Do rising interest rates matter to the stock market? Many in the financial media and advisory community are scrambling to locate periods where rates rose along with stocks. Has it happened? Absolutely. However, it was only a function of timing until it mattered.

Let’s start with the narrative.

Hedge fund manager Bill Ackman is worried about the impact of rising interest rates on his portfolio:

History shows Ackman’s worries about his long-only portfolio could be misplaced though. Earlier this year I looked at the relationship between rising interest rates and stock market performance:

Ben Carlson

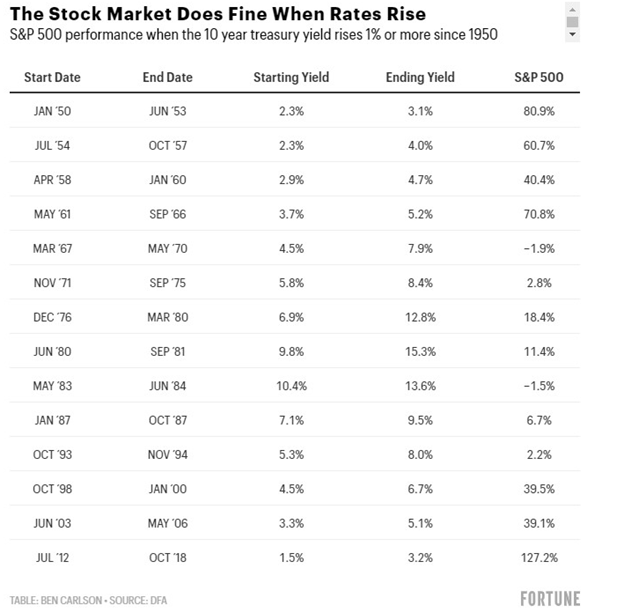

The table shows periods where interest rates were rising and the relative return of stocks during those periods. As Ben notes:

There have only been two instances where stocks fell during a rising rate environment. In fact, the annualized returns in each of these periods where rates rose 1% or more was 10.5%, which is right around the average long-term return for the U.S. stock market.

While he is correct, the problem with the analysis is that it doesn’t go far enough to tell you what happened next.

The Long-Term View Of Rates & Stocks

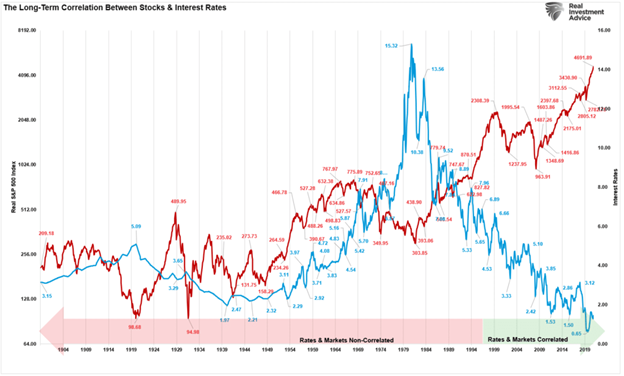

The chart below is the monthly “real,” inflation-adjusted return of the S&P 500 index compared to interest rates. The data is from Dr. Robert Shiller, and I noted corresponding peaks and troughs in prices and rates.

The data is a bit cluttered when looking at it in this manner. However, even an untrained eye can pick up that spikes in interest rates led to unfavorable outcomes for stocks.

