Investors have faced a near constant barrage of headlines about the U.S. Treasury curve. The spread between 2-year and 10-year Treasury notes has been negative, and at the time of writing this, it’s only barely positive. This undoubtedly leaves us with questions like: Does this mean a recession is imminent? Is it possible that this tried-and-true signal is no longer reliable?

If you can’t make more money by taking on more risk in terms of the length of time you’re lending, that leaves some potentially unsettling choices about lending to riskier borrowers. This decision is even more fraught with risk because if the curve is telling us something, we need to be cautious about our borrowers’ credit worthiness.

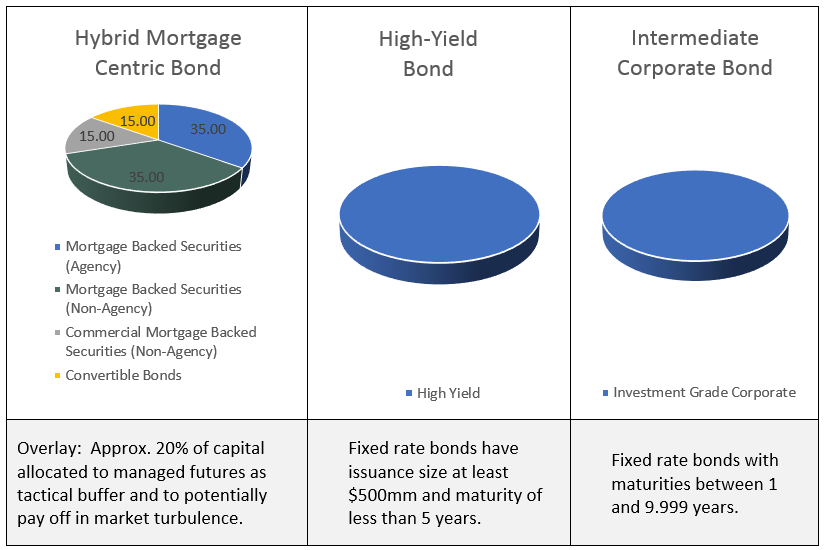

In seeking greater yield, we should evaluate the risks of two popular investment sectors (and one not as well known): high yield bonds, intermediate high-grade corporate bonds, and a new-comer, hybrid mortgage centric bond portfolio with tactical managed futures.

The chart below illustrates the key components of each portfolio investment.

