Greedy corporations are not causing inflation. Such is despite the claims of many of those on the political left that failed to understand the very basics of economic supply and demand.

Here is the basic argument by those pushing for a more socialistic agenda:

“Greedy corporations are causing inflation by jacking up prices and enjoying record profits.”

Elizabeth Warren is pushing this particular narrative very hard.

For the majority of Americans who now get their “news” from social media, the uneducated masses now have a new target of hatred for their financial woes.

The problem, as with many of the narratives ramping up the ire of Americans on social media, is it is patently false.

As Michael Maharrey recently penned:

“One simply has to reason through the claim to uncover the absurdity. If corporations can willy-nilly raise prices and enjoy “excessive” profits, why don’t they do it all the time? Did corporations suddenly get greedy in 2021? And why did the Federal Reserve spend a decade fretting about inflation being ‘too low’ as it struggled to hit its 2% target? Was there not enough corporate greed before coronavirus?”

When you think about it this way, it is apparent something else happened.

Always And Everywhere A Monetary Phenomenon

When it comes to inflation, many armchair economists are quick to quote Milton Friedman.

“Inflation is always and everywhere a monetary phenomenon.”

The problem is there is much more to Friedman’s statement on the cause of inflation.

“It is always and everywhere a result of too much money, of a more rapid increase of money, than of output. Moreover, in the modern era, the important next step is to recognize that today the governments control the quantity of money so that, as a result, inflation in the United States is made in Washington and nowhere else, Of course, no government any more than any of us, likes to responsibility for bad things.

All of us are humans. If something bad happens, it wasn’t our fault. And the government is the same way, so it doesn’t accept responsibility for inflation. If you listen to people in Washington talk, they will tell you that inflation is produced by greedy businessmen, or it’s produced by grasping unions, or it’s produced by spendthrift consumers, or maybe its those terrible Arab sheiks who are producing it.”

As he concludes:

“But none of them produce inflation, for the very simple reason that neither the businessmen, not the trade union, nor the housewife have a printing press in their basement on which they can turn out those green pieces of paper we call money. Only Washington has the printing press, and therefore, only Washington can produce inflation.”

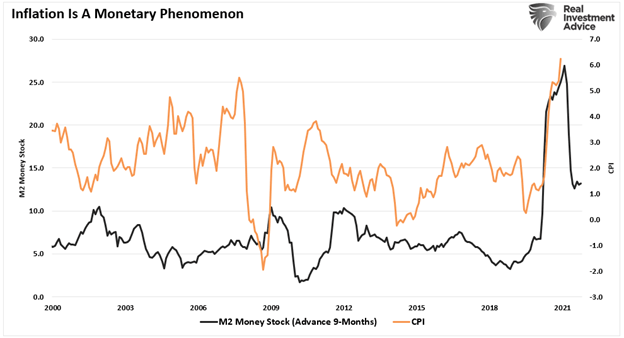

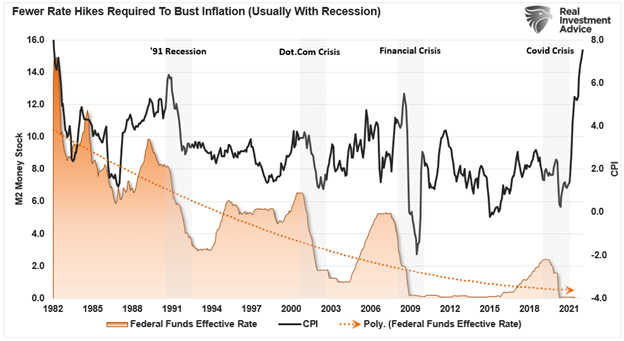

Milton Friedman’s statement is backed up by the chart below of the M2 money supply compared to inflation (with a 9-month lag).

