This article first appeared on the Equity Armor Website and is a part of The Ripple Effect Newsletter. Make sure you never miss an update by clicking here.

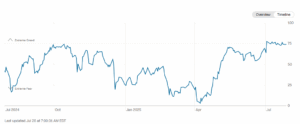

The VIX pit floor taught me markets remember everything, then forget it all in a heartbeat. Today I watch the S&P 500, NASDAQ, SMH, and MAG-7 indices carve fresh all-time highs while the VIX sleeps like a house cat. This disconnect amazes me—how quickly we erase the memory of chaos and embrace the illusion of perpetual calm.

History Rhymes Again

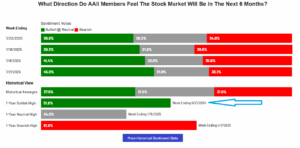

We’ve lived this movie before. Last August, AAII bullish sentiment struck a 52-week high right before the Fed launched its September rate cutting cycle. Markets had already baked those cuts into prices weeks ahead of time, creating the perfect “buy the rumor, sell the news” setup that somehow never triggered because easy money kept flowing.

Now, twelve months later, we face an eerily similar script: markets breaking records, volatility dozing, and this week’s Fed meeting fueling September rate cut speculation once again. Markets expect the Fed will slash rates twice in 2025, starting in September—a temporal echo that gives me déjà vu.

Here’s the twist: if markets price in Fed cuts this August like they did last year, we might witness another melt-up phase before volatility crashes the party. Easy money expectations possess a magical ability to launch asset prices into fantasy land before reality delivers its inevitable reality check.

But the journey we took to reach this moment? Pure insanity.

The Year That Broke All Prediction Models

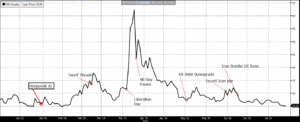

I stare at my VIX 2025 chart, dotted with event markers that read like a thriller novel no screenwriter would dare pitch:

- The Election Earthquake: Political upheaval that many predicted would shatter market confidence

- Fed’s Double Cut Surprise: Monetary policy pivots that caught even seasoned Fed watchers off guard

- The Great Fed Pause of ’25: Markets pricing cuts, getting crickets instead

- Iran-Israel War Escalation: Geopolitical powder keg that analysts expected to detonate the market

- Tariff Liberation Day: Trade policy announcements that moved trillions in market cap overnight

- The 60-Day Pause: A brief ceasefire in the trade war that markets treated like a permanent peace treaty

- US Debt Downgrade: Credit rating agencies questioning American creditworthiness while markets shrugged

Each bullet point marks moments when the VIX was widely expected to rocket into the stratosphere. Instead, implied volatility acts like a sedated golden retriever, content to nap while the world burns around it.

September’s Historical Appetite for Chaos

September always rolls out the red carpet for volatility’s grand entrance. Summer liquidity evaporates, Congress returns from vacation, and institutional portfolios face their annual stress tests. Historical data screams this truth: September volatility clusters like food trucks at a music festival.

This year carries different energy. The CNN Fear & Greed Index and AAII sentiment readings place us in dangerous territory where everyone feels brilliant, positioning grows crowded, and complacency settles over markets like morning fog in San Francisco.

The Prediction Game’s Fatal Flaw

Twenty-plus years of trading volatility hammered one lesson deep into my brain: if you think you can predict the next 12 months based on the last 12, you’re playing a sucker’s game.

Who predicted a sitting president would step aside mid-campaign? Who saw Iran-Israel tensions simmering without igniting market panic? Who forecasted that tariff threats would morph into negotiating theater rather than economic warfare?

Markets climb walls of worry while ignoring obvious risks with maddening beauty. This taught me to trade what I see, never what I think might happen.

The Crowd’s Dangerous Embrace

Let me share what the pit taught me about human nature—wisdom I now apply daily managing a volatility-hedged equity strategy and a Nasdaq-100 hedged strategy. Right now, we’re surfing one hell of a bull run. Every portfolio manager I know feels the magnetic pull to join the crowd, chase returns higher, prove they belong by riding the wave. FOMO runs thick in conference rooms across Wall Street.

I’ve felt that pull myself. During the dot-com boom, standing in the pit watching fortunes multiply daily, the temptation to abandon discipline for crowd euphoria nearly broke me. Now, running strategies that marry buy-and-hold equity philosophies with actively managed volatility overlays, I face that same temptation to drift from our core foundation: buy volatility low, sell volatility high.

The herd mentality shows no mercy—it seduces seasoned professionals just as easily as retail investors. Our strategies exist precisely because we’ve learned to resist that pull.

But bull runs carry a brutal truth: they all find resistance eventually. Market physics demands it. When that moment arrives—and it always arrives—most traders panic. Fear grips their chest, screens flash red, and they sell with the same crowd they once chased higher.

The Professional’s Ultimate Test

This creates the volatility professional’s core contradiction:

- We prepare for chaos during perfect calm

- We hunt opportunity in others’ terror

- We profit from uncertainty while craving stability

- We know low volatility breeds high volatility, yet timing the transition remains impossible

The current setup—all-time market highs with compressed volatility—screams unstable equilibrium. Picture a rubber band stretched to its breaking point, waiting for the catalyst we cannot yet see.

Step Into the Fresh Air

When resistance finally meets this bull run (not if, but when), I challenge you to do something counterintuitive: resist the panic. Don’t sell with the crowd. Instead, step away from the trading floor noise, find some fresh air, and hunt for opportunities.

But here’s the plot twist: we might not be there yet. If markets price in Fed cuts this August like they did last year, we could witness another leg higher—a classic melt-up that makes current highs look quaint. The same dovish expectations that fueled last year’s rally could send markets into orbit before gravity reasserts itself.

The danger isn’t just the eventual fall—it’s the intoxicating rise that precedes it. When markets melt up on Fed cut expectations, every instinct screams “buy more.” The pit taught me that the best trades happen when everyone else loses their minds, but sometimes the crowd stays crazy longer than logic suggests possible.

This is exactly why we built our strategies around buying volatility when it’s cheap and selling it when it’s expensive. While others chase momentum or panic at corrections, we maintain equity exposure and systematically harvest volatility premiums. It’s not glamorous, but it works across cycles.

While others surrender to greed or fear, smart money positions for the next move. While euphoria or terror dominates headlines, disciplined professionals build shopping lists and plan their exits.

The Contrarian’s Advantage

As we approach another September with the Fed commanding center stage and markets scaling new peaks, I return to that fundamental lesson from the pit: the crowd always gets it wrong at extremes.

Right now, the crowd chases this bull run higher. Soon—maybe this September, maybe next quarter—the crowd will panic and sell everything. Your job as a professional? Stand apart from both extremes.

Remember that finance’s most dangerous words remain “this time is different.” The volatility spike might emerge from expected sources—Fed policy errors, geopolitical explosions, or corporate earnings disasters. Or it might blindside us from directions we haven’t even considered.

Here’s what I know with absolute certainty: after spending years in the VIX pit, watching fortunes evaporate and materialize on waves of fear and greed, money flows to those who think independently. When everyone zigs, smart money zags. When volatility returns—and it always returns—opportunity follows close behind for those brave enough to step away from the crowd.

The charts display calm seas, but experienced sailors watch the horizon religiously. When volatility returns, it never bothers sending calendar invitations.

This article first appeared on the Equity Armor Website and is a part of The Ripple Effect Newsletter. Make sure you never miss an update by clicking here.