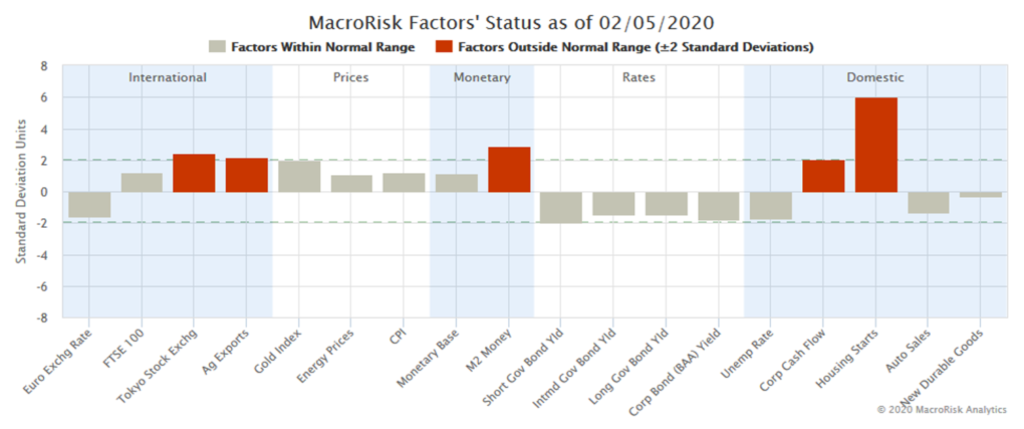

It looks like times are better for U.S. farmers, and this is shown in the “economy status” chart published on MacroRisk.com. This graph shows the current economy as expressed by 18 key macroeconomic factors, including U.S. agricultural exports. The chart shows a “z-score” relative to a historical average and the bars in red are those, which are more than two standard deviations away from their historical values.

The MacroRisk.com economic status as of 2/5/2020 shows that ag exports are one of five economic variables currently above their historical values. (The others are the Tokyo Stock Exchange index, the M2 Money Supply, Corporate Cash Flows, and Housing Starts.)

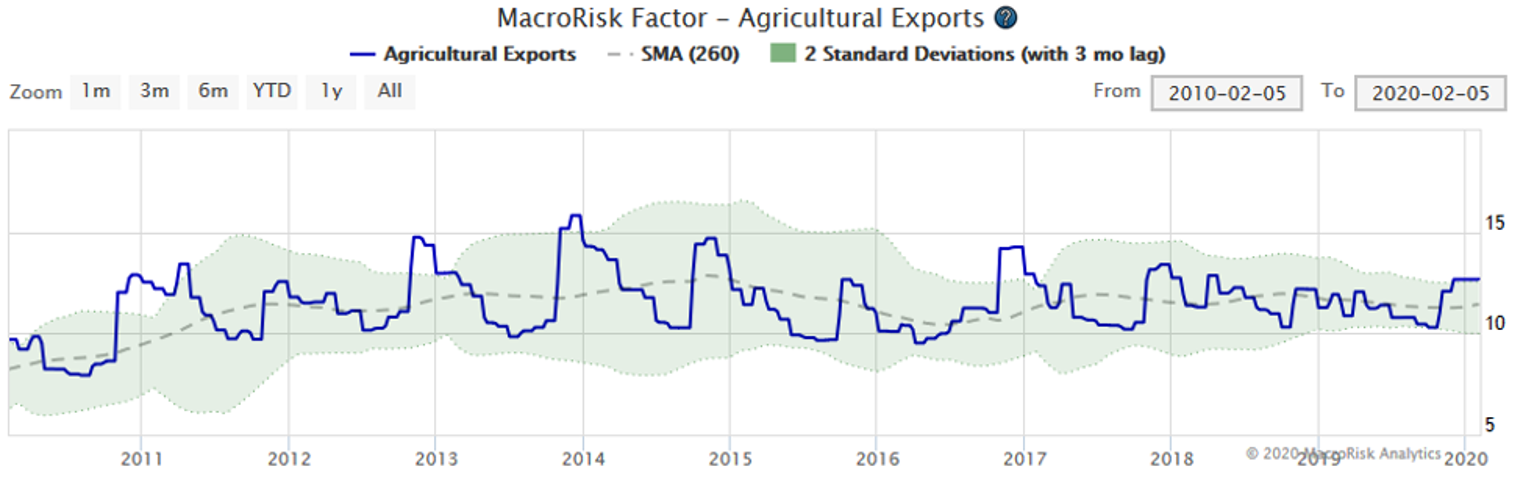

While ag exports are high compared to their recent history, the exports still have quite a ways to go to meet the levels achieved during the previous administration.

Below are the 10 stocks out of the S&P 500 Index that have the largest, positive exposure to the agricultural exports as a proportion of their economic risk as of 2/5/2020. These may be companies to evaluate if ag exports continue growing.

| Name | Symbol | Sector | Proportion of Ag Exports sensitivity to economic risk as of 2/5/2020 |

| MGM Resorts International | MGM | Consumer Discretionary | 5.46% |

| Pultegroup Inc | PHM | Consumer Discretionary | 5.37% |

| NVR Inc | NVR | Consumer Discretionary | 5.07% |

| Blackrock Inc | BLK | Financials | 4.92% |

| Intel Corp | INTC | Information Technology | 4.66% |

| Lennar Corp | LEN | Consumer Discretionary | 4.56% |

| BorgWarner Inc | BWA | Consumer Discretionary | 4.10% |

| Las Vegas Sands Corp | LVS | Consumer Discretionary | 3.99% |

| CBRE Group Inc Common Stock Class A | CBRE | Real Estate | 3.92% |

| Freeport-McMoran Inc | FCX | Materials | 3.53% |

And shown below are the 10 stock out of the S&P 500 with the largest, negative exposure to agricultural exports as a proportion of their economic risk as of 2/5/2020. These are stocks that might be examined because of a possibility of underperformance as ag exports continue expanding.

| Name | Symbol | Sector | Proportion of Ag Exports sensitivity to economic risk as of 2/5/2020 |

| Expedia Group Inc | EXPE | Consumer Discretionary | -7.55% |

| Baxter International Inc | BAX | Health Care | -5.89% |

| Digital Realty Trust Inc | DLR | Real Estate | -5.81% |

| Medtronic PLC | MDT | Health Care | -5.18% |

| Hasbro Inc | HAS | Consumer Discretionary | -5.10% |

| IDEXX Laboratories Inc | IDXX | Health Care | -5.06% |

| Gilead Sciences Inc | GILD | Health Care | -4.31% |

| Take-Two Interactive Software Inc | TTWO | Communication | -4.22% |

| Activision Blizzard Inc | ATVI | Communication | -3.83% |

| Jack Henry & Associates Inc | JKHY | Information Technology | -3.64% |

“Ag exports” is just one of 18 economic variables that are used by MacroRisk.com to estimate current intrinsic value and numerous specific risk measures for almost every major traded stock, fund, and ETF on the U.S. and Canadian exchanges. As the economy changes, different stocks may have unexpected responses but MacroRisk’s “The Economy Matters” reports and its “Investment Tools for the Changing Economy”® can help you prepare for the unexpected.