Recession warnings are clearly on the rise. Much of the initial media fervor focuses on the inversion of the yield curve.

The 2-year and 10-year Treasury yields inverted for the first time since 2019 on Thursday, sending a possible warning signal that a recession could be on the horizon.” – CNBC

Of course, investors, analysts, and economists continue to debate the meaning of the 2-year/10-year yield-curve inversion. Since 1978, yield curve inversions consistently provide recession warnings.

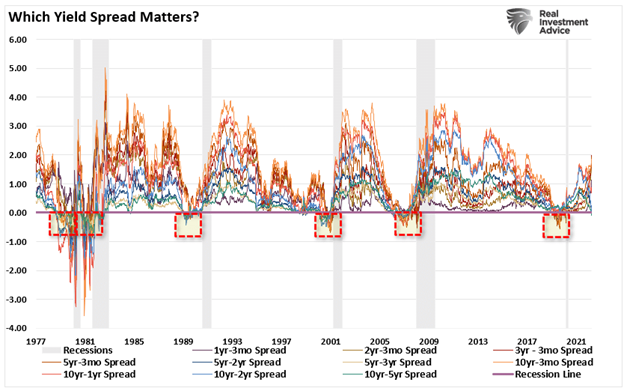

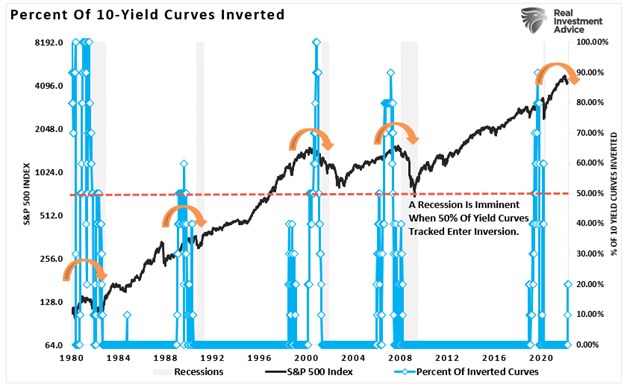

Most of the yield spreads we monitor, shown below, have yet to invert. However, the best signals of a recessionary onset occur when 50% of the 10-yield spreads that we track turn negative simultaneously. Notably, it is always several months before the economy slips into recession and even longer before the National Bureau Of Economic Research officially dates it.

Source: Treasury.gov Chart: RealInvestmentAdvice.com

Such is essential as when yield spreads initially turn negative; the media will discount the risk of a recession and suggest the yield curve is wrong this time. However, the bond market is already discounting weaker economic growth, earnings risk, elevated valuations, and a reversal of monetary support.

Historically, a recession followed when 50% or more of the tracked yield curves became inverted. Every time. (Read this for a complete history.)

Source: Treasury.gov Chart: RealInvestmentAdvice.com

But it isn’t just the yield curve warning of a recession currently.

Other Indicators Suggesting Recession Risk

Ben Casselman recently penned for Yahoo Finance, “The U.S. Economy Is Booming?” To wit:

“Such predictions [of recession} may seem confusing when the economy, by many measures, is booming. The United States has regained more than 90% of the jobs lost in the early weeks of the pandemic, and employers are continuing to hire at a breakneck pace, adding 431,000 jobs in March alone. The unemployment rate has fallen to 3.6%, barely above the pre-pandemic level, which was itself a half-century low.”

Interestingly, many of the data points suggesting the “economy is booming” are lagging indicators subject to significant negative revisions in the future. Furthermore, as is always the case, record levels of anything are a “record” because such was the high or low watermark of the previous cycle.

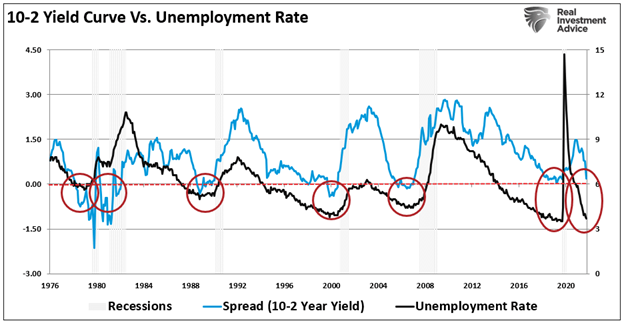

For example, Ben notes the U.S. has regained 90% of the jobs lost. Such certainly sounds robust until you realize we are not creating NEW jobs to absorb a growing population but only rehiring for the job vacancies created by the shutdown. However, more notably, near record-low unemployment is also a recessionary warning sign.

Source: St. Louis Federal Reserve Chart via RealInvestmentAdvice.com

While such seems counter-intuitive, it isn’t.

“The economy has to slow somewhat in the not-too-distant future, because at 3.8% unemployment, ‘We’re out of workers. It’s hard to produce more when there is no one to produce it.’” – The Financial Times

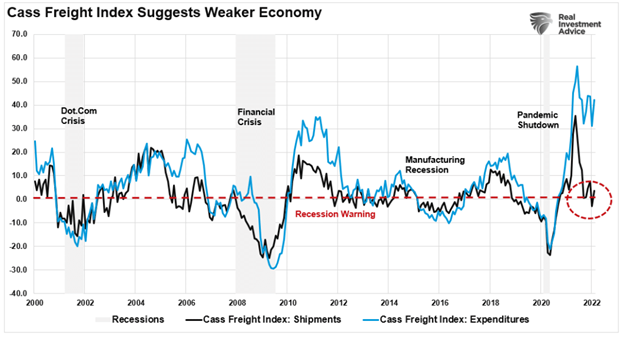

As noted, unemployment is a lagging indicator. However, freight transportation is a leading indicator that suggests the economy is NOT booming. If the economy is booming, the demand for goods gets reflected in higher freight shipments. Currently, that is not the case, and when coupled with increased expenditure levels, the slowdown could be more dramatic.

