The financial health of consumers and households is a very important variable driving the U.S. economy. As a thematic investor, I am anchored to the global consumer spending phenomenon. Not just consumer discretionary or staples, but all spending categories. In order to track such an important theme, roughly $44 trillion per year and growing, I look at consumer-health data that can help me understand where the opportunities are and where potential problems could eventually be building.

Consumer Health: Steady Like a Rock

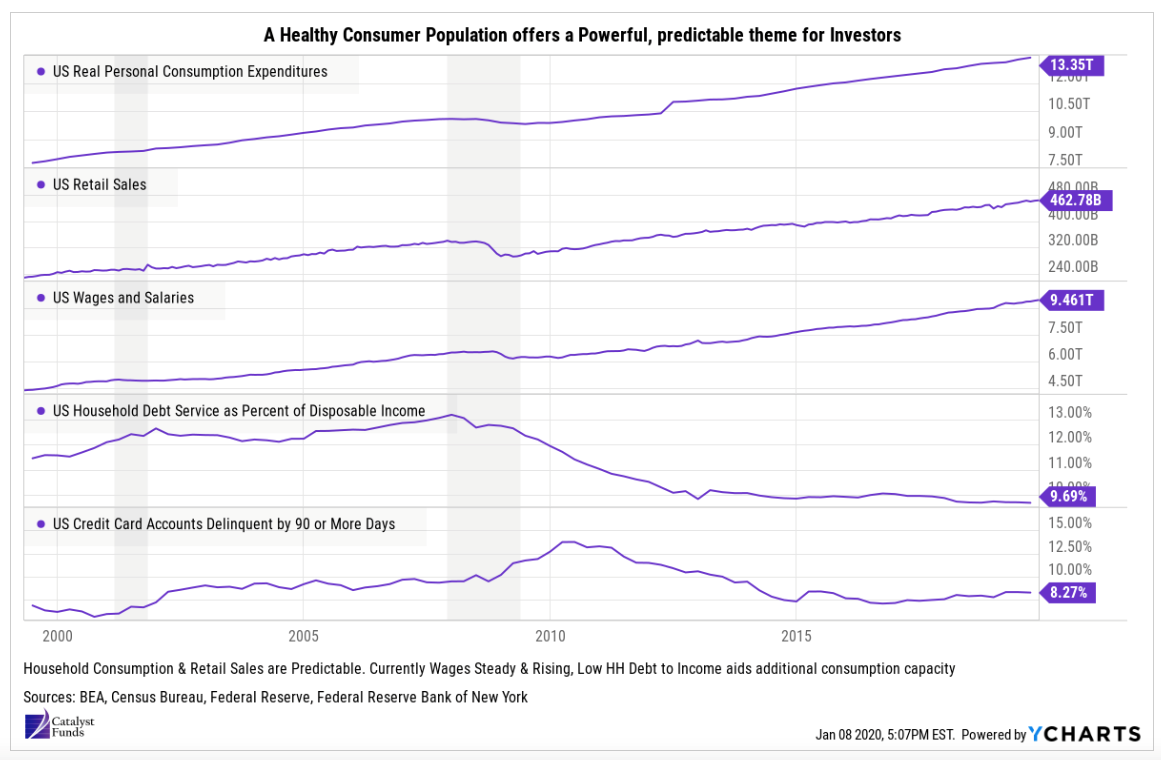

As far as the health of U.S. consumers are concerned, the following are some key points to consider:

- Real personal consumption has been rising steadily for decades – spending is in our DNA.

- Retail sales rarely experiences a slowdown making it very predictable. The shallow dip in 2008/2009 was short-lived and spending snapped back quickly.

- Wages and salaries continue to be steady and rising helping consumers feel good about spending.

- Household debt to disposable income remains at multi-decade lows offering the ability to expand consumption capacity if consumers have the urge.

- Credit card delinquencies continue to be low and stable so there’s no sign of imminent stress on consumers and their ability to pay their credit card bills.

Attractive Consumer Spending Categories in 2020

As I’ve stated many times in these missives, consumers and their buying habits can be fickle at times. That keeps a brand on its toes, a very good thing. The brands that stay relevant and offer the products and services that consumers want, that deliver them in the manner in which they need and at the most attractive price points will continue to take market share and thrive as stocks. Now that we are in 2020, I wanted to highlight the areas we think are the most attractive from a consumer and therefore, an investment perspective.

