The financial media is rife with misinformation on the debt ceiling and the jump in interest rates. However, a history review shows that the “debt-ceiling” issue is not only a non-crisis, but the recent rise in rates is likely an opportunity to buy bonds.

Let’s start with the media scare tactics over the debt ceiling:

- If Congress doesn’t raise the debt ceiling, the Treasury will run out of money.

- The U.S. will default on its debt.

- The markets and economy will crash.

While there is a grain of truth behind these statements, they are largely false. However, for the media, a manufactured crisis should never be allowed to go to waste.

To wit:

The jobs, benefits and financial security of millions of Americans could start disappearing in less than a month as the Republican House leverages a debt showdown to try to force big spending cuts on President Joe Biden.

Treasury Secretary Janet Yellen on Monday issued a stark warning that the US government could run out of money to pay its obligations as soon as June 1 unless Congress raises its borrowing authority. Failure to do so could trigger a domestic and international financial catastrophe.

Or this from the Washington Post:

“Time is running out on Congress to raise the debt ceiling and prevent the nation from defaulting, a scenario that could destabilize global markets and devastate the economy.

If no deal is reached, Congress doesn’t act, and the White House doesn’t do something unilaterally, it’s likely the government wouldn’t have enough money to pay all of its bills. It would ‘default’ on some of its obligations. There is no precedent for the government missing payments like this.”

While a remarkable statement to get “clicks,” even a cursory review of history suggests the hyperbole falls well short of reality.

What Is The Debt Ceiling Anyway

Let’s start with an explanation of the “debt ceiling.”

“The debt ceiling is the legal limit on the total amount of federal debt the government can accrue. The limit applies to almost all federal debt, including the roughly $22.3 trillion of debt held by the public and the roughly $6.2 trillion the government owes itself as a result of borrowing from various government accounts, like the Social Security and Medicare trust funds. As a result, the debt continues to rise due to both annual budget deficits financed by borrowing from the public and from trust fund surpluses, which are invested in Treasury bills with the promise to be repaid later with interest.” – CRFB

The purpose of establishing a debt ceiling was to place a “credit limit” on the Government. In a responsible Government, as the debt ceiling approaches, members of Congress should begin discussing budget cuts, spending reductions, or revenue increases. The goal, logically, is to keep the country in a “surplus” position over time.

In 1980, that all changed, and seven administrations and four decades later, Government debt surged, deficits exploded, and the debt ceiling rose 78 times. (49 times under Republicans and 29 times under Democrats.)

Has The U.S. Ever Defaulted On Its Debt?

Yes.

“Investors in T-bills maturing April 26, 1979, got told that the U.S. Treasury could not make its payments on maturing securities to individual investors. The Treasury was also late in redeeming T-bills which become due on May 3 and May 10, 1979. The Treasury blamed this delay on the failure of Congress to act in a timely fashion on the debt ceiling legislation in April. Also, an unanticipated failure of word processing equipment used to prepare check schedules contributed to the delay.” – The Financial Review

Because “fear-mongering” attracts readers, the mainstream media missed that there are two types of default.

The first is an actual default, where the borrower cannot repay the principal owed to its creditors.

The second is a “technical default.” In 1979, as noted, the Treasury was entrenched over a “debt ceiling debate” and could not make interest payments. There was little worry by lenders over the safety or security of their capital. They knew that when the U.S. resolved the “technical issues,” the Government would make its payments.

Such is the “crisis” bond investors currently face.

- Could there be a short-term delay in making interest payments? Absolutely.

- Is there any risk of a default on the payment of interest or principal on outstanding Treasury bonds? Absolutely not.

The 10-year Treasury rate did spike shortly over the initial concerns of the default. However, as bondholders realized there was no continuing threat, they began to buy bonds at a discount to the previous value. Over the next few months, rates fell as sanity returned to the bond market. (Later that year, rates would rise again over legitimate concerns of the oil crisis.)

Debt Ceiling Crisis Non-Crisis

Congress will lift the debt ceiling. As noted by the Treasury Department:

“Congress has always acted when called upon to raise the debt limit. Since 1960, Congress has acted 78 separate times to permanently raise, temporarily extend, or revise the definition of the debt limit – 49 times under Republican presidents and 29 times under Democratic presidents. Congressional leaders in both parties have recognized that this is necessary.”

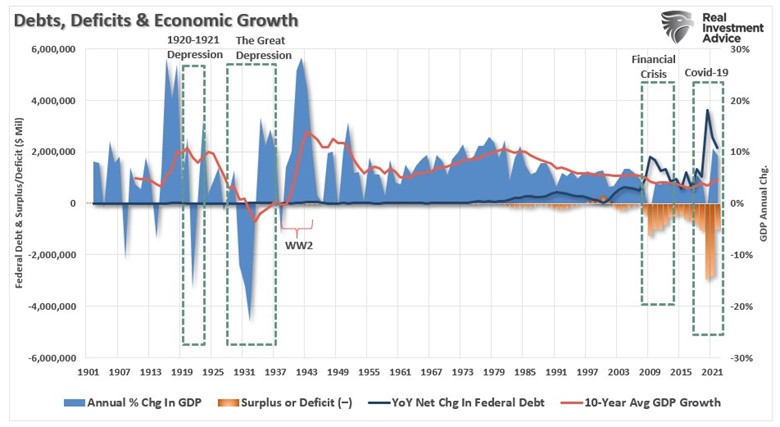

Just as happened every time previously, Congress will lift the debt ceiling again. However, we are assured there will a lot of drama in the process, with both parties of Government pointing their finger at each other. The simple reason is that despite differences of opinion and political agendas, both parties want to continue spending money. Such is why the runaway spending and deficit increases continue to accelerate. The consequence of increasing debts and deficits is evident in the declining economic growth rates over the past 40 years.

