Key Points

- Peter Lynch is one of the most successful investors of all time. He ran the Fidelity Magellan Fund.

- Fidelity Magellan was the best performing active fund in the industry under Lynch.

- To generate outsized returns, Lynch advocated embracing volatility & staying invested.

“I’d rather invest in pantyhose versus communication satellites or hotel chains versus fiber optics”

” I love volatility…Take YUM Brands (Taco Bell)… I knew the company was in great shape and market volatility allowed me to buy more shares as it fell from $14 to $7 to $1 per share only to be acquired by Pepsi for $42 a few years later.

Here’s a quick three-minute link to an interview with Peter Lynch where he talks about market volatility: Peter Lynch: “I love volatility”

Peter Lynch…Invest in What you Know.

There are a handful of investors that have risen above everyone else over time. Peter Lynch was one of the titans of investing. Peter ran the Fidelity Magellan Fund from May 1977 to April 1990. Over that period, the Magellan Fund was the top performing equity fund. His “invest in what you know” approach is quite similar to what we preach with the top global brands approach to investing. Many things have changed in markets since Peter’s retirement in 1990, but nothing is more timeless than investing in companies you know, trust, and love and in the products and services you consume on a frequent basis. There’s a lot more research involved than just “investing in what you know”, but this ideal is a great first step in identifying potential strong investment opportunities. Peter preferred businesses that were easy to understand. He constantly stated that individual investors had an advantage over fund managers because they knew what brands were dominant in their local communities. It was like having insider information he used to say. He clearly believed in top brands given the holdings he had over his tenure, a testament to the fortitude of the thematic. He also clearly loved industry leaders as well as interesting turnaround situations. He preferred growth companies that could be bought for reasonable valuations and was keenly focused on important profitability metrics and competitive advantages. We whole-heartedly agree.

There are so many similarities between our approach and his that it’s uncanny. Brands matter as much today as they did when Peter was running Magellan. Brand relevancy changes over time but being the dominant brand in important spending categories tends to lead to very positive investment outcomes over time.

The Magellan Fund Under Peter Lynch’s Direction:

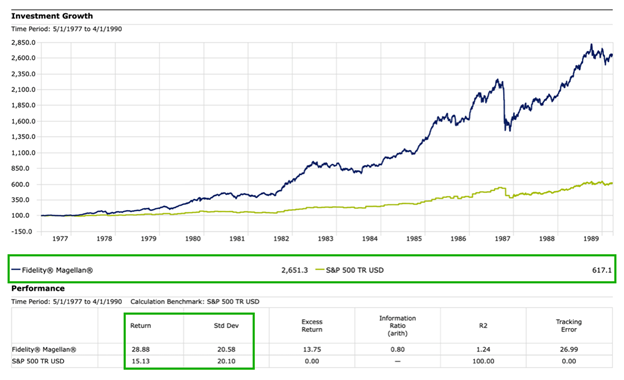

Wow, is all I can say. The Fund was the #1 performing equity fund during Peter’s management. Here’s a chart of the fund versus the S&P 500 over this 13-year period (Source: Morningstar).

Massive, annualized outperformance with similar volatility of returns when compared to the S&P 500. Perhaps there’s something to this “invest in what you know and understand” approach? I’ve looked at a number of holdings during his tenure and it reads like a who’s who of top brands of their time. It’s fun to look at these brands to see how relevant they are today or if they have become parts of other highly relevant brands. The great returns were generated through investing in some iconic brands like: Toys R Us, Taco Bell, La Quinta Resorts, Cracker Barrel, Home Depot, Albertson’s Fed-Ex, Coca-Cola, Ford, Chrysler, Pep Boys, McDonalds, Philip Morris, Disney, Delta Airlines, and many others.

Timing the Market is Difficult, Stay Invested & Add on Dips

There have been many stories written about the success of Peter’s approach and his track record at Magellan. What few people talk about is the path that investors had to follow to receive those returns. Like today, there was plenty of market volatility and frequent drawdowns, yet Peter somehow compounded people’s capital at a very high rate. The trick he said, is to use volatility to your advantage and stay invested for the long-term. In theory that is easy, in practice, it is difficult and requires fortitude and conviction. When stocks are volatile and have drawdowns, like today, the emotional response is to get to the safety of cash because we extrapolate the short-term direction of stocks well into the future.