Consumer Discretionary

The average index and investor portfolio are chronically under-weight consumer discretionary stocks. How do I know? I’ve analyzed active mutual fund and ETF data rigorously. I even looked at the top performing consumer fund with a minimum of 10-year track record and was not shocked that the performance was better than 100% of large cap blend, growth, and value funds over 10 years and 15 years, but was completely puzzled when I saw it only had $3 billion in assets. If there was a broad-based large cap equity fund with such a dominant track record it would typically have $60+ billion in assets not $3 billion.

With such a healthy consumer economy, this sector should continue to be an overweight position in a portfolio in my opinion. Clearly, I’m talking my book, but I’m not mandated to be overweight any sector so this is not a stubborn or mandated opinion. Within consumer discretionary, there are sub-industries that look particularly attractive and lots of places to rotate around if/when things get volatile.

- Internet & Direct Marketing

This sub-industry is filled with many of the most relevant brands as well as the last decades top performers. This is where you’ll find key e-commerce brands. E-commerce is a key focus for us and our portfolios. E-commerce sales is still in its infancy and where the bulk of the investment opportunities live. There are names like: Amazon, Alibaba, Booking Holdings (formerly Priceline), and eBay, as well as some emerging market e-commerce brands like JD.com, Mercado Libre and Pinduoduo.

- Home Improvement

With interest rates still low and showing no signs of life, the housing sector and home improvement is still robust. Home Depot & Lowes are performing well and have been very stable performers. The home builders also still look quite attractive and are still not expensive stocks.

- Apparel, Accessories, and Luxury Goods

This category has had some real winners and a lot of dreadful performers. Having a proprietary brand relevancy scoring system has helped us find some great brands and avoid some real stinkers. The most attractive stocks here based on my work are: LVMH (Moet Hennessy Louis Vuitton), VF Corp (Van’s, North Face, etc.), Lululemon, and Levi’s.

- Footwear

One word is all that matters. Nike. Full stop. Nike is the greatest marketing company on the planet and has plenty of room to grow sales internationally.

Communication Services

Given the secular tailwinds across telecom, tech, and consumer, this sector is a likely big winner in a consumer driven world. Here’s some sub-industries that appear particularly well positioned:

- Interactive Media & Services

Some mega-brands “live” here and I like many of them currently. Here’s my favorites: Google, Facebook, Snap Inc, and Match Group. There’s a clear theme running through these names and its social media, digital advertising, mobile advertising, artificial intelligence, virtual reality, and online/digital dating. Big secular growth trends here indeed.

- Media & Entertainment

This sub-industry has been a very popular one. It all started by Netflix dominating the category and offering some of the most robust 10-year returns ever seen but now the competition has woken up and things are getting interesting. The move from linear TV to streaming is pronounced and un-stoppable. The eventual shift from box-office delivery to immediate home streaming delivery of movies is just a matter of time. The experience-economy (live events & music) is just getting started as Millennials and Gen-Z opt for experiences over “stuff”. The most relevant brands living in this category based on my work are Disney, Netflix, Spotify, Roku, Live Nation, Formula One Group, and Madison Square Garden. Each have unique business opportunities and should perform well in 2020.

- Interactive Home Entertainment

This is where the fun lives. Video gaming continues to grow by leaps and bounds and in every direction: consoles, mobile, online subscriptions, and e-sports. There are more global gamers than ever before, and this wave is not even close to its termination date. I love Nintendo, Electronic Arts, Take-Two Interactive, Tencent in China (the largest gaming company by revenue in the world and owner of many game publishers).

Bottom Line on Consumerism:

In summary, here are some key takeaway points on consumerism.

- The current state of consumers is healthy.

- When the consumer is healthy, people spend and when spending is robust, stocks tend to perform well.

- Look inside your total portfolio and assess the current exposure to the consumer. The data likely warrants a continued overweight position. I’ll be the first to tell you when I see the data that supports a change.

- There are a few key sub-industries that appear particularly well positioned with the consumer discretionary and communications services sectors.

- There are some dominant, industry leading brands to choose from in these two sector over-weights.

DISCLOSURE:

This information was produced by and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.