You can watch Milton’s entire speech on “Money and Inflation”

The Government Caused It

The quantity theory of money states that prices vary in proportion to the money supply. That relationship is based on the following premise:

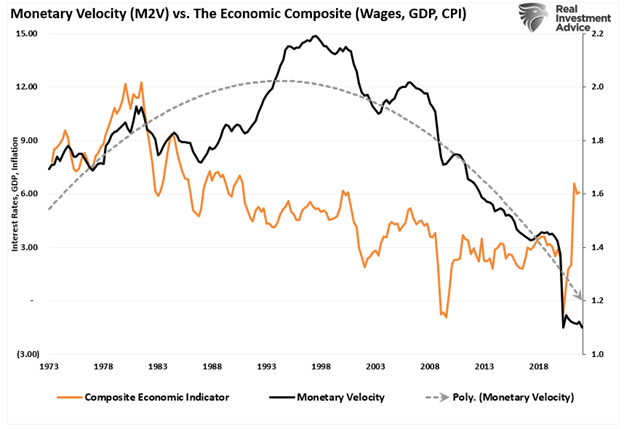

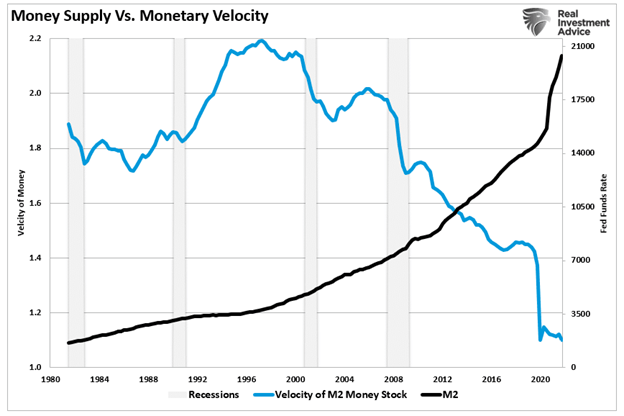

“The value of the transactions carried out in an economy is equal to the quantity of money existing in that economy multiplied by the number of times that money changes hands (aka velocity of money). That assumes the velocity of money is relatively constant and growth in money supply is in line with growth in economic activity, Such implies price stability. On the other hand, if the money supply grows more quickly than economic activity, this generates upward pressure on prices, i.e. inflation.”

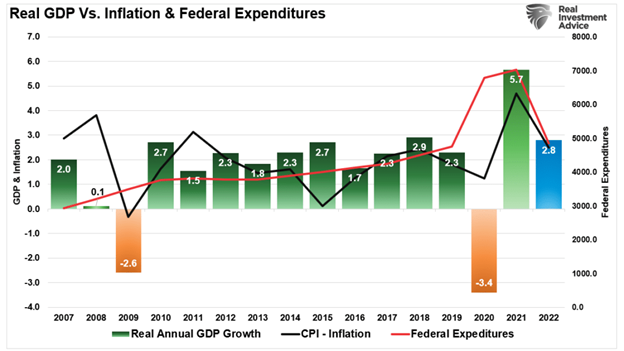

As shown, monetary velocity, the growth in money supply, and economic activity are grossly misaligned.

Not surprisingly, the massive surge in money supply flooding the system during an “economic shut down” created a demand glut against a constrained supply.

With consumers flush with “free capital” to spend, there was no available production to provide the needed supply. With too much money chasing too few goods, inflation was the inevitable outcome.

As noted in “Economic Stagnation Arrives:”

“As the stimulus hits consumers, they spend it rather quickly, which leads to a ‘sugar rush’ of economic activity.”

