Key Points

- The CORE of a portfolio should be tethered to the core of the economy.

- A collection of the most relevant brands serving consumers has performed very well.

- When great brands go on sale like in 2022, you get a wonderful opportunity to add.

The Core + Satellite Approach

In a bull market, generally every asset goes up and to the right. Some portfolios perform better than others but overall, everyone is making money and happy. Thankfully, markets go up roughly 80% of the time. I’ve been working with Advisors for 28 years now and have had the opportunity to analyze portfolio construction through the lens of a holdings-based approach. There is no right or wrong way to build a portfolio but today I wanted to highlight the potential benefits of a simple, 3-pronged approach driven by commonsense, logic, and robust data.

The classic portfolio definition of CORE: the largest and most important part of something.

The classic portfolio definition of SATELLITE: that which surrounds the core and adds value.

Remember, to oversimplify, this is generally what investors want when they make the decision to invest their capital for long-term growth:

- Achieve attractive returns.

- Have as smooth a ride along the way as possible.

- Reach their target goal on time and intact.

How they accomplish these three goals is where the magic happens. In many cases, it’s the BALANCE between the core and satellites that helps them accomplish their goals.

The CORE of the portfolio: tethered to the core of the economy.

If given the option, I will bet 90%+ of HNW clients would prefer to own a portfolio they understand yet few clients could explain their portfolio construction to their neighbors or friends. At the core of Peter Lynch’s portfolio philosophy was “invest in what you know.” As consumers, investing in what we know tends to be easy because the answer lies within our spending DNA. We know roughly 70% of U.S. GDP is household consumption. We also know, roughly 60% of global GDP is consumption. So, there’s this phenomenon called “consumption” that accounts for roughly $44 trillion each year, in good times and bad.

If consumption is the core of every economy, by definition and logically, shouldn’t consumption stocks be the core of our investment portfolios? Given the persistent home bias embedded in our portfolios, it seems odd to exclude the single largest driver of our country. Hard to dispute the concept yet in my experience, few have implemented the allocation with a weighting that is warranted for a proper “CORE”.

Consumption Stocks Have Performed Well & Added Strong Diversification Benefits.

Consumers all over the world make purchase decisions every day. At the center of these decisions is brand loyalty. Whether we realize it or not, we have a few brand favorites for every consumption category we participate in. Most brands have global reach, and the most relevant brands tend to have higher market share than peers. Logically, the most relevant brands serving the largest end-markets SHOULD be pretty good businesses which tends to make them pretty good stocks over time. Not every great brand is a great stock every year but, over time, the alpha tends to happen for top brands. Again, I don’t think many people would dispute this premise. That’s why we believe a Consumption Brands CORE is a timeless allocation so long as you constantly monitor brand relevance. Our team is relentless about analyzing brand relevancy.

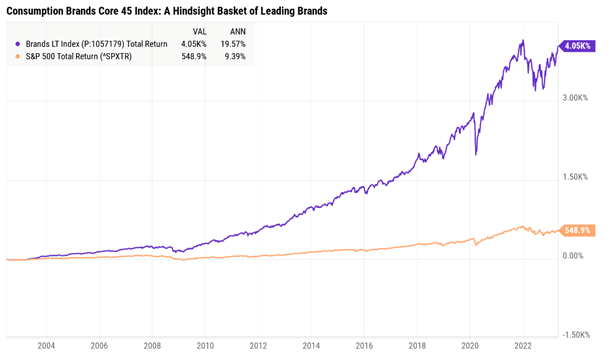

The most important question for investors, have leading brands been worthy performers and worthy of being the CORE of a portfolio? To answer this, I built a 45 brand, hindsight basket of leading brands with long-term track records of staying relevant. The chart starts after the Netflix IPO, July 1, 2002, and runs to April 30, 2023. 20+ years of data in total.

Data source: Ycharts.com.

Very important: the cumulative annualized returns of the top brands basket above do not matter. This is a hypothetical illustration of how powerful the theme of global consumerism is.

A basket of leading consumption-economy brands serving global consumers and the consumption economy SHOULD, in theory perform well over time. That’s indeed what this hindsight-created basket shows. Should we be surprised when consumerism is in our DNA?

Here’s the leading brands that comprise the 45-stock, hindsight consumption portfolio:

Amazon, American Express, Apple, Autozone, Best Buy, Booking Holdings, CarMax, Church & Dwight, Clorox, Coca-Cola, Colgate-Palmolive, Constellation Brands, Costco, Darden Restaurants, Decker’s Outdoors, Dollar Tree, eBay, Garmin, General Mills, Johnson & Johnson, L’Oréal, Lennar, Lowe’s, Marriot, McDonald’s, Mondelez International, Monster Beverage, Nestle, Netflix, Nike, O’Reilly Automotive, Pepsi, Procter & Gamble, Ross Stores, Sherwin Williams, Starbucks, TJX Companies, Target, Estee Lauder, Hershey, Home Depot, Walt Disney, Tractor Supply, Walmart, and Yum Brands. Internally, we call this the Timeless 45.

Also important: Because I wanted to show a long-term time horizon, this analysis ignores some of the younger but highly relevant brands that have also been monster performers since going public. Brands like: Chipotle, Tesla, Lululemon, Crocs, Google, Meta (Facebook), Microsoft, LVMH, Hermes, Ferrari, Ulta Beauty, Etsy, and Domino’s Pizza to name a few.

Yes, it would have been impossible to know that all the brands above would have been today’s key brand leaders, but one could assume if a brand stayed relevant and operated in important consumption industries, the stock likely performed well over time. The irony, if I was tasked with creating a Timeless 45 portfolio a decade ago, most of the brands in the list of 45 would have been the same as those I used for today’s analysis. When a brand reaches Mega-Brand status, it’s typically due to a long period of time dominating a category. Even great businesses do not always perform well, that’s impossible to ask of any company. In 2022, for example, Amazon was down 50% at the lows, and LVMH, Nike, Lululemon, Estee Lauder were down 40%+ while Meta and other top tech brands were down 60-75% as rates normalized. Many of these brands are up double digits or more YTD as of April 2023.

Lastly, there’s a clear benefit to pivoting to defensive, Consumer Staples when economic weakness is coming or simply holding them long-term, as the analysis shows. In bull markets the staples tend to lag but they also tend to play wicked catch-up when the growth brands are struggling. Consumer staples and other defensive sectors tend to be wonderful volatility dampeners so combining offense and defense in a portfolio can really help smooth the ride for investors.

Disclosure:

The above report is a hypothetical illustration of the benefits of using a 3-pronged approach to portfolio management. The data is for illustrative purposes only and hindsight is a key driver of the analysis. The illustration is simply meant to highlight the potential value of building a consumption focused core portfolio using leading companies (brands) as the proxy investment for the consumption theme. This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.