A brutally honest take from someone who profits when everyone else panics

Meta Description: Volatility trader reveals why markets keep climbing despite Trump-Musk feuds, tariff chaos, and geopolitical tensions. CPI data could trigger the next big move.

For those curious about how a volatility trader who also manages portfolios thinks, let me cut through the noise. After reading the morning briefings and watching the market drama unfold, I’m reminded why volatility trading remains the most honest profession in finance. We don’t pretend to predict direction—we just know things will move.

The Beautiful Chaos of June 2025

Trump vs. Musk: A Volatility Trader’s Christmas Morning

The public feud between Trump and Musk over the “Big Beautiful Bill” delivered a masterclass in volatility creation. Tesla drops 14% one day, rebounds 5% the next—that’s not mean reversion, that’s pure vol expansion. As fascinating as it was to watch these titans clash over fiscal policy, the 14% drop followed by a 5% rally just means more volatility is coming.

But here’s the thing about markets—they’re already moving on to the next drama. Today’s focus has shifted to the LA riots, and interestingly, this crisis seems to be bringing Trump and Musk back together. Yesterday’s Twitter enemies become today’s crisis partners. The underlying volatility patterns remain unchanged—only the catalysts shift.

The Vol Trader’s Truth: When billionaires have public spats, volatility explodes. The specific drama matters less than the emotional intensity it creates.

Tariff Roulette: The Whiplash Machine

Trump’s tariff strategy continues creating perfect volatility storms. The pattern is mesmerizing: as soon as tariff threats look catastrophically bad, something turns around and makes them look brilliant. Then vice versa. The S&P 500 fell 1% on May 30 when trade tensions escalated, then rallied when London talks were announced. Lululemon cratered 20% on tariff concerns while other stocks ignored identical news.

What makes this particularly volatile is the underlying reality: U.S. exports to China remain super low, creating genuine economic tension. Meanwhile, ongoing discussions about crucial rare earth minerals add another layer of complexity. These aren’t just trade spats—they’re disputes over materials essential to everything from smartphones to defense systems.

This isn’t rational price discovery—it’s emotional whiplash. Every tariff announcement creates binary outcomes that amplify normal market movements into volatility events.

The Geopolitical Volatility Buffet

Multiple Conflict Zones = Multiple Vol Opportunities

Iran threatening responses to U.S. proposals, Ukraine conducting deep strikes into Russia, and the ongoing conflict in Gaza creates a trifecta of uncertainty. Oil prices have pushed higher as these conflicts rage on, though oil might also be responding to broader global growth signals rather than just geopolitical risk.

This dual nature of oil’s move—war premium plus growth optimism—creates even more complexity for markets to digest. When energy prices rise for multiple reasons simultaneously, the volatility ripple effects spread across sectors in unpredictable ways.

Portfolio Manager Reality Check: You can’t hedge against every geopolitical risk, but you can position for the volatility they create. The news flow is relentless, and markets overreact to everything.

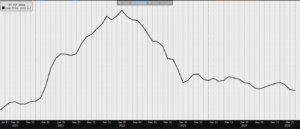

The Great Climb: Markets Scale the Wall of Worry

Here’s what’s really happening behind all this volatility: the market continues its relentless climb up the wall of worry. Despite every reason to panic—Trump-Musk feuds, tariff threats, geopolitical chaos—the S&P 500 just closed above 6,000 for the first time since February. AI and growth stocks are absolutely soaring, with Nvidia up 45% since April alone.

The dirty secret? Massive amounts of money remain parked on the sidelines. With the end of the quarter approaching, portfolio managers who’ve been cautious are facing a brutal reality: they might have to chase performance just to keep up. When defensive managers start buying into strength, volatility doesn’t disappear—it just shifts into hyperdrive.

The Fundamental Tailwinds Nobody’s Talking About

Behind all the political theater, some genuinely positive fundamentals are emerging. Inflation has actually fallen far enough to make Fed rate cuts plausible—markets are already pricing in potential cuts in October and December. Lower rates would be rocket fuel for growth stocks that have been climbing despite elevated borrowing costs.

Trump’s “Big Beautiful Bill,” despite the Musk drama, contains elements that could supercharge growth: lower taxes, reduced regulations, and targeted spending programs. If it passes, we’re looking at a triple tailwind of fiscal stimulus, monetary easing, and deregulation hitting simultaneously.