Source: St. Louis Federal Reserve Chart via RealInvestmentAdvice.com

Housing Supply & Mortgage Rates

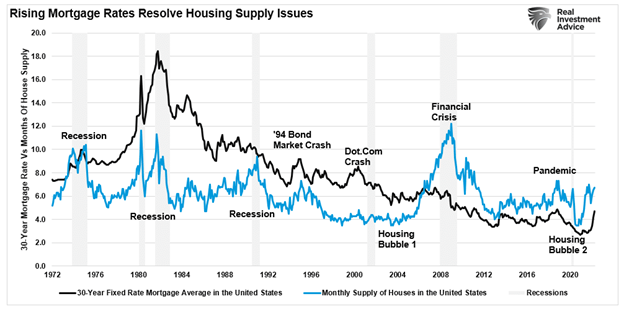

Of course, given record levels of housing activity rivaled that seen before the “Great Financial Crisis,” we would be remiss not to take note.

Housing is economically sensitive and gets driven by income and mortgage rates. Following the pandemic-driven shutdown, the flood of checks to households, combined with record-low mortgage rates, led to another “great housing boom.”

Housing inventories dropped to low levels due to surging demand and lots of liquidity. However, as we addressed previously, there is no such thing as a “housing shortage.”

“Not surprisingly, recessions have a nasty habit of rapidly increasing the housing supply. As job losses mount, the available pool of buyers who can afford to buy a home sharply contracts. Given that ‘housing inventory’ is a function of buyers versus the number of houses for sale, the numerator’s reduction matters much.”

As mortgage rates rise, so do housing inventories as demand drops. Furthermore, as opposed to employment which is a lagging indicator, inventories at roughly 8-months of supply often predict an impending recession.

Source: St. Louis Federal Reserve Chart via RealInvestmentAdvice.com

As opposed to employment, many other leading indicators currently point to an economic slowdown or worse.

At the same time, the “demand economy,” created by trillions of monetary liquidity sent directly to households, is reverting to a “supply economy.” As supply outstrips demand, the eventual deflationary drag will become problematic for the Fed.

The Fed’s Inflation Fight Will Be Short-Lived

We’ve often argued that in 2020 and 2021, the Fed should have been hiking rates due to the impending inflationary spike from excess monetary liquidity. Unfortunately, the Fed kept rates at 0% for far too long, and now they are getting forced into an aggressive rate hiking campaign to combat an “inflation monster” of their own making.

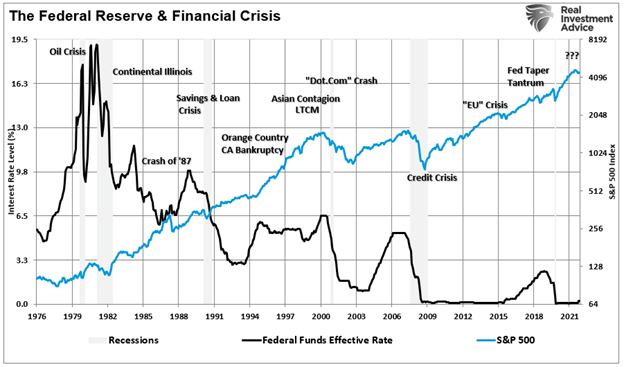

While many believe the Fed will focus on the inflation fight despite impending financial instability, history suggests they won’t be. Ever since the “Great Financial Crisis,” the Fed has repeatedly rescued the financial markets from declines to maintain stability.

Source: St. Louis Federal Reserve Chart via RealInvestmentAdvice.com

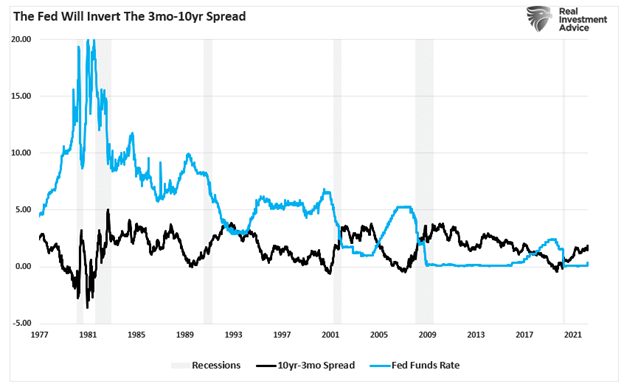

The Fed may indeed be able to hike rates currently to battle inflation without pushing the economy into a recession. While many suggest “this time is different” as the 3-month versus 10-year yield curve is not inverted, as the Fed hikes rates, it won’t take long to catch up.

Source: St. Louis Federal Reserve Chart via RealInvestmentAdvice.com

Despite commentary to the contrary, the yield curve is a “leading indicator” of what is happening in the economy currently, as opposed to economic data, which is “lagging” and subject to massive revisions.

More importantly, while the consumer may be continuing to support growth currently, such can, and will, change dramatically when job losses begin to occur. Consumers are fickle beasts, and the contraction in demand will happen rapidly as a change in psychology occurs.

While many believe the Fed will “stick to their guns” in the fight against inflation, history clearly shows a lack of fortitude to withstand financial instability.

History has not been kind to those that ignore the warnings signaling a potential for a recession.

However, we suspect the Fed will be back to zero interest rates, and monetary QE, far sooner than many expect.