Chart: RealInvestmentAdvice.com Source: St. Louis Federal Reserve, Refinitiv

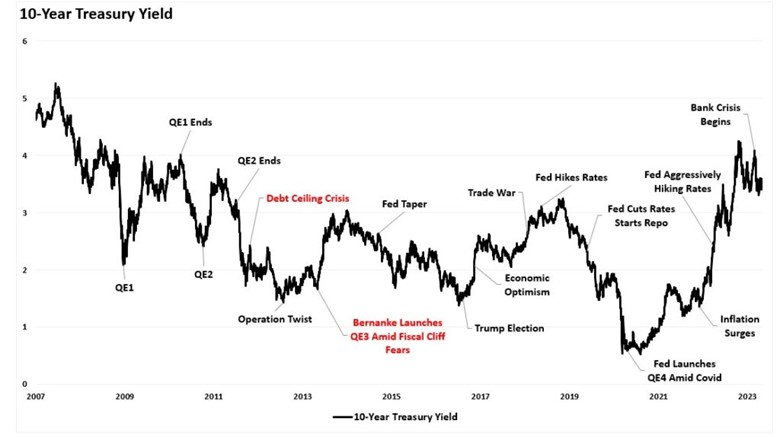

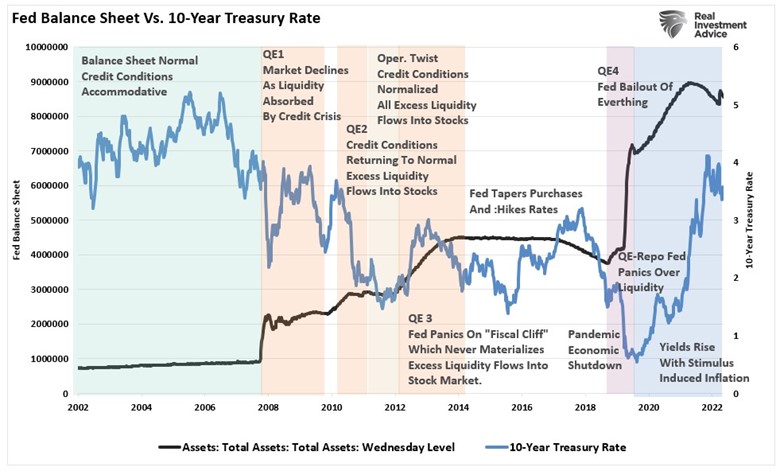

Since 2009, a debt ceiling fight has become almost an annual event between policymakers. The most prominent was in 2011, which led to a comprise to cut $1 trillion in spending. At that time, Ben Bernake launched the third round of Quantitative Easing to compensate for what was feared to be a “fiscal cliff” in 2013. Such was due to spending cuts getting automatically imposed.

As shown, rates spiked during the “debt ceiling crisis” as concerns over default rose. Subsequently, rates fell to new lows as deficits surged and economic growth slowed. Currently, rates have risen due to surging inflation and strong economic growth from massive fiscal injections in 2020 and 2021. However, as the monetary leaves the system, economic growth rates are already slowing, as debt levels crest $31 Trillion. Yields will eventually move lower in response to a reversal of inflation and economic activity.

Chart: RealInvestmentAdvice.com Source: St. Louis Federal Reserve, Refinitiv

There are several vital points evident from reviewing history.

- While politicians talk a tough game, the current debate over the debt ceiling is nothing more than political posturing.

- The media is a primary source of misinformation about the debt ceiling and potential outcomes.

- Bond investors should welcome the debt ceiling debate as an opportunity to buy bonds at cheaper prices with higher yields.

Are there currently risks to the bond market that investors should be concerned about near term? Yes. The current spike in inflation has lasted longer than expected due to the massive amount of monetary liquidity still in the economy. Furthermore, rates rise when the Fed “tapers” its bond purchases as they are doing now.

However, both of these issues will resolve themselves going forward. Eventually, inflation will decline as economic activity slows, and the Fed will return to monetary accommodation. More importantly, yields historically fall as investors’ “risk preference” shifts from “risk-on” to “risk-off” during economic recessions.

Chart: RealInvestmentAdvice.com Source: St. Louis Federal Reserve, Refinitiv

For investors, there is a great opportunity being presented to add long-dated Treasury bonds to portfolios in the event of a technical default.

For everyone else, headlines of a debt crisis are greatly overblown, but then again, it did get you to read this article.