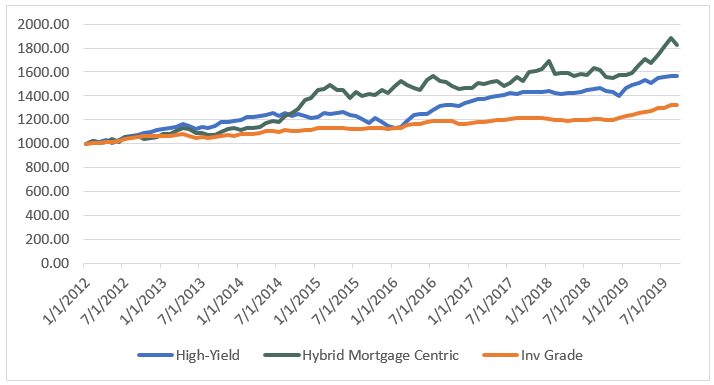

Hybrid Mortgage Centric vs. High-Yield vs Intermediate Corps from 2012-

| Hybrid Mortgage Centric | High-Yield | Corporates | |

| Annualized Return | 8.2% | 6.0% | 3.7% |

Source: Bloomberg

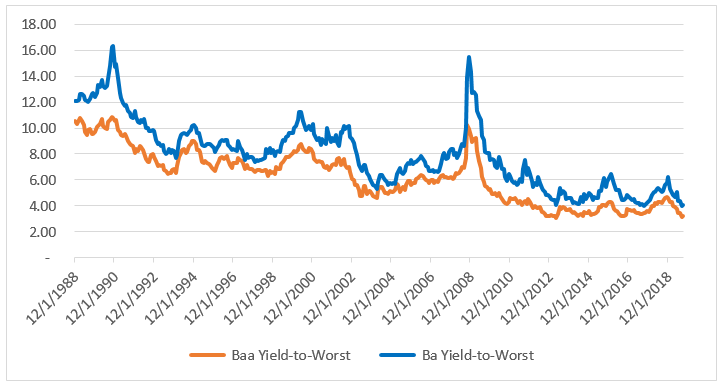

Of all three portfolios, the hybrid mortgage-centric bond delivers the highest annualized return. The problem for both high-yield and investment grade corporates is that yields available right now are as paltry as they’ve ever been historically. The chart below represents High Yield bonds in Blue by the “Ba” segment of the Bloomberg Barclays Credit Index and Investment Grade bonds in Orange by the “Baa” segment of the Bloomberg Barclays Credit Index.

High-Yield Bond Yield vs Investment Grade Yield

Source: Bloomberg

Source: Bloomberg

But we can’t operate on a “preferred” investment universe, we have to focus on the current investment landscape. In order to gauge how each could perform going forward, we want to stress these different investments in different interest rate and equity market environments we’ve faced before.

Let’s start with interest rates since 2012. To do this, we examine average performance over one-year periods in which interest rates either rose or fell:

2-year U.S. Treasury Rate Fall by More than 25 bps w/ average drop of 88 bps:

| Hybrid Mortgage Centric | High Yield | Corporates | |

| 1-Year Return | 12.0% | 7.2% | 8.5% |

2-year U.S. Treasury Rate Rise by More than 25 bps w/ average rise of 71 bps:

| Hybrid Mortgage Centric | High Yield | Corporates | |

| 1-Year Return | 4.6% | 5.1% | 1.7% |

Source: Bloomberg

In this case, declining yields lift all the fixed income alternatives. The hybrid mortgage centric investment comes out ahead and investment grade bonds outperform their riskier high-yield counterpart. However, at of the end of September 2019, yields across the board for the U.S. Barclays Aggregate Bond Index are a little over 100 basis points (bps) lower than at beginning of this year. This means that we have much less room to fall, so an asset class such as investment grade corporates, which counts on price appreciation from falling interest rates to propel return above their coupon, should see smaller prospective return.

With rising yields, the hybrid mortgage centric investment and high yield bonds compete for top billing. However, tighter corporate credit spreads (particularly the high yield sector) mean that the yield cushion high yield bonds provide for total return in rising rates going forward is substantially lower, so the margin for error is smaller. Much wider spreads are available in the mortgage credit sector – in both residential and commercial – and many bonds have floating rate coupons.

So how have investments fared compared to stock market performance post-2012? It’s been a bull market through-and-through, so there are only a handful of periods in which the stock market declined for any length. In order to examine more periods, we look at six-month timeframes when the stock market returned less than or greater than 0.50%.

S&P 500 returns 0.50% or less w/ average return of (3.0) %:

| Hybrid Mortgage Centric | High Yield | Corporates | |

| 6-mo Return | 0.9% | (2.7) % | 1.4% |

S&P 500 returns more than 0.50% w/ average return of 9.7%:

| Hybrid Mortgage Centric | High Yield | Corporates | |

| 6-mo Return | 5.0% | 4.3% | 1.8% |

Source: Bloomberg

It’s obvious from above that high yield bonds have a significant correlation to equities and generate, on average, negative return when stocks fall. Both investment-grade corporates have shown an ability to generate return in both weak and strong equity markets. But with the current investment landscape, we can’t ignore that overall yields are much lower than previous years, and that if equities decline, there’s doubt in which investment grade corporates can deliver.

Our solution to this investment jungle full of unknowns is the addition of a tactical component to a mortgage-centric portfolio in order to to make money. This addition sets up the investment to potentially perform better in a market, which faces greater volatility.

Disclaimer

The performance data displayed herein is compiled from various sources, primarily Bloomberg. Portfolios are comprised solely of benchmark indices and are rebalanced monthly except where noted otherwise. Benchmark index performance shown is primarily from Bloomberg Barclays indices. Exceptions are Societe General CTA Index for managed futures and Markit Non-Agency MBS for non-agency MBS. These indices are for the constituents of that index only, and do not represent the entire universe of possible investments within that asset class. And further, that there can be limitations and biases to indices such as survivorship, self-reporting, and instant history. Past performance is not indicative of future results.