We tend to do that after a big drawdown has already occurred and typically closer to the bottom in stock prices. Every economic situation is different, but the results seem to be the same: we love holding stocks when markets are calm and stocks are going up and we extrapolate disaster when markets are volatile and the media is painting a bleak picture. This forces us to make irrational, emotional decisions that run counter to our long-term goals. Let me be very clear, when great businesses go on mega-sale, you buy more. So long as the big picture of the business hasn’t changed much, the weakness should be bought.

There is always renewed demand for great brands when they go on sale. Use that knowledge in times like today when some of the greatest businesses the world has ever seen are 20-50% off their recent highs. As you’ve seen from my former blogs, implementing a systematic cost averaging strategy can add significant value around the core position and helps you recover quicker over time. Here’s that recent blog if you haven’t read it: https://catalyst-insights.com/analysis-cost-averaging-adds-significant-value/

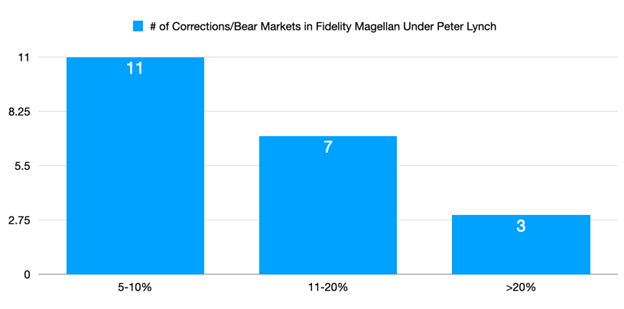

Being a long-term investor means you will occasionally see some drawdowns. Some are just shallow pullbacks in a bull market, some are more event-driven corrections, and some are inflation and interest rate driven bear markets like we have today. I analyzed Magellan Fund returns while Lynch managed the fund and below are the number of times the fund saw different types of pullbacks.

Data source: Accuvest & Magellan returns via Ycharts.

That’s a lot of pullbacks over a 13-year period and if your emotions got the better of you, you lost the ability to generate the returns many of the great brands of yesteryear generated.

“If you can’t banish forever the fatal thought “when I’m down 25%, I’m a seller, you’ll never make a decent profit in stocks” said Lynch in his book, “One Up On Wall Street.”

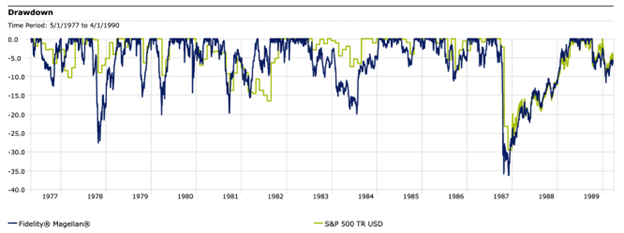

Peter Lynch had many famous quotes but this is another one of my favorites: “when the market went down, so did the fund, most of the time it went down more than the market, it’s just that simple…expect it.” The graph from Morningstar highlights this fact. The blue line is the Magellan Fund and the green line is the S&P 500. Typically, when markets went lower, the fund also went lower, and it lost more value than the index during those drawdowns.

In the end though, the fund that was driven by one of the greatest investors of all time using a simple, common-sense approach of “investing in what you know”, somehow managed to go on to reach new all-time highs again and again. From a top brands perspective, I have seen this same movie happen over and over for the last 30 years and I expect the same to be true going forward. Great companies that dominate their industries find new ways to win over time. That’s what makes them great brands.

There’s always going to be something to worry about, but remember Peter Lynch’s words:

“Buy great businesses, embrace volatility, be willing to buy more of what you completely understand, and stay invested for the long-term.” This simple process will serve you well during your investment career.

Disclosure:

This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.

The Chipotle hypothetical cost averaging example highlights the potential power of holding core positions in industry leading brands and being committed to adding to these positions when the market acts irrationally. Cost averaging leading companies can add significant value to your long-term portfolio even if you do not catch the absolute bottom in the stock. Details on this hypothetical are below.