I track 200 leading brands serving the “lifetime spending” theme. People all over the world, spending money on things they want and need is possibly the most predictable phenomenon around the globe. Consumers are a fickle bunch so tracking brand relevancy is vitally important for allocators of capital. Consumer buying habits change over time and there are a few key consumption trends happening that warrant investment and conversation.

In this blog post, I’ll highlight the important trends happening in media consumption. One of my favorite brands is ROKU and it also happens to be very misunderstood by investors, analysts, and consumers. Roku is the gateway to our streaming video addiction and is changing the way ads are delivered to consumers here and around the world.

Some of you may know what Roku does and some may never have heard of this company. If you have dabbled or switched fully to SVOD (streaming video on demand) then you will likely find your way to Roku. If you have an old TV and want to upgrade to a Smart TV but do not want to pay for a new TV, Roku has a way for you to convert your old TV to a Smart TV for $30; that’s power.

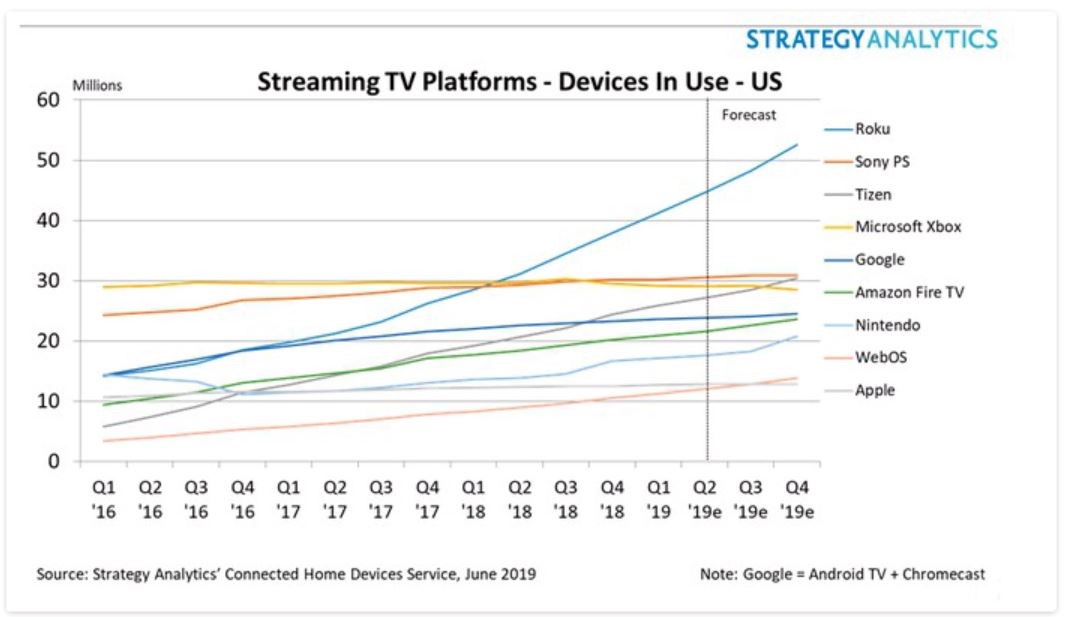

Many analysts struggle with Roku because they see the company as a commodity player delivering a dumb remote to media viewers. They are missing the opportunity completely in my view. The growth is in the streaming business and Roku is the undisputed leader.

The content creation space is about as crowded as it can get right now. Every media company now wants to become the next Netflix and have a streaming service for consumers. But how many streaming services can one family have?

I’m already getting tired of adding one-off subscriptions and dealing with starting and cancelling them according to the shows I want to watch. The cost of content creation is now outrageous so I’m less interested in investing in all the content creators (other than the big ones like Disney and Amazon) as I am investing in a platform that delivers them all to me so I can choose what, how, and when I want it delivered.

That’s the secret sauce of Roku. They are not in the content-creation business; they are in the content delivery business and the advertising delivery business. To me, that’s a much safer route to take and when a company creates an easy to use platform to allow us all to consume without friction, we become fiercely loyal customers.

