Key Points

- The Federal Reserve has been very clear about their approach to tapering & hiking rates.

- Large portions of the economic data have significant room higher to revert to “normal.”

- This week’s data highlights the mean reversion has already begun.

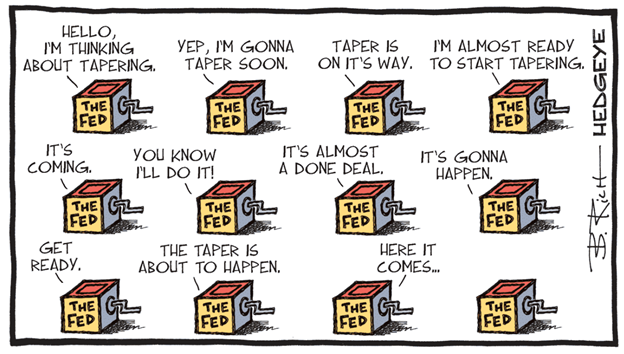

The Best Cartoon I have Seen: The Fed loves to string the markets along.

11/3/21 – My Fed Meeting Notes.

The Fed announced the taper of bond purchases will begin this month with $15B and they will also taper in December. Some think the December announcement is slightly hawkish but I think the market just likes certainty so I’m happy they told us December would be the same. As always, they said they will adjust their tapering as needed by the economic data. This is why I laugh when everyone focuses so closely on every word by the Fed. Jerome has been very clear since his whiff in Q4 2018 when he kept raising rates into a clear economic slowdown. His actions are data dependent. Period. He stated the slowdown created by Delta variant has kept the economy below potential and implied what we have been saying all along: we would not be having labor issues, supply chain problems and wage inflation were it not for Covid, therefore as supply chains get cleared up (it still takes time) and hiring picks up, much of the inflation that’s been created should start to ease. Companies will absolutely try and hold onto the price increases they have enacted but I suspect they will be quick to lower prices where they can if demand starts to fall. That’s certainly why I’m focused on the most in-demand brands and spending categories as consumers begin to make choices about where they spend. The wage hikes will be sticky and companies that are not leaders in their peer group and that don’t have high demand and pricing power will start to see margin erosion. Asset light businesses should be better positioned than capital-heavy, labor heavy businesses. I suspect that will be a key theme for 2022 earnings. Second and third tier companies are NOT where you want to be next year, they likely do not have the ability to keep margins and sales high in the face of high labor costs and demand that may slow. Inflation pressures overall should peak on a ROC basis as these issues subside and go back to normal.

Most important part: there was NO mention of fed rate hikes on the horizon which should put that issue on the backburner for now. The Fed wants to see hiring get back to normal levels first. Getting back towards full employment and a stabilization of earnings and overall growth should allow them to start thinking about small rate hikes but I see no evidence that meaningful rate hikes will happen in 2022. This economy, with its debt and demographics has been running at sub-par trend growth since 2009 and I see nothing that changes that. The one caveat will be added productivity created because of all the belt-tightening in corporate America from Covid. Technology allows companies to do more with less so there’s always a chance productivity enhancements will allow for sustained strong financial metrics in the face of higher labor costs. Having lots of slack in the labor force should keep a lid on rates and inflation though. Earnings & financial metrics could stay strong because of tough decisions made in the beginning of Covid. Companies get hooked on better financial metrics and stock prices so they will be slow to slip back into their inefficient ways going forward. The business efficiencies that were created in Covid should prove to be long-lasting.

Bottom line: For now, I think we have a goldilocks economic scenario where growth is trending in the right direction as inflation pressures subside. That’s a pretty good environment for equities.

Important Components of the Economic Data Have A lot of Room to Improve

We have a long way to go to get back to full employment. Hiring should continue to be robust for the foreseeable future. More people working creates more consumption capacity. That bodes well for continued consumer spending.

Consumers paid down debt at a historic rate over the last few years. Now they’re able to add more debt which helps future consumption capacity. We are still way below “trend”. That’s a good thing for consumer health but the capacity to spend is a future call option on strong spending trends if need-be.

Consumer Sentiment has significant room to improve and is highly correlated to the squeeze-flation across all goods and services. These will ease which should drive sentiment back up. When we feel good, we spend more. It’s been the same since the beginning of time.

This week’s Economic Data Highlights Strength Across Important Metrics via Hedgeye.

October’s U.S. ISM Manufacturing PMI came in at 60.8, which was the 17th month of growth and solidly in expansion territory (despite massive supply chain issues!).

The October U.S. Services PMI was an absolute blow out coming in at 66.7, which was a massive acceleration from September and an all-time high. Within this business activity and new orders were even higher at 69.8 and 69.7, respectively.

The ADP jobs report (not our preferred measure of employment but a measure nonetheless) showed the economy added 571,000, which was an acceleration from September and the highest level since June.

With more than 2/3s of the SP500 having reported, revenue is up near 19% Y/Y and earnings are up near 40% Y/Y.

Michigan Consumer Confidence ticked up +0.3 points September to October to +71.7.

Housing has also turned the corner from the summer with U.S. monthly mortgage applications accelerating to +7.5% from their August lows.

Summary:

- The Fed is still your friend. That’s a major positive for markets.

- After a soft-patch, the economic data appears to be re-accelerating.

- This week’s data highlights the emerging positive momentum across the economy.

Disclosure:

This information and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.