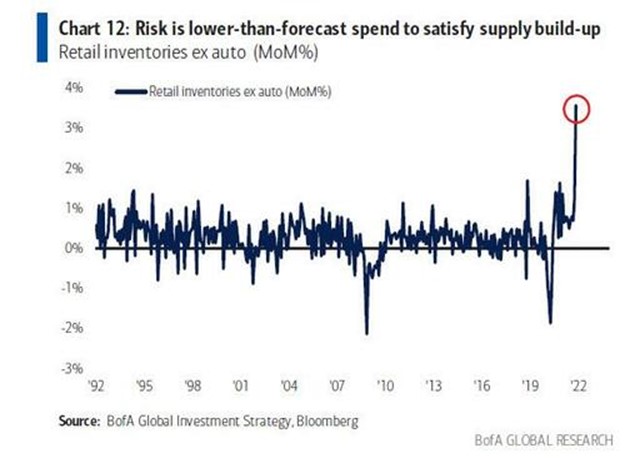

Now, that cycle is beginning to reverse as supply increases and demand weakens. As noted in “Market Bottom:”

Stimulus payments to US households are evaporating from $2.8tn in 21 to $660bn, and there is no buffer from excess savings with the rate at 6.9%, which is lower than 7.7% in 2019). There is a huge inventory build in retail products (ex-auto), while the upcoming weak US consumption most likely catalyst for consensus cuts in GDP/EPS.”

Of course, that reversal of the “Government printing press” is problematic economically speaking.

However, there is a cure for inflation.

Inflation Is Cured By High Prices

There is an old axiom that the “cure for high prices, is high prices.”

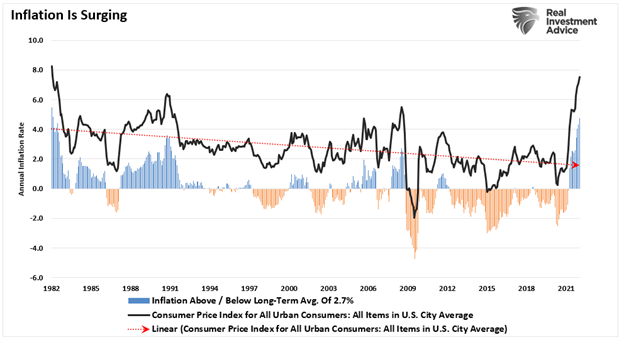

While the Fed is considering hiking rates to quell inflation, if they do nothing inflation will eventually cure itself through the normal economic cycle. With the massive deluge of government-provided liquidity now used, disposable incomes are falling which constrains consumer spending. Not surprisingly, over the course of the next 12-months inflation will return to the long-term trend of 2% annualized.

However, this reversion in inflation will happen more rapidly as the Fed hikes rates. The problem for the Fed is that each successive monetary policy cycle requires fewer rate hikes before something breaks economically.

Notably, producer prices, as shown below, have risen substantially faster than consumer prices. Such shows that those “greedy corporations” are absorbing input costs, which eventually impairs their profitability. There is a high correlation between corporate earnings and inflation.

When the inflation spread rises enough to impair profitability, corporations take defensive measures to reduce costs (layoffs, cost cuts, automation.) In turn, as job losses rise, consumers contract spending pushing the economy towards a recession.

Inflation quickly becomes deflation.

Conclusion

Inflation, particularly in 2022, is a function of the increased money supply from Government injections directly to households. There was too much money chasing too few goods, and inflation was the consequence.

As Maharrey concludes:

“The truth is the federal government needs inflation. It depends on Federal Reserve money printing to support its borrow and spend budgeting strategy. Without the Fed’s inflationary activity, the government couldn’t finance its out-of-control spending habit. But politicians don’t want you to know that they are levying an inflation tax on you, so they perpetuate all kinds of myths about inflation to try to make you feel better about it.”

The average person is particularly susceptible to the greedy corporation myth. Since people already have a mistrust of big corporations, and inundated by false information on social media, and have little understanding of economics, it is not surprising. People, like Elizabeth Warren, prey on the weak-minded to promote their own political agenda.

“If you hear somebody blaming inflation on greedy corporations, it indicates they don’t understand inflation. Or they’re lying to you.” – Maharrey

If they are a politician running for re-election, it’s probably the latter.