News related to progress (or rather lack thereof) on the trade front with China has moved the financial markets year-to-date and for a good portion of last year. Tweets promising progress have cheered investors, while tweets of the breakdown of talks have often triggered selloffs.

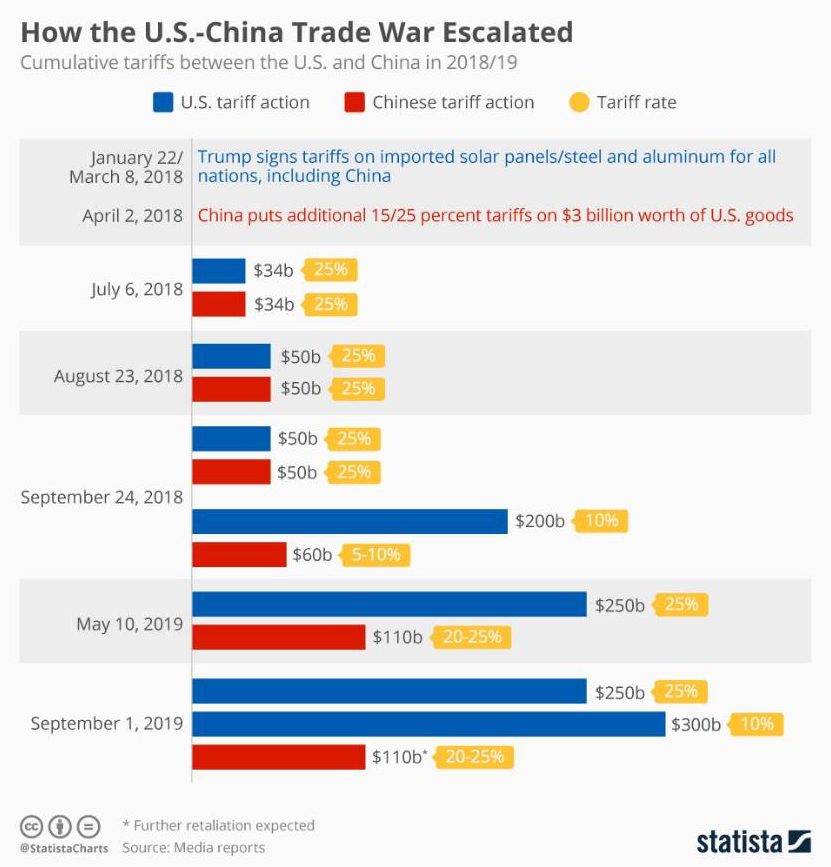

Last week, following what the President referred to as China not fulfilling their promised actions, the U.S. decided to impose additional tariffs on more Chinese imports. With this action, nearly every product entering the U.S. from China (except those with exemptions) will face an import tax of at least 10% and up to 25%.

In retaliation, the Chinese announced they would halt buying U.S. agricultural products and allowed their currency to fall to a 10-year low.

These actions forced the United States Treasury to designate China as a currency manipulator (1st time since 1994). Thus, the U.S. is required to negotiate for one year before retaliating.

Let’s not kid ourselves; all countries “manipulate” their currencies through the printing of money and interest rates. For example, since last year, Donald Trump has pushed hard to force the hand of the U.S. Federal Reserve Board chairman to lower interest rates. In response, the Fed cut rates 25 basis points on July 31st; however, their desire to let the data dictate any further cuts left the President wanting additional action. Lower interest rates in the U.S. would likely lower the value of the U.S. dollar, thereby making U.S. goods more competitive in other countries. The Chinese have achieved this by lowering their currency and effectively reducing the cost of their goods and negating a portion of the tariffs.

In the end, both countries have a lot to lose if this develops into a full-blown trade war. President Trump is eyeing the upcoming November 2020 election, and a trade war would undoubtedly hurt the economy, possibly even pushing it into a recession. Such an environment would hurt his chances of re-election regardless of any attempts to positively spin the rhetoric. This, in turn, would create additional uncertainty should a new candidate, with new tax, economic, and trade policies be elected. China, on the other hand, is already facing an economic slowdown and recent civil unrest in Hong Kong is creating another area of investment risk, exacerbating the economic impact.

We believe both countries will eventually strike a compromise on this issue. Technology firms such as Microsoft, Oracle, Salesforce, have lost billions of dollars of sales over the years due to piracy and theft. Furthermore, the sad reality is that manufacturing jobs will not be coming back en masse to the U.S., given that we are not a low-cost producer. Even China is losing some of these jobs to countries that offer lower costs of labor relative to their own. Intellectual property is truly the crown jewel for the United States and must be protected. Protecting intellectual property will be the cornerstone of any compromise on the trade front. Agriculture will also likely play a key role, as China needs to import food to feed its large population. Despite the ability for China to obtain replacement agricultural products from other countries such as Brazil (due to years of stockpiling by farmers looking to achieve better economics), there is not enough to go around and such an agreement would earn President Trump the appreciation (and votes) from farmers eager to return to regular planting and harvesting activities.

Despite our optimism that a deal will eventually be reached, the key will be how long an agreement takes to materialize. The length of the dispute will likely continue to add uncertainty, from an investment perspective, both at the corporate and investor level. By focusing on stocks with attractive valuations, we believe the portfolio is well-positioned for a modest/slowing growth environment that we project the economy will confront during the foreseeable future. However, what has worked for the last decade probably will not work for the next. We believe selectivity is prudent in constructing the portfolio, and what you don’t own will prove more important than what you do own. Furthermore, we believe a patient approach to investing will protect our clients from the negative impacts associated with a protracted trade dispute, and the defensive nature of our portfolio should lend itself well.

Certain statements made by us may be forward-looking statements and projections which describe our strategies, goals, outlook, expectations, or projections. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements.