Key Points

- Uncertainty & 2022 macro PTSD is still high across markets.

- Every portfolio deserves an allocation to the smartest investors & their strategies.

- Alternative asset managers are embedded with a coiled spring of future earnings.

Investors are still focused on macro versus company micro fundamentals.

The difficulties of navigating markets in 2022 are well chronicled. Very difficult years tend to create investor PTSD, which often holds them back from uncovering opportunities. In my conversations with advisors and analyzing money flow data, there appears to be lingering apprehension for risk-taking initiatives. While it’s quite natural to feel nervous driving a car after a car wreck, often the only thing holding us back is our fear of yesterday’s boogie man. In the investment business, great opportunities are presented when markets struggle and fall. Macro can only carry us so far before the company fundamentals and their long-term opportunities again take the wheel. While the world is still waiting for the next shoe to drop in macro, high quality companies continue to perform well, adapt to the changing environment, and their stocks have had nice recoveries thus far in 2023. We expect volatility to stay elevated because there are still some outstanding items needing more clarity. But largely, our work suggests that brands with strong balance sheets, free cash flow generation, and large untapped market opportunities will exceed lowered expectations and their stocks will turn in much better years versus 2022. Perhaps it’s time to shift our focus away from macro and trying to predict the next black swan event and focus on investing in the themes and companies best positioned for the new normal of higher inflation, rates, and the cost of capital.

Monetizing today’s uncertainty through the best investors on the planet.

If you want to know who some of the smartest investors are, I urge you to go buy a new book or audiobook from Private Equity pioneer, David Rubenstein, the co-founder of The Carlyle Group, a global private equity investment manager.

The book is called, “How to Invest” and it was released recently. I could not put this book down and read it over a 5-day period while visiting family in NJ. Here’s a link for your convenience:

David interviews some of the smartest and most successful investors in the world. They include: Larry Fink, Ron Baron, Bill Miller, Jon Gray, Sam Zell, Seth Klarman, Ray Dalio, Stan Druckenmiller, Jim Simons, John Paulson, Bill Ackman, Sandra Horbach, Bruce Karsh, Marc Andreesen, and Michael Moritz of Sequoia Capital to name a few.

Widening the investment lens to longer time periods and cloning what the smartest investors do is a powerful one-two punch for a portfolio. The facts are clear, the longer the time period, the higher the odds for investment success. Who are the most successful investors and those that focus on long-duration investing? The alternative asset managers and private equity firms like Blackstone, KKR, Brookfield, Apollo, etc.

There is a mega-trend under way in our industry and the game is in the early innings. With the democratization of alternative assets well under way, investors can either invest in specific thematic funds managed by great firms or they can invest in the stocks of the firms themselves or do both. The statistics show the average HNW investor still only has a small portion of their total assets invested in alternatives and the evidence is as clear as day when looking at the benefits. A great future lies ahead for asset gatherers in this space.

Institutions have been allocating a significant portion of their portfolio to “alternatives: real assets like differentiated real estate, infrastructure, renewable energy and energy transition, private equity, venture, private credit, growth equity” for decades. Why would any investor not want to piggy-back that well-researched approach for their personal portfolio? Our team has significant exposure to the leading brands in alternatives because they have excellent track records across all investment disciplines and because they see the world from a 30,000-foot view better than most of the investor universe. 2022 was a difficult year for alternative asset managers from a stock perspective. No matter what opportunities you have in front of you, when there’s a bear market and you are a publicly traded stock, your stock trends down like the rest of the market. However, a look under the hood highlights what an incredible year of fund raising each of these brands had in 2022. Blackstone raised $226 billion of new capital, KKR raised $81 billion, and Brookfield raised $93 billion. These firms raised more capital in one year than the total assets of most investment managers!

For investors in these firms, here’s where it gets interesting. Each firm will begin to generate attractive fee revenue over time from this new capital. New fees from this dry powder being put to work, plus fees from existing fee-paying AUM, plus future monetization’s and performance fees, will all lead to a coiled spring dynamic for the earnings of these firms over the next few years. Investors that are too short-sighted miss the staggering step-up in revenue these firms will have over time. That’s why we love these stocks today.

Bonus: owning the stocks of these great franchises is by no means a crowded trade, the stocks of the smartest investors in the world are heavily under-owned by institutions and individuals and they aren’t yet included in the major indices. I expect this to change in time as index committee’s get more comfortable with dual share class corporate structures.

Private markets offer a smoother ride.

