Coming into 2020 the pipeline sector was in good shape. Spending on growth projects peaked in 2018, and lower growth capex combined with rising cashflow from existing assets were set to drive Free Cash Flow (FCF) higher. Across the companies that are in the American Energy Independence Index it was on course to more than double, from $9BN last year to $21BN this year (see Updating the Coming Pipeline Cash Gusher).

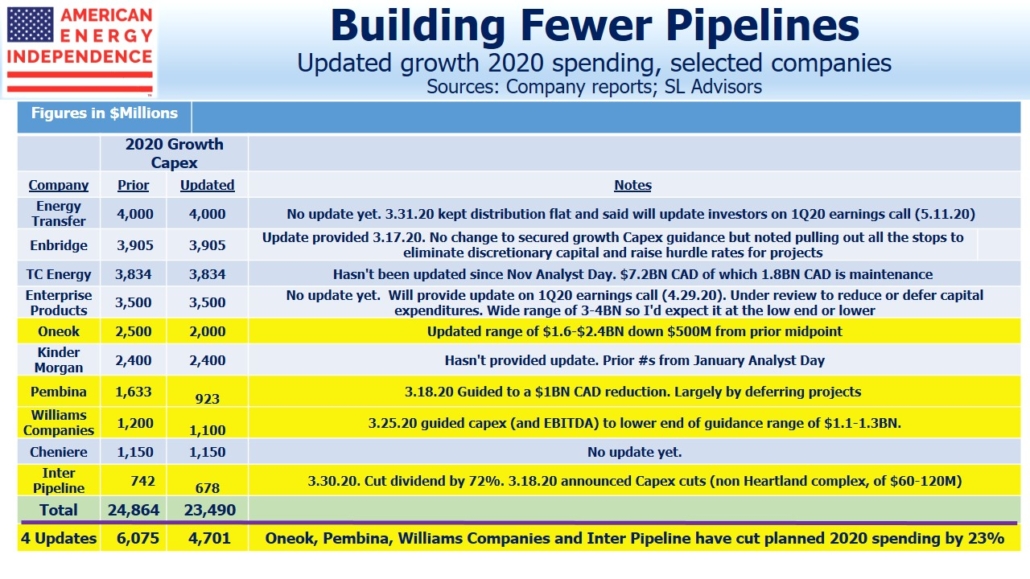

Some companies have been providing updated guidance in recent weeks. The top ten companies represent 60% of the sector by market cap. Four of them have already revised their spending lower for the remainder of the year, with only Enbridge reiterating prior growth project guidance. We expect the remaining five to revise their numbers in the weeks ahead.

Global crude oil demand is estimated to have fallen by 25% or more in April, and the collapse in crude prices is the dominant energy story. But pipelines carrying natural gas, natural gas liquids and facilities supporting Liquefied Natural Gas (LNG) exports represent 62% of the sector’s market cap, versus just 28% for petroleum products. Natural gas demand has so far shown little coronavirus impact (see Natural Gas Demand Still Stable). Midstream MLPs are more weighted towards crude oil than pipeline corporations, which has hurt recent relative MLP performance (see The Disappearing MLP Buyer).

Our recently updated FCF blog assumed 2020 growth capex of $37BN. Reductions here will provide a cushion to offset any shortfall in cashflow, since a dollar not spent is a dollar of additional FCF. Four companies on the list (Oneok, Pembina, Williams and Inter Pipeline) have lowered growth spending by $1.4BN, around 23%. Enbridge said on their recent update that they’d raised the return hurdle for new projects. Enterprise Products is likely to lower their spending, last estimated at $3-4BN. Others have yet to provide any new guidance.

It’s also worth noting that first quarter spending was already completed by the time these updates were provided, so the 23% reduction is in practice more like a 31% cut for the remaining nine months of the year. If we assume a 23% cut in the industry’s originally planned $37BN 2020 spending, that’ll free up an additional $8.5BN to support FCF.

We are invested in the names listed above.

The post Pipeline Companies Trim New Projects appeared first on SL-Advisors.