Even the tariff situation might have a surprisingly positive ending. With rare earth mineral discussions ongoing and exports to China at super lows, there’s enormous room for improvement if negotiations succeed. The current tariff uncertainty might be the worst-case scenario—resolution could unlock significant upside.

These aren’t just wall-of-worry climbing fundamentals—they’re legitimate catalysts for additional upside risk.

This Week’s Market Movers: What Could Shake Things Up

CPI Reading – The Big Kahuna: This week’s Consumer Price Index reading will be the most important catalyst. After Friday’s strong jobs report, any inflation surprise could send markets into convulsions. Higher than expected? Growth stocks might finally take a breather. Lower than expected? The chase into risk assets accelerates.

Oracle (Wednesday) and Adobe (Thursday): These earnings reports will test whether the AI euphoria has legs or if reality is finally catching up to valuations.

End-of-Quarter Positioning: With just weeks left in Q2, expect institutional window dressing to create unusual flows. Managers who’ve underperformed are getting desperate.

Trade Talks Continuation: The London meetings could provide another binary event—progress sends risk assets higher, setbacks create flash crashes.

The irony? All this worry and uncertainty is creating the exact conditions that fuel continued market advances. Fear keeps enough money on the sidelines to provide buying power for every dip.

The Structural Volatility Multipliers

End-of-Quarter Chase Mode: Here’s where things get interesting. Institutional investors aren’t just doing their quarterly beauty pageant—they’re scrambling. With AI and growth stocks ripping higher, managers who stayed defensive are now forced to buy into strength or face career risk. This creates artificial demand that amplifies every move.

Options Expiration Chaos: With monthly options expiration approaching, gamma effects are building. But now these technical factors are overlaying a market where FOMO (fear of missing out) is replacing traditional risk management. Large options positions force market makers to hedge dynamically, but when the underlying trend is parabolic, the feedback loops become extreme.

The Honest Assessment

Bank of America’s Warning

BofA warns that the S&P 500 is nearing “sell” signals due to heavy investor inflows. JPMorgan’s Dimon highlights stagflation risks from trade tensions. These aren’t predictions—they’re observations about stretched positioning.

When everyone’s positioned the same way, small catalysts create massive moves. The current environment has all the ingredients for violent reversals.

Valuations vs. Reality

The S&P 500’s forward P/E of 21 suggests expensive valuations, but expensive doesn’t mean wrong until it’s wrong. Markets can stay irrational longer than most portfolios can stay solvent.

Bitcoin hitting $105,000 while treasury yields fluctuate wildly shows how divorced asset prices have become from traditional fundamentals.

The Vol Trader’s Advantage

Why We Thrive in This Environment

While directional investors struggle with conflicting signals, volatility traders feast on uncertainty. Trump-Musk drama, tariff threats, geopolitical tensions, and data dependency create perfect conditions for volatility strategies.

We don’t need to predict whether Tesla goes to $300 or $150—we just need it to move violently. Current conditions guarantee violent moves.

The Simple Truth

Stocks go up. Stocks go down. Sometimes they go sideways, but lately, they’re doing everything with maximum drama. Political feuds, trade wars, and geopolitical tensions ensure that quiet markets remain extinct.

For volatility traders, this isn’t a problem to solve—it’s an environment to exploit.

The Bottom Line

The market’s relentless climb up the wall of worry has created a new type of volatility environment, but the real game-changer is the potential alignment of fundamental catalysts. Fed rate cuts becoming plausible due to falling inflation, fiscal stimulus through tax cuts and deregulation, and potential tariff resolutions could create a perfect storm of upside drivers.

This week’s CPI reading isn’t just about confirming the inflation trend—it’s about validating the Fed’s ability to ease policy. If the data cooperates and the political drama resolves positively, we’re not just looking at chase-based volatility anymore. We’re looking at legitimate upside risk where current market levels could prove conservative.

With so much money still on the sidelines and quarter-end positioning pressure building, any positive catalyst combination could trigger moves that make recent volatility look tame. The morning briefings paint complexity, but the trading reality has evolved into a high-stakes game where the biggest risk might be underestimating the upside potential.