The daily pricing mechanism in public markets feels comfortable until it doesn’t. As investors, we have grown accustomed to assuming the day’s closing price is the true and realistic value of a business. In an algo-driven world where about 70-80% of the daily trading volume comes from computers, it’s simply unrealistic for public market pricing to be a real assessment of corporate value. As a private market’s investor, company valuations are not tied to the daily volatility of public markets. Public markets and values tend to be tied to wild swings in sentiment where values in private markets are driven by deep analysis by third-party auditors, peer comparisons, and rigorous discounted cash flow models. In addition, these firms are probably the most opportunistic investors I have ever seen.

Their best long-term return vintages always begin when prices are low, and anxiety is high. They have a history of buying when most of the world has retrenched. Isn’t this the type of company you should want in your portfolio? To own great companies with enormous forward opportunities, one must be willing to assume some volatility along the way. There is no free lunch on Wall Street.

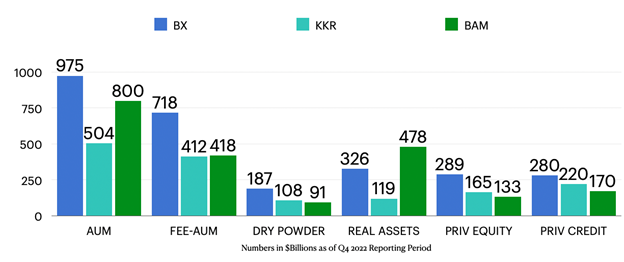

Below is a quick re-cap of the three alt asset managers we own in portfolios: Blackstone, KKR, and Brookfield Asset Management. I took this information from their latest quarterly reports. These leading brands manage a current AUM that totals roughly $2.3 trillion, with fee-paying AUM at $1.55 trillion and growing, and most important for opportunistic investors, they have about $386 billion in dry powder to be put to work into any distress that happens around the world. These are very savvy and patient investors, the optionality they have with so much capital to deploy should allow anyone to sleep at night.

Performance is the proof-point.

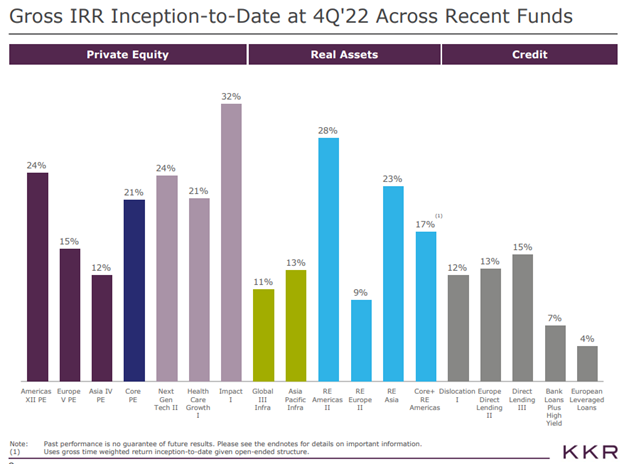

Analyzing performance across the alternatives category can sometimes be difficult, but largely the industry has done a very good job of generating strong excess returns per unit of risk taken, particularly when compared to most equity and fixed income peers. Below is a powerful chart from leading firm KKR showing the since inception IRR’s across the product suite since each strategy was created. The look-back performance across each asset class is even more attractive at Blackstone.

Remember, if you cannot gain access to the investment products managed by Blackstone, KKR, Apollo, Brookfield, Carlyle and others, their stocks are publicly traded and are trading at what our team considers to be “heavily discounted” prices. These firms are all set to compound their fee revenue as well as accelerating monetization’s as markets and economies normalize. Consensus analyst expectations are simply too low in our opinion.

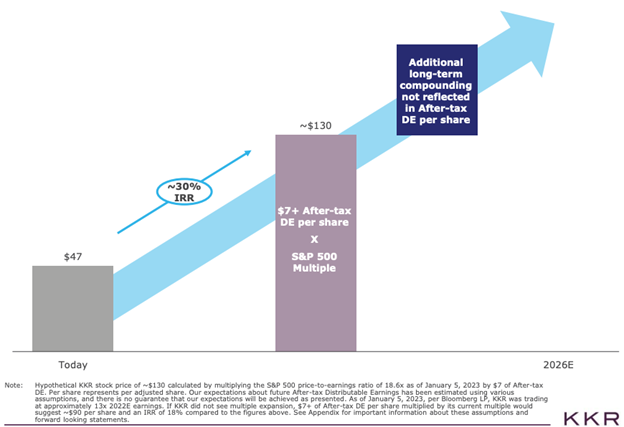

Here’s another great slide from KKR’s recent report highlighting the potential growth of the stock if their long-term goals are met. Hint, these firms have a history of under-promising and over-delivering. KKR stock is trading at roughly $58 on February 13, and using various assumptions around future distributable earnings and the appropriate multiples for these assumptions, there’s some significant upside potential here and across the group because every firm we own has similar long-term growth opportunities to monetize for LP’s.

Disclosure:

This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.