5 Minutes, 3 Sentiment Charts, Opportunity Focused.

Core allocations should be highly correlated to core themes around the globe.

Global consumer spending is 60% of the world’s $100 trillion GDP or $60 trillion per year.

Key Summary:

- The stock market was showing extreme negative breadth readings on October 3rd.

- Positive seasonality is upon us at a time when breadth measures are extreme.

- Markets are currently in extreme FEAR mode, offering a contrarian opportunity.

Important thesis: Buying leading companies operating in vital consumer spending industries is a timeless investment approach. Being opportunistic and buying these great assets when the market puts them on sale (like today) allows your recovery time to shorten.

Consider this: the S&P 500 Index has generated an annualized return of roughly 8-10% over the long-term, leading companies serving important industries should, in theory, generate 300bps+ more over long periods of time. That’s what history has shown where leading brands are concerned. Understanding this and investing for it offers investors a long-term edge. Brands matter because consumer behavior is largely driven by brand loyalty. The higher the loyalty, the better the business. The better the business, generally the better the stock.

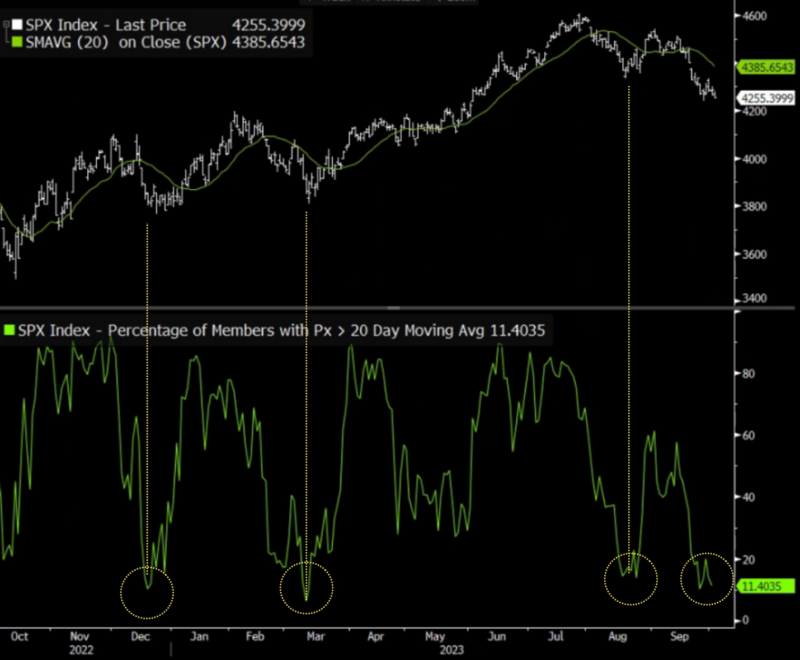

Stock Market Breadth Has Reached Extreme Levels, Typically a Contrarian Buy Signal:

- The equity market of 2023 has largely been one driven by narrow leadership.

- The average stock is up low single digits to flat on the year.

- The mega cap stocks have largely been where returns have come from.

- These companies & brands largely have solid balance sheets & leadership positions.

- When the number of stocks trading below the 20-day moving average gets below 10%, a contrarian buy signal is produced.

- For those with time, beginning to build bigger positions tends to be rewarding.

- As of this writing, just 9% of the S&P 500 stocks are trading above the 20DMA.

- The chart below highlights other periods when breadth was so poor and what direction the equity markets took following extreme readings like today. (Bloomberg chart).