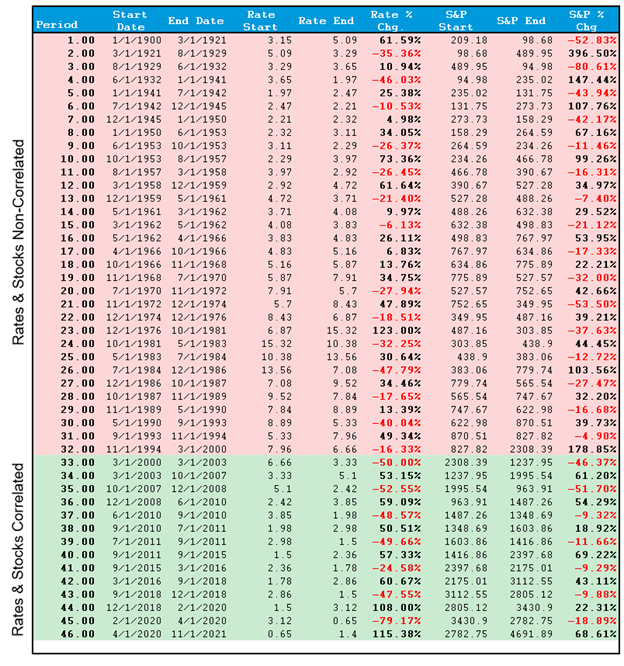

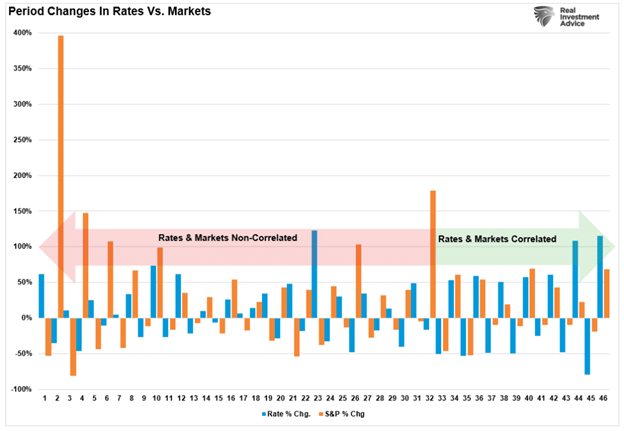

To try and understand the relationship between stock and bond returns over time, I took the data from the chart and created the table below of 46 periods over the last 121-years.

What jumps is the high degree of non-correlation between 1900 and 2000. As one would expect, in most instances, if rates fell, stock prices rose. However, the opposite also was true. The chart below shows each of the 46-periods graphically.

The historical non-correlation changed in 2000, and rate movements and stock prices became correlated. The only change that explains this immediate switch from non-correlation to correlation is the Federal Reserve.

The Fed Changed The Correlation

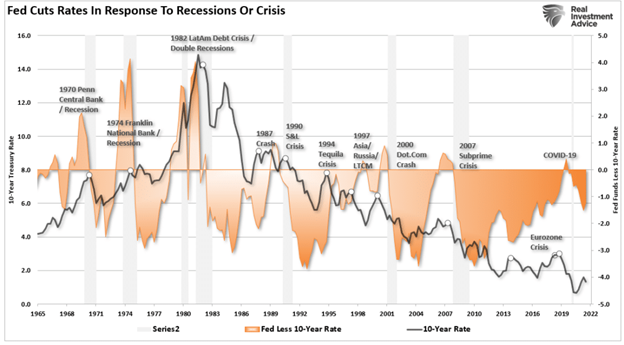

While many focus on the Federal Reserve’s interventions beginning in 2008, the Fed was becoming more active in stabilizing financial markets under the guidance of Alan Greenspan. From bailing out Long-Term Capital Management to sharply dropping interest rates during the “Dot.com” crash, the early experiments of monetary policy formed. Importantly, for investors, “don’t fight the Fed” became a mantra.

Then in 2008, with the invention of “Quantitative Easing.” the evolution of monetary policy became complete and cemented the stock/bond relationship. As investors became trained that monetary policy would push asset prices higher, investors sold bonds (risk-off) to buy stocks (risk-on.)

While Ben’s table above is correct, what it lacks is what came next. In EVERY period where rates and stocks both rose, most of those gains got forfeited as interest rates slowed economic growth, reduced earnings, or created some crisis.

In the short term, the economy and the markets (due to the current momentum) can DEFY the laws of financial gravity as interest rates rise. However, as interest rates increase, they act as a “brake” on economic activity. Such is because higher rates NEGATIVELY impact a highly levered economy:

- Rates increases debt servicing requirements reducing future productive investment.

- Housing slows. People buy payments, not houses.

- Higher borrowing costs lead to lower profit margins.

- The massive derivatives and credit markets get negatively impacted.

- Variable rate interest payments on credit cards and home equity lines of credit increase, reducing consumption.

- Rising defaults on debt service will negatively impact banks which are still not as well capitalized as most believe.

- Many corporate share buyback plans and dividend payments are done through the use of cheap debt.

- Corporate capital expenditures are dependent on low borrowing costs.

- The deficit/GDP ratio will soar as borrowing costs rise sharply.

I could go on, but you get the idea.

The Valuation Problem

Most notably is the valuation problem.

The primary bullish argument for owning stocks over the last decade is that low-interest rates support high valuations.

Such gets based on the assumption the present value of future cash flows from equities rises, and subsequently, so should their valuation. While true, assuming all else is equal, a falling discount rate does suggest a higher valuation. However, as Cliff Asness noted previously, that argument has little validity.

“Instead of regarding stocks as a fixed-rate bond with known nominal coupons, one must think of stocks as a floating-rate bond whose coupons will float with nominal earnings growth. In this analogy, the stock market’s P/E is like the price of a floating-rate bond. In most cases, despite moves in interest rates, the price of a floating-rate bond changes little, and likewise the rational P/E for the stock market moves little.” – Cliff Asness

Here is the primary problem of the current argument that higher rates won’t impact stock prices:

“You can’t have it both ways.”

Either low-interest rates are bullish, or high rates are bullish. Unfortunately, they can’t be both.

As noted, rising interest rates correlate to rising equity prices due to market participants’ “risk-on” psychology. However, that correlation cuts both ways. When rising rates reduce earnings, economic growth, and investor sentiment, the “risk-off” trade (bonds) is where money will flow.

With exceptionally high market valuations, the market may remain correlated to rising interest rates for a while longer. However, at some point, rates will matter, and they often matter more than most think.