Passive ETFs are hiding a bear market in stocks. That may sound like a strange statement when you look at major stock market indexes hovering near all-time highs. However, much like an iceberg, what we see on the surface hides much of what lies beneath.

Such was a point we discussed in more detail in “Wipe Out:”

“One of the problems with the financial markets currently is the illusion of performance. That illusion gets created by the largest market capitalization-weighted stocks. (Market capitalization is calculated by taking the price of a company multiplied by its number of shares outstanding.)

Notably, except for the Dow Jones Industrial Average, the major market indexes are weighted by market capitalization. Therefore, as a company’s stock price appreciates, it becomes a more significant index constituent. Such means that prices changes in the largest stocks have an outsized influence on the index.

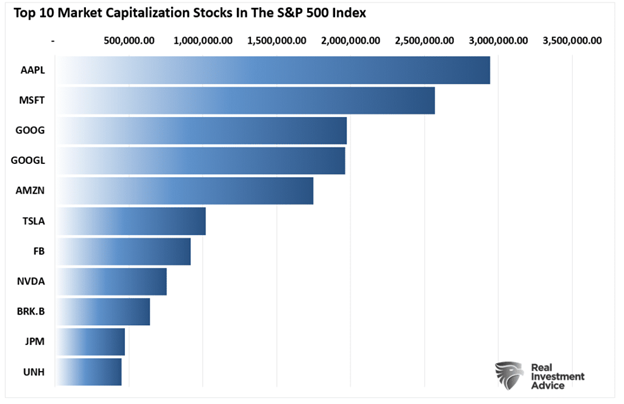

You will recognize the names of the top-10 stocks in the index.”

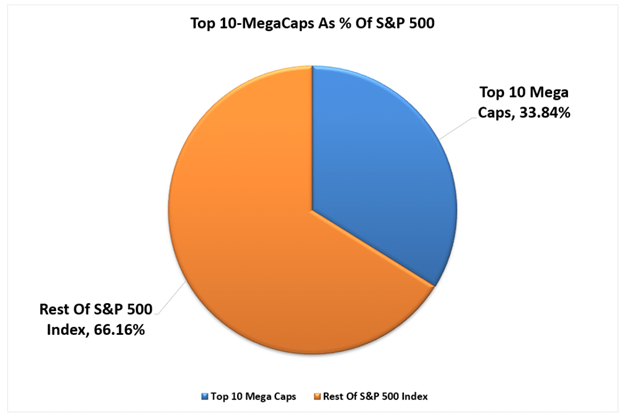

Currently, the top-10 stocks in the S&P 500 index comprise more than 1/3rd of the entire index. In other words, a 1% gain in the top-10 stocks is the same as a 1% gain in the bottom 90%.

Such is the story of 2021. Had it not been for the enormous returns in companies like Apple (AAPL), Google (GOOG), Microsoft (MSFT), Tesla (TSLA), and Nvidia (NVDA), the return for the year would be much different.

The Nasdaq Bear Market

The same story holds for the Nasdaq, which is also heavily dominated by the same stocks as the S&P 500. As noted, without the support of the top-10 holdings, the year-to-date returns and overall volatility would be very different.

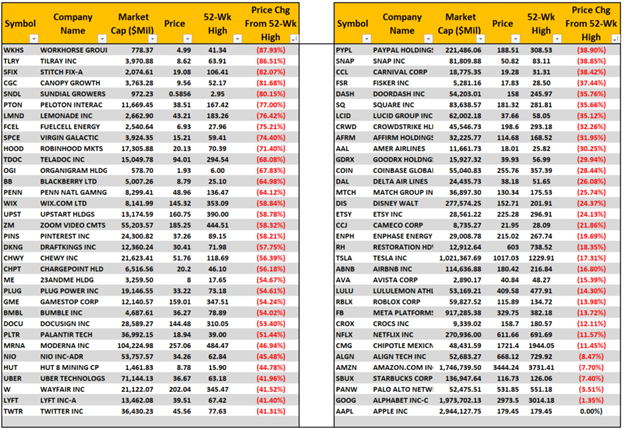

If we look at a sampling of the more “popular” trading stocks, you can understand current retail traders’ frustration. A vast majority of 2020 and early 2021’s high-flying stocks are down significantly from their respective 52-week highs.