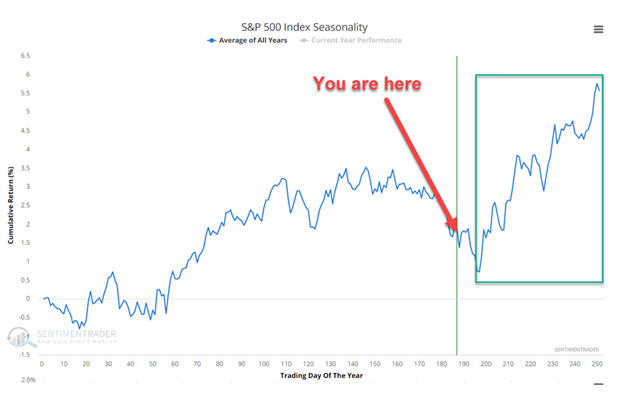

Positive Seasonality Begins Soon:

- Between conflicting macro data, interest rates rising, and inflation, markets have become more volatile.

- Volatility creates opportunity because prices get dislocated from fundamentals.

- Consumer sentiment remains low but offers a longer-term contrarian signal.

- The chart below from Sentimentrader.com highlights the upcoming positive seasonality for equities.

- Equity markets are reaching extreme negative breadth conditions at the same time positive seasonality begins.

- There is no single indicator that highlights a high probability buy signal, but the above datapoints have traditionally been solid periods to begin adding more equity exposure.

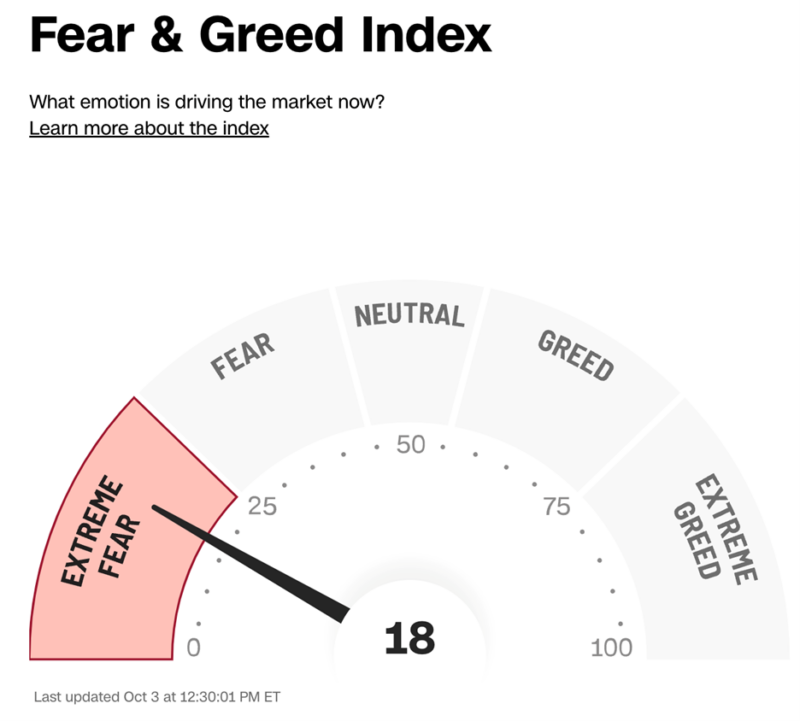

Retail Investor Sentiment Also Firing a Contrarian Buy Signal: (CNN Fear & Greed Reading).

- The Fear & Greed Index measures 7 indicators that measure stock market behavior.

- They include market momentum, stock price strength, stock breadth, put & call option activity, high yield bond demand, overall market volatility, and demand for safe assets.

- The index measures how much each indicator deviates from their long-term averages.

- The adage, buy fear & sell euphoria is a time-tested approach to making money.

- Today, the Index is firmly in the FEAR category, which is typically a contrarian buy signal.

Bottom Line:

- There’s still a significant amount of uncertainty.

- Uncertainty causes volatility.

- Volatility causes a dislocation of prices.

- Great brands are on sale again. A gift for long-term investors.

- Buying low, to sell higher is a time-tested approach to growing one’s wealth.

Disclosure: The above report is a hypothetical illustration of the benefits of using a 3-pronged approach to portfolio management. The data is for illustrative purposes only and hindsight is a key driver of the analysis. The illustration is simply meant to highlight the potential value of building a consumption focused core portfolio using leading companies (brands) as the proxy investment for the consumption theme. This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.