Key Summary:

- History shows, the average investor gets bearish at precisely the wrong time.

- Exceptionally strong 1-month returns tend to hint at better returns ahead.

- Consumer Sentiment improvements could be a hidden bullish opportunity for stocks.

Important thesis: If equities generate roughly 8-10% a year over time, the leaders of industry should, in theory, compound at 13%+ over time. We have significant proof on this topic where top brands are concerned. Due to the pandemic, rapidly rising inflation and an interest rate normalization phase, the last few years has been difficult for the average stock. As the normalization process continues, investors are getting some wonderful buying opportunities today, particularly in quality, smaller companies.

Being a Contrarian Has Often Generated Strong Returns.

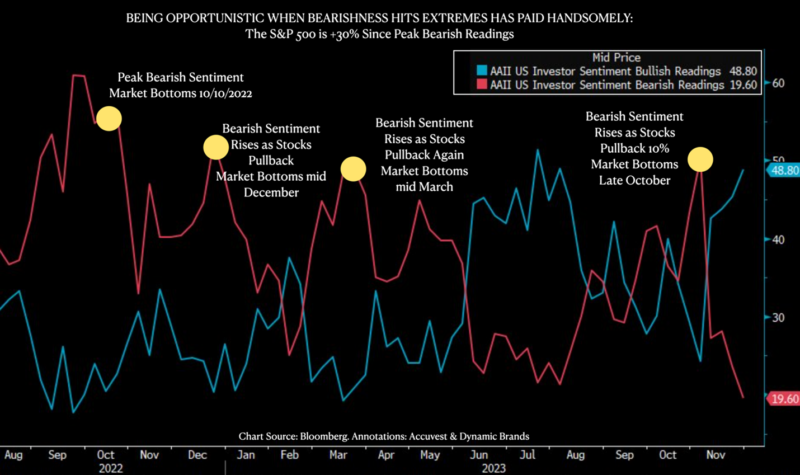

There are many ways to track consumer and investor sentiment. Generally, only at extremes does the data offer very compelling investment opportunities. Towards the end of October, sentiment across markets was dreadful. The equity markets experienced a decent pullback and retail investor sentiment, as measured by the AAII Survey, reached a bearish extreme. Just as everyone was leaning bearish and expecting the next down move, the calendar turned, and stocks ripped higher in November, leaving many investors flat-footed and under exposed. My channel checks showed little interest in adding to stocks, as they have most of the year, and the news flow was skewed negative. It’s important to note; negative narratives always sound so provocative, they are always present, and yet markets rise about 80% of the time. Is there any wonder why the average investor fails to generate the returns they should over time?

To illustrate the disconnect between equity prices and retail investor sentiment, below is a chart showing bullish and bearish reading from the AAII Investor Survey. The track record of fading bearish extremes remains impressive. The stock market is +30%+ since the peak of bearish readings. Buying great merchandise on sale has generally been a very wise decision.

Extremely Poor Stock Breadth + Peak Bearishness Positioning Tends to Lead to Gains

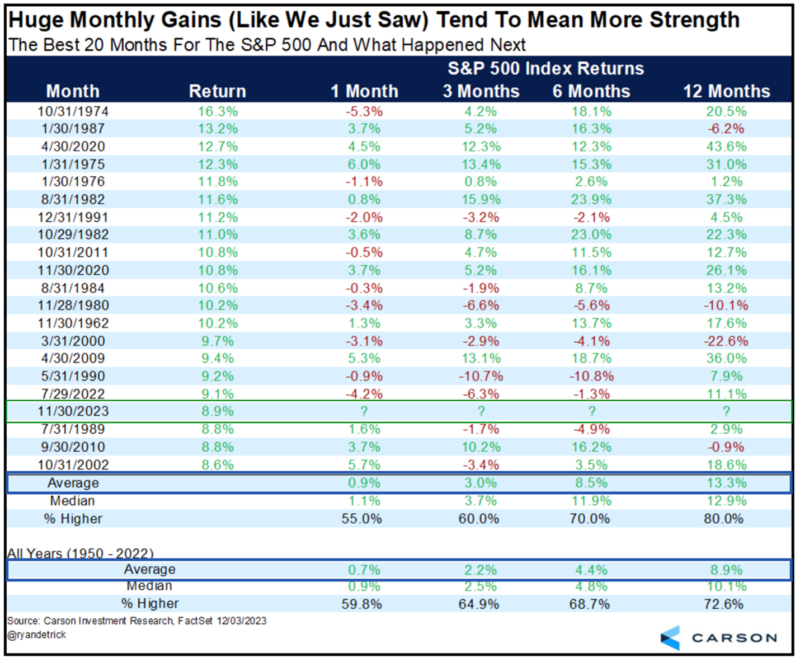

The chart below from market technician, Ryan Detrick from the Carson Group highlights past instances when an outsized month occurred since 1950. In a recent Tweet, he notes: “last month (November), was the 18th best monthly gain for the S&P 500 since 1950. Looking at previous top 20 monthly returns shows ABOVE average returns going forward. A year later, the market was +13.3% on average and higher 80% of the time.” The chart notes, the average return from 1950 to 2022 was +8.9% so his work hints at 2024 being a better than “average” year. No one knows the future and there are certainly plenty of macro, political, geopolitical, and economic events that could set an overbought market back, but when the average stock has still gone nowhere for two years, the odds favor a better, more broadly participating market in 2024 for stocks. Just remember, stocks can be volatile over short periods but please do not lose sight of the big picture.

Overall Consumer Sentiment Remains Low. There’s a Ton of Room for Improvement.

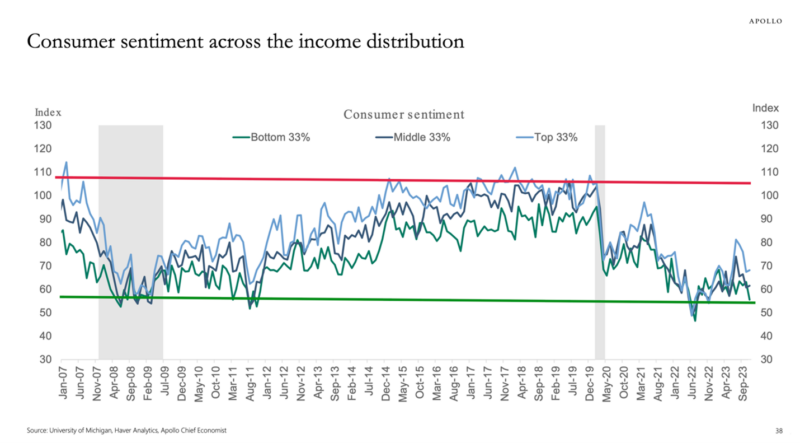

In markets, it’s the rate of change of things that’s often most important. Over the last few years, consumers have generally remained quite cautious and/or outright negative. If there’s one factor that has the opportunity to make an outsized move back to “normal ranges”, it’s consumer sentiment. Being forced to spend more on virtually everything tends to lead to being in a foul mood, but many items are in the process of mean reverting to normal. As savings begin to build up again and prices gradually normalize, consumer sentiment should begin to trend back towards normal. The move from negative to normal should translate into sustained consumer spending and help consumer-focused stocks, and the overall market, get back to their winning ways.

Disclosure: The above report is a hypothetical illustration of the benefits of using a 3-pronged approach to portfolio management. The data is for illustrative purposes only and hindsight is a key driver of the analysis. The illustration is simply meant to highlight the potential value of building a consumption focused core portfolio using leading companies (brands) as the proxy investment for the consumption theme. This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.