Covid accelerated a trend already in place in the U.S. energy sector, which is to grow Free Cash Flow (FCF) rather than production. Chevron’s Investor Day last week promised 10% annual increase in FCF through 2025. This return to shareholder-friendly metrics is attracting investors – including recently Berkshire Hathaway.

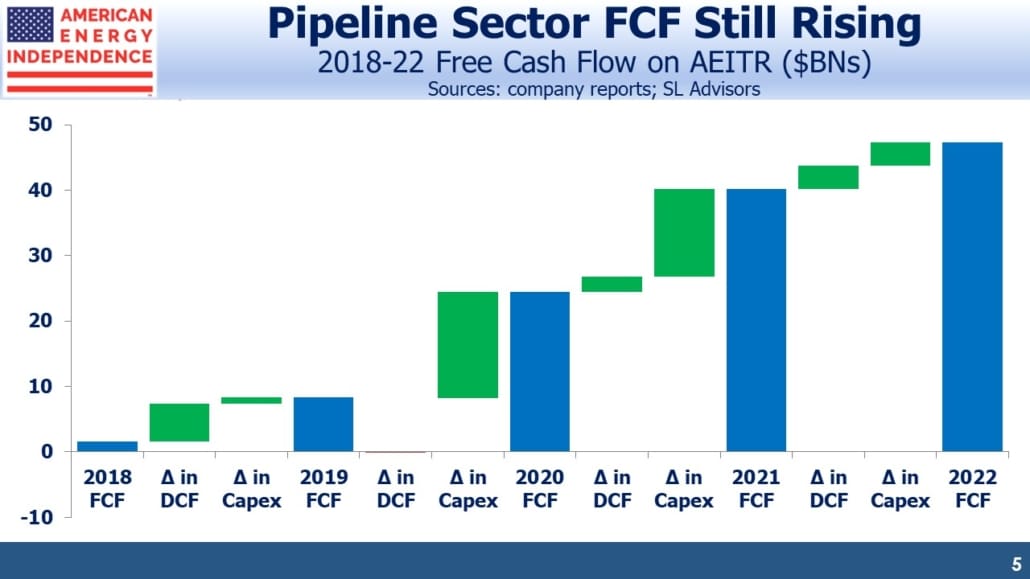

Midstream energy infrastructure has grasped this as readily as their upstream E&P customers. Full year 2020 earnings have been reported. The companies in the American Energy Independence Index, the best representation of the North American pipeline industry, grew FCF to $25BN last year. This is almost three times their 2019 performance, a result that seemed implausible a year ago when Covid drove panic selling.

Continued reductions in growth capex are the reason – Distributable Cash Flow (DCF), equivalent to cash from operations minus maintenance capex, was flat last year. Pre-Covid, DCF was expected to increase from $54BN to $60BN, but Enbridge (ENB), Enterprise Products Partners (EPD), Kinder Morgan (KMI) and TC Energy (TRP) each came in $1BN or more below target. However, capex reductions were widespread during the year, and these largely offset the drop in DCF which is why FCF came in around target.

The result is the bridge chart shown below, which continues to track a path towards higher FCF for the industry. On current trends we should exit 2021 with a FCF yield of over 10%, more than twice the S&P500. Having rallied so far, one might conclude that the sector’s mis-valuation prevailing last year has been eliminated. The FCF yield shows this isn’t the case.

The biggest single variable in the industry’s capex figures is Enbridge’s planned replacement of Line 3. This is a 1,000 mile crude oil pipeline oroginally built in the 1960s that runs from Edmonton, Alberta to Superior, Wisconsin. Canada has long struggled to find economic ways to get its crude oil to market. The proposed new pipeline will more than double capacity, from the current 370 thousand barrels a day (MB/D) to 760 MB/D. ENB recently raised the estimated total cost of this project by almost $1BN, to $7.3BN.

Predictably, environmental extremists are opposing the pipeline, although it’s a safe bet that they drive regularly, including to their protests. With Biden having canceled the Keystone XL project shortly after his inauguration, the Line 3 Replacement (L3R) has become a new target. So far, ENB and most analysts expect the project to proceed. Our estimate of 2021 growth capex for the industry is $4.5BN higher than we forecast in December; $3.5BN of this relates to L3R.

For 2022 and beyond, the pipeline sector is on track to further reduce growth capex.

Energy executives provided quarterly updates over the past few weeks, which included updating their capex guidance. On the energy transition, typically they acknowledge it and have plans to reduce their company’s carbon footprint. The prevailing view is that global energy consumption will increase for all forms of energy, including oil and gas.

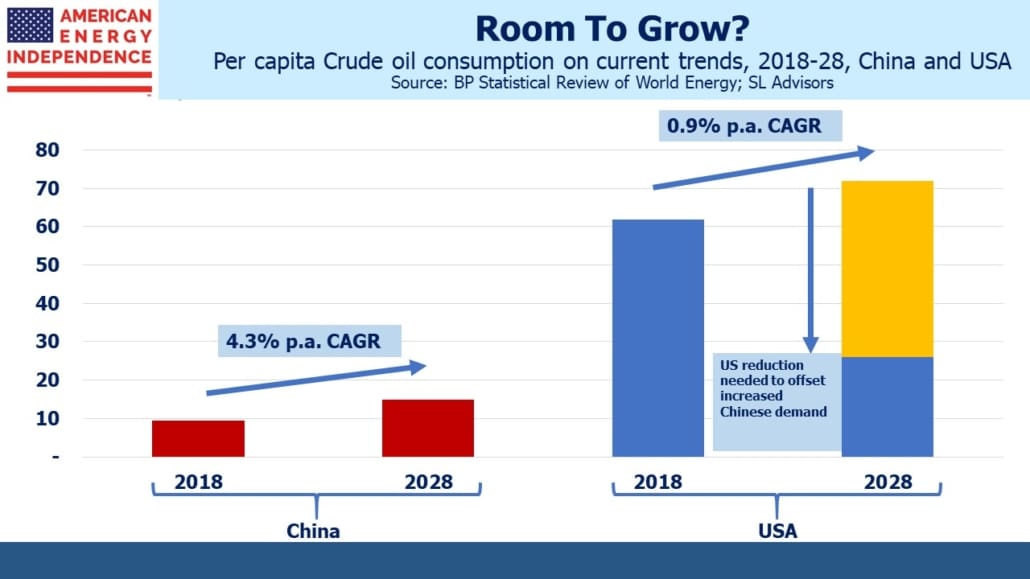

Consider the following: China’s oil consumption is about two thirds the U.S. But China’s per capita consumption is only 15% of the U.S. Its population is growing at around 0.4% p.a., versus about 0.6% for the U.S. China’s per capita consumption of crude is growing at 4.3%, and total consumption at 4.7%.

If China’s per capita oil consumption grows over the next decade at the same rate as it has for the past five years, China would be consuming more than the U.S. if we kept consumption flat. If the U.S. wanted to lower consumption to offset China’s growth, our per capita consumption would need to fall by almost 10% p.a. Currently it’s growing at 0.9%.

Even in this implausible scenario, crude oil consumption is unchanged – it’s simply shifted from the U.S. to China.

This is the daunting math that confronts efforts to reduce emissions. Electric vehicle penetration is higher in China, and they drive around a quarter as many miles as Americans. But 1.4 billion Chinese striving for western living standards is going to require a big adjustment from 330 million Americans, if crude oil consumption and emissions are to fall.

There are many more variables to consider, but this simple example illustrates why Exxon Mobil and Chevron think oil still has a future.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

The post Pipeline Cashflows Continue Higher appeared first on SL-Advisors.