That’s why I think Roku has many years of growth to come. Important: the stock is volatile because it’s mis-understood and their earnings can be lumpy according to deals they do and when they have to recognize that revenue but make no mistake, the trends are wildly in favor of Roku for the long-term.

Roku’s business and revenue streams are diverse:

- Roku sells a cheap piece of hardware (remote & HDMI box), eventually the remote will be replaced by an app on your phone, they have always said the remote is a stepping stone. I suspect it will be replaced when they have 50 million or more subscribers, they have roughly 32 million now. They sell a voice remote, basic remote, and a gaming remote.

- Roku sells accessories like adapters, ear phones, sound bars, HDMI cables, etc.

- Roku is now the operating system of roughly a third of the smart TV’s sold so they make money when global consumers upgrade their TVs. Plus, if you aren’t using Roku now, you likely will once you buy the new TV or upgrade your old TV, from there you will likely buy streaming services and Roku gets paid when you sign up.

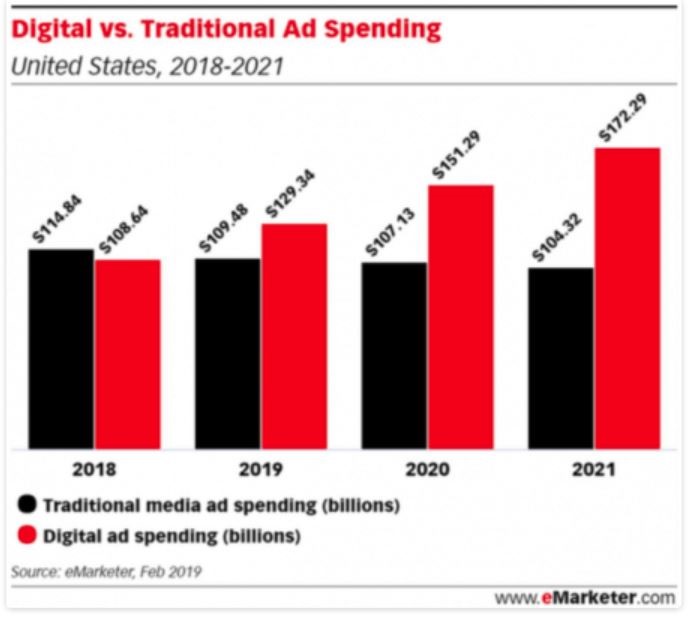

- Roku also works with brands who create and place advertising, just like the commercials you see on linear TV via your cable operator. Here’s the fun part, Roku has great data on viewing habits so they can work closely with brands to deliver more relevant ads to people. We know cord-cutting is a very important theme going forward and we know streaming video is where people go once, they cut the cord so the advertisers will continue to shift ad dollars away from cable and towards streaming options. Roku has the best market share and best user interface so they will likely continue to get more ad revenue as ad loads shift to where the eyeballs are. There’s a significant amount of growth potential in the U.S. and abroad with Roku driving the bus.

- Advertising is becoming artificial intelligence (AI) driven and those that have the data, have the advertisers’ attention. Roku recently announced they have created technology that allows a consumer to click on an ad they see inside a Roku program and get more information on the product/service. Just think about that for a minute. In the past, brands had very little insight into their ads and whether they were resonating with consumers or compelling them to buy the products. The Return on Investment was tough to measure but they had to try and reach the consumer. With the Roku technology, brands now can get hard data on what is resonating so they can deliver more targeted messages to the appropriate people. How long before there’s an E-commerce capability to allow us all to click on an ad and add the product to a shopping cart for purchase? There’s where we are headed, interactive TV and shopping. There’re significant revenue opportunities here and the total addressable market opportunity is enormous.

- Roku’s platform is easy to understand and use making user adoption very likely. They have an unlimited number of opportunities to add more content creators and therefore revenue opportunities. I can easily see a shopping network, a video gaming streaming subscription gateway, etc.

If you would like more information about Roku and their significant growth opportunities, here’s the link to my full post via the global brands website:

https://www.globalbrandsmatter.com/roku-roku

DISCLOSURE:

This information was produced by and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts.