Key Summary:

- Consumer spending has mean reverted to normal ranges after the pandemic excesses.

- When leaders lag for a trailing 3-year period, a mean reversion opportunity is presented.

- Retail Sales can be volatile, but the trend is up and to the right. Consumers love to spend.

Very Important thesis: If equities generate roughly 8-10% a year over time, leading brands serving the dominant driver of the economy, in theory, should compound at 13%+ over time. We have significant proof on this topic below. For a variety of reasons, the last few years has been difficult for the average stock. Betting against consumption-focused stocks after a below-average 3 years has been a poor investment decision. History is very clear on this topic.

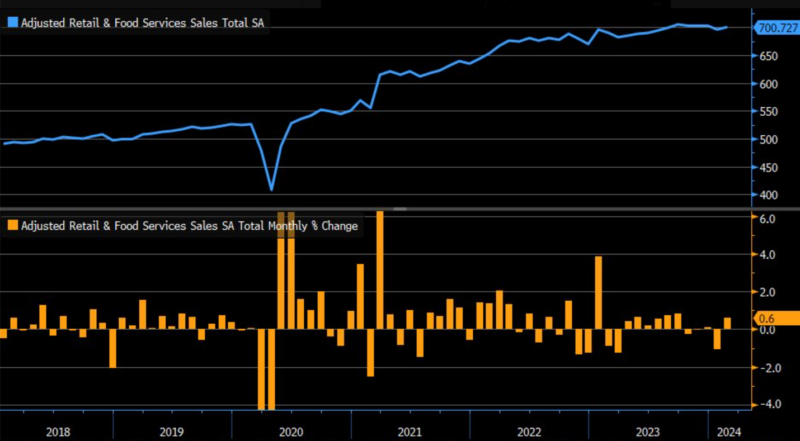

U.S. Retail Sales: Up and to the Right the Vast Majority of the Time. (source Bloomberg)

Like most economic data, the monthly data series can often be volatile and noisy, yet very few datapoints are worthy of making portfolio shifts. Avoid the noise, focus on the long-term, linear trend.

For household spending and the important Retail Sales data, the trend has been your friend for many decades. Should that surprise anyone given it’s roughly 70% of the economy and such an enormous datapoint worth about $6 trillion per year. My question is always, “do you think $6T in retail sales and/or $15T in total household spending is large enough to warrant dedication in your portfolio?” We certainly believe it is, and the opportunity is enormous for investors because very few have any dedication to a group of high-quality consumer brands. This allocation remains THE most commonsense but under-allocated theme in a portfolio.

Let’s look at some of the categories from today’s Retail Sales report for February. Again, there’s not a ton to extrapolate out of one month of data but our team likes to look at the inner workings of consumer spending to see what industries to avoid or embrace in portfolios. Total U.S. Retail Sales ex-food, autos, and gas saw a slight acceleration from January. E-commerce saw a slight downtick month/month, while most other categories either got better and stayed positive or were slightly better than January while still being negative. Remember, Retail Sales data was trending well above the linear long-term average because of excess savings and stimulus payments so we are well on our way to mean reverting back towards the long-term trend. There were so many distortions created by the Pandemic and the responses to it, is there any wonder the average consumer stock has experienced a rare sub-par 3 year return relative to the typical outperformance they have tended to generate long-term? Just remember, generally when an outperforming theme turns in a rare underperformance period, the opportunities on a go forward basis tend to be robust assuming nothing has changed with the theme. Consumer spending is about as predictable as it gets, so we see blue skies for the leading brands operating in important spending categories here and abroad.

Retail Sales Could Accelerate Going Forward but Will Remain Stable in 2024.

Generally, the comparisons get easier from here as well. For perspective, the YOY change in total Retail Sales ending February 2023 was +6%, this has mean reverted to more normal levels at +1.6%. We have tax refunds coming so that should also give a boost to consumer spending as consumers save and spend some of any refunds they get. Then we have the summer travel season and all the things we purchase for vacations. E-commerce slowed a bit, month over month but is still solid at 6% YOY. Amazon is still printing money as the leader here. Sporting goods, toys, & hobbies are easing off the tough comparisons but stabilizing. Electronics, one of the categories hit particularly hard last year have begun to stabilize and are generally back in positive YOY territory. Furniture remains a tough category, although you would never know it when listening to Williams Sonoma’s recent earnings report. Some businesses just resonate more with consumers and the stock acts in kind. Comps for the category about as bad as we think they will get; we are just not sure they will recover in V-fashion. The general merchandise category remains very stable. Think Walmart, Target, Costco here. These companies are doing just fine today even while dealing with theft and margin pressures. The clothing & accessory stores are generally trending fine, no big moves in either direction given the category is somewhat of a necessity. We do think the consumer spending here is somewhat bifurcated between higher priced, differentiated goods and low-priced, trade down activity at discount stores. Consumers are still interested in high quality, differentiated experiences and services while being very specific about their goods consumption. Trade-down activity and saving money are still a priority. Generally, that’s how the portfolio is allocated today.

Disclosure:

The above data is for illustrative purposes only. The retail fund used in this illustration is simply being used as a proxy for the merits of the theme and to highlight the potential opportunity for investors. This fund is highly concentrated in a few mega cap brands and can be very volatile but has shown merit for investors. The Dynamic Brands fund and it’s track record are highly correlated to the retail fund making this analysis pertinent and relevant. Not every great brand is always a great investment but over time, the leading brands with high brand relevancy have generated outsized returns for investors. This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.