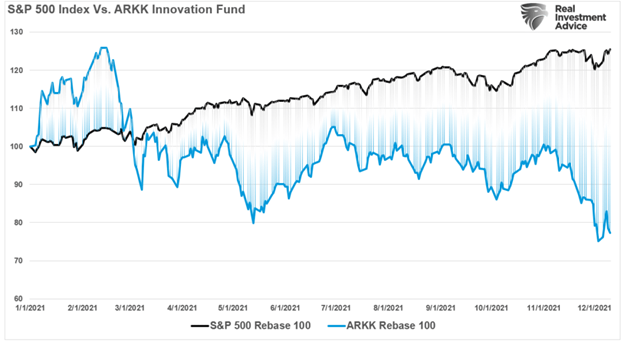

Of course, probably one of the best representations of the disparity between what you see “above” and “below” the surface is the ARKK Innovation Fund (ARKK). While the S&P 500 index was up roughly 27% in 2021, ARKK is down more than 20%. That is quite a performance differential but shows the disparity between the mega-cap companies and everyone else.

As discussed in this past weekend’s newsletter, such is a phenomenon.

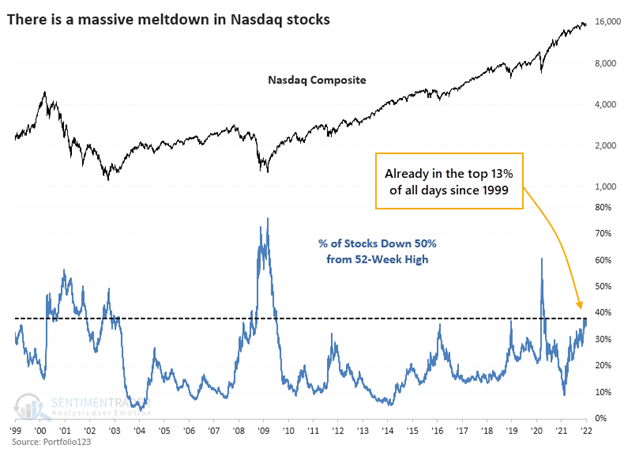

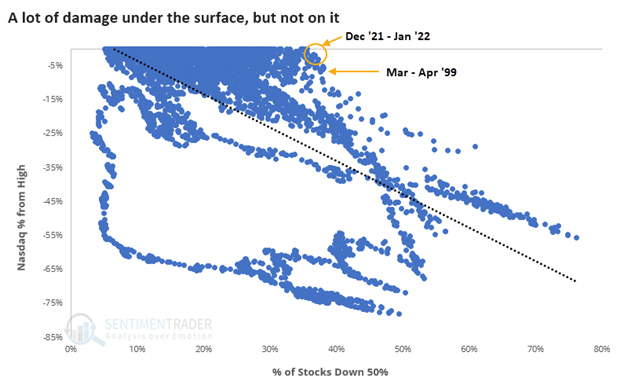

“After Wednesday’s post-FOMC selloff, more than 38% of stocks trading on the Nasdaq are now down 50% from their 52-week highs. Only 13% of days since 1999 have seen more stocks cut in half.

At no other point since at least 1999 have so many stocks been cut in half while the Nasdaq Composite index was so close to its peak. When at least 35% of stocks are down by half, the Composite has been down by an average of 47%. – Sentiment Trader

The last sentence is critical. There is no precedent for when so many stocks were in a bear market, yet the index was near its historical highs.

It’s A Passive Indexing Mirage

So, how is it that despite the destruction below the surface, so many indexes hold near highs? Not surprisingly, it is a mirage caused by passive indexing.

Currently, more than 1750 ETFs are trading in the U.S., with each of those ETFs owning many of the same underlying companies. For example, how many passive ETFs own the same stocks comprising the top-10 companies in the S&P 500? According to ETF.com:

- 363 own Apple

- 532 own Microsoft

- 322 own Google (GOOG)

- 213 own Google (GOOGL)

- 424 own Amazon

- 330 own Netflix

- 445 own Nvidia

- 339 own Tesla

- 271 own Bershire Hathaway

- 350 own JPM

In other words, out of roughly 1750 ETF’s, the top-10 stocks in the index comprise approximately 25% of all issued ETFs. Such makes sense, given that for an ETF issuer to “sell” you a product, they need good performance. Moreover, in a late-stage market cycle driven by momentum, it is not uncommon to find the same “best performing” stocks proliferating many ETFs.

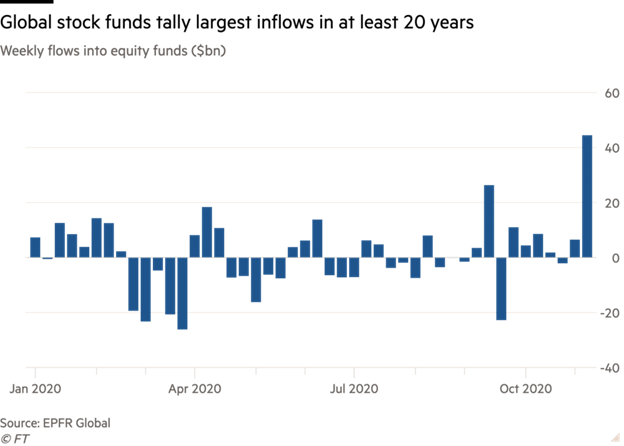

Therefore, as investors buy shares of a passive ETF, the shares of all the underlying companies must get purchased. Given the massive inflows into ETFs over the last year and subsequent inflows into the top-10 stocks, the mirage of market stability is not surprising.

The following chart shows the mirage of the stability of the index from Sentiment Trader. Despite the most significant damage below the surface since 1999, the reason that most of the large-capitalization passive ETFs don’t own the majority of the smaller capitalization stocks in the index. Therefore, the continuous buying of ETFs keeps the largest capitalization, and hence the index themselves, elevated.

Of course, that will change if, and when, investors who are “passive investing” become “active sellers.”

The Liquidity Problem

The “stability” provided by passive index buying will also ultimately be the source of “instability.” When so many ETFs own the same company, the “liquidity” problem becomes evident during a market rout. The head of the BOE, Mark Carney, warned about the risk of “disorderly unwinding of portfolios” due to the lack of market liquidity.

“Market adjustments to date have occurred without significant stress. However, the risk of a sharp and disorderly reversal remains given the compressed credit and liquidity risk premia. As a result, market participants need to be mindful of the risks of diminished market liquidity, asset price discontinuities and contagion across asset markets.”

Howard Marks also noted in ‘”Liquidity:”

“ETFs have become popular because they’re generally believed to be ‘better than mutual funds,’ in that they’re traded all day. Thus an ETF investor can get in or out anytime during trading hours. But do the investors in ETFs wonder about the source of their liquidity?'”

Let me explain.

There is a true statement about how markets work.

“For every buyer, there is a seller.”

Market participants believe if an individual wants to sell, there will always be a buyer available to “sell to.”

Such equates to the “greater fool theory.”

However, such is not the case.

A Lack Of Buyers

The correct statement is:

“For every buyer, there is a seller….at a specific price.”

In other words, when the selling begins, those wanting to “sell” overrun those willing to “buy,” so prices have to drop until a “buyer” is willing to execute a trade.

The “Apple” problem, using our example above, is that while investors who are long Apple shares directly are trying to find buyers, the 363 ETF’s that also own Apple shares are vying for the same buyers to meet redemption requests.

This surge in selling pressure creates a “liquidity vacuum” between the current price and a “buyer” willing to execute. Therefore, as we saw last week, Apple shares fell faster than the SPDR S&P 500 ETF, of which Apple is one of the most significant holdings.

Secondly, as noted, the ETF market is not a PASSIVE MARKET. Today, advisors are actively migrating portfolio management to passive ETFs for either some, if not all, of the asset allocation equation. Importantly, they are NOT doing it “passively.” The rise of index funds has turned everyone into “asset class pickers” instead of stock pickers. However, just because individuals are choosing to “buy baskets” of stocks rather than individual securities, it is not a “passive” choice but rather “active management” in a different form.

While “passive indexing” sounds like a winning approach to “pace” the markets during the late stages of an advance, it is worth remembering it will also “pace” just as well during the subsequent decline.

Conclusion

Despite the best intentions, individual investors are NOT passive even though they invest in “passive” vehicles. Eventually, some exogenous, unexpected event will change investors’ “speculative” psychology. When the psychology changes from “bullish” to “bearish,” the rush to liquidate entire baskets of stocks will accelerate the decline making sell-offs more violent than what we saw in the past.

This concentration of risk, lack of liquidity, and a market increasingly driven by “robot trading algorithms,” reversals are no longer a slow and methodical process but rather a stampede with little regard to price, valuation, or fundamental measures as the exit becomes very narrow.

March 2020 was just a “sampling” of what will happen to the markets